Introduction

Regions Bank, a venerable financial institution with over 150 years of experience, has made its mark as a leading provider of financial services, catering to both personal and business clients. Among its comprehensive offerings is a suite of bespoke investment services designed to empower individuals and businesses in their quest for financial prosperity. Leveraging its deep understanding of the financial markets and its commitment to personalized service, Regions Bank stands as a steadfast partner, guiding its clients toward their financial aspirations.

Regions Bank’s investment services encompass a broad spectrum of solutions tailored to meet the diverse needs of its clientele. Whether you’re a seasoned investor seeking sophisticated investment strategies or a novice just starting to navigate the intricacies of the financial markets, Regions Bank has something to offer. With its knowledgeable and experienced financial advisors, the bank provides customized guidance and support, ensuring that each client’s investment portfolio is aligned with their unique financial goals, risk tolerance, and time horizon.

The investment services offered by Regions Bank are not merely products; they are meticulously crafted solutions designed to help clients achieve their financial dreams. Regions Bank’s financial advisors possess a deep understanding of the investment landscape, staying abreast of the latest market trends and economic developments. They work in close collaboration with clients, taking the time to understand their individual circumstances and aspirations, before crafting tailored investment strategies. With Regions Bank as your investment partner, you can rest assured that your financial future is in capable hands.

Asset Management

Regions Bank’s asset management services are akin to a skilled orchestra conductor, orchestrating a harmonious blend of investment strategies designed to maximize returns while mitigating risk. The bank’s asset management team comprises seasoned professionals who possess a comprehensive understanding of the financial markets and employ a disciplined investment approach. They meticulously research and analyze various investment opportunities, constructing diversified portfolios that are tailored to each client’s unique financial goals and risk tolerance.

Regions Bank’s asset management services encompass a wide range of investment strategies, including both active and passive management approaches. Active management involves the judicious selection of individual stocks and bonds, while passive management tracks a particular market index, such as the S&P 500. The bank’s asset management team deftly employs both approaches, depending on the client’s specific needs and preferences. Whether your investment goals involve long-term growth, income generation, or a combination thereof, Regions Bank has the expertise to craft an asset management strategy that aligns with your aspirations.

Furthermore, Regions Bank’s asset management services are not confined to traditional investment vehicles. The bank also offers alternative investment options, such as private equity, real estate, and hedge funds, which can potentially enhance portfolio diversification and returns. These alternative investments are meticulously evaluated by the bank’s investment team to ensure they complement the client’s overall investment strategy and align with their risk tolerance. With Regions Bank’s asset management services, you can gain access to a comprehensive suite of investment solutions designed to help you achieve your financial goals.

Retirement Planning

Retirement planning is akin to embarking on an adventurous journey, one that requires careful preparation and a reliable guide. Regions Bank’s retirement planning services are designed to be your trusted compass, helping you navigate the complexities of retirement planning and ensuring a secure financial future. The bank’s team of retirement planning specialists possesses a wealth of knowledge and experience, enabling them to provide personalized guidance and support throughout your retirement journey.

Regions Bank’s retirement planning services encompass a comprehensive range of solutions, tailored to meet the diverse needs of its clients. Whether you’re just starting to plan for retirement or nearing the finish line, the bank’s financial advisors will work closely with you to develop a customized retirement plan that aligns with your unique circumstances and goals. They will help you assess your current financial situation, identify potential income sources during retirement, and determine the most suitable investment strategies to achieve your desired retirement lifestyle.

Regions Bank’s retirement planning services extend beyond investment management. The bank also offers a variety of educational resources and seminars designed to empower clients with the knowledge and skills necessary to make informed decisions about their retirement. These resources cover a wide range of topics, including retirement savings strategies, Social Security benefits, and estate planning. With Regions Bank as your retirement planning partner, you can gain the confidence and clarity you need to plan for a secure and fulfilling retirement.

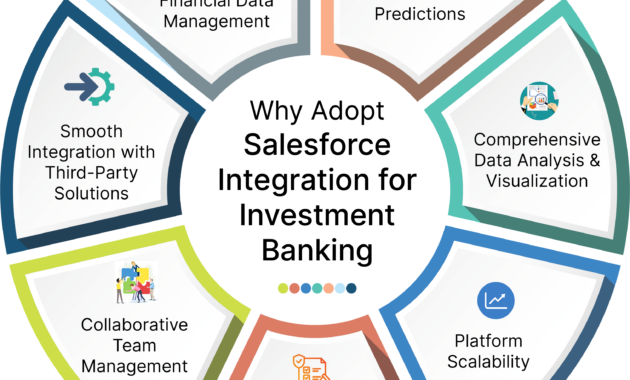

Investment Banking

Regions Bank’s investment banking services are akin to a skilled surgeon’s scalpel, precisely guiding clients through the intricacies of capital markets and complex financial transactions. The bank’s investment banking team comprises seasoned professionals who possess a deep understanding of the financial markets and a proven track record of success. They provide a comprehensive suite of investment banking services, tailored to meet the unique needs of corporations, institutions, and government entities.

Regions Bank’s investment banking services encompass a wide range of capabilities, including mergers and acquisitions advisory, debt and equity underwriting, and financial restructuring. The bank’s investment bankers work closely with clients to develop and execute tailored financial strategies that align with their specific objectives. Whether you’re seeking to raise capital, acquire a strategic asset, or restructure your debt, Regions Bank has the expertise to guide you through the process with precision and efficiency.

Regions Bank’s investment banking team is not merely a group of financial professionals; they are trusted advisors who bring a wealth of experience and industry knowledge to the table. They take the time to understand your business objectives and challenges, providing customized solutions that are designed to maximize value and minimize risk. With Regions Bank as your investment banking partner, you can gain access to a team of seasoned professionals who are committed to helping you achieve your financial goals.

Regions Bank Investment Services: Your Financial Compass in Uncertain Markets

Navigating the ever-changing landscape of the financial world can be a daunting task, but with the right guidance, you can chart a course toward financial success. Enter Regions Bank Investment Services, a beacon of expertise ready to steer you through the choppy waters of the market.

Investment Management: A Tailored Approach to Wealth Accumulation

Like a skilled tailor who meticulously crafts a suit to fit your form, Regions Bank’s investment management services are meticulously tailored to your unique financial needs. Our team of seasoned investment professionals takes the time to understand your aspirations, risk tolerance, and long-term goals.

Together, you’ll embark on a personalized investment journey, carefully selecting a portfolio that aligns with your financial blueprint. Whether you’re a seasoned investor seeking growth or a novice navigating the financial labyrinth, Regions Bank’s investment management services will guide you every step of the way.

Investment Philosophy: A Compass in the Financial Wilderness

Investment decisions should never be made in a vacuum. At Regions Bank, our investment philosophy provides a guiding light, a compass in the unpredictable financial wilderness. We believe that a well-diversified portfolio, judiciously balanced between different asset classes and investment styles, is the cornerstone of long-term success.

Our investment philosophy is also anchored in thorough research and unwavering discipline. We scour the global financial markets, analyzing economic trends, company fundamentals, and geopolitical events to make informed investment decisions.

Investment Strategies: Navigating the Ebb and Flow of the Market

Just as a ship’s captain adjusts the sails to the changing winds, Regions Bank’s investment strategies are dynamically adapted to the ever-evolving market landscape. Our team of experienced investment professionals monitors market conditions vigilantly, making tactical adjustments to your portfolio as needed.

From value investing to growth investing and everything in between, we employ a wide range of investment strategies to capture potential returns while managing risk. Like a skilled chess player, we anticipate market moves and position your portfolio accordingly, seeking to maximize your financial advantage.

Investment Products: A Wealth of Options for Every Investor

Our comprehensive suite of investment products is designed to meet the diverse needs of our clients. Whether you prefer the flexibility of mutual funds, the potential upside of individual stocks, or the stability of bonds, we offer a myriad of investment options to suit your unique preferences and risk tolerance.

Our investment professionals will work closely with you to select the investment products that align with your financial goals. They’ll provide clear explanations, answer your questions, and help you make informed decisions that can pave the path to financial prosperity.

Performance Monitoring: Keeping You in the Know

In the world of investing, knowledge is power. Regions Bank provides you with regular performance reports and updates, keeping you informed about the progress of your investments. Our online platform and mobile app offer real-time access to your account information, so you can track your investments at your fingertips.

Our investment professionals are always available to discuss your portfolio’s performance and make adjustments as needed. They’ll provide insights into market trends, economic conditions, and how these factors may impact your investments. With Regions Bank, you’ll always be in the know, ensuring that your financial journey is on the right track.

Client Service: A Commitment to Excellence

At Regions Bank, we believe that exceptional client service is the cornerstone of a successful partnership. Our dedicated team of investment professionals is committed to providing you with the highest level of service and personalized attention.

We understand that your time is precious, so we make every effort to respond to your inquiries promptly and efficiently. Whether you prefer to connect in person, over the phone, or through our online platform, our team is always ready to assist you.

Our commitment to excellence extends to every aspect of our client service. We strive to build long-lasting relationships based on trust, transparency, and a deep understanding of your financial needs.

Join Regions Bank Investment Services today and embark on a journey toward financial success. With our personalized investment management services, tailored investment strategies, and unwavering commitment to client service, we’ll help you navigate the complexities of the financial world and achieve your financial aspirations.

Regions Bank Investment Services: A Comprehensive Guide

If you’re seeking expert financial guidance to navigate your investment journey, Regions Bank Investment Services stands ready to be your trusted advisor. With a robust portfolio of services and a team of experienced professionals, the bank empowers individuals and businesses to achieve their financial goals. This article delves into the intricacies of Regions Bank Investment Services, providing a comprehensive analysis of its investment offerings, advisory services, and cutting-edge technology that sets it apart.

Investment Products

Regions Bank Investment Services caters to a wide spectrum of investment needs with its diverse array of investment products. The bank’s offerings encompass stocks, bonds, mutual funds, and exchange-traded funds (ETFs). Stocks represent ownership shares in publicly traded companies, offering investors potential capital appreciation and dividends. Bonds, on the other hand, are fixed-income securities that provide regular interest payments and a return of principal upon maturity. Mutual funds pool investments from multiple individuals, offering diversification and professional management. ETFs combine the characteristics of stocks and mutual funds, trading on exchanges like stocks but providing the diversification of mutual funds.

Advisory Services

Beyond its investment products, Regions Bank Investment Services offers a suite of advisory services tailored to individual investment objectives. The bank’s financial advisors work closely with clients to understand their unique circumstances, risk tolerance, and financial goals. They provide personalized investment recommendations, portfolio management, and ongoing guidance to help clients navigate the complexities of the financial markets. Whether you’re a seasoned investor or just starting your investment journey, Regions Bank’s advisors are dedicated to helping you make informed decisions and maximize your financial potential.

Investment Technology

Regions Bank Investment Services recognizes that technology plays a pivotal role in modern investing. The bank has invested heavily in cutting-edge technology to empower clients with convenient, real-time access to their investments. Clients can manage their portfolios online or via the mobile app, monitor market trends, and receive personalized investment insights. Regions Bank’s advanced technology platform seamlessly integrates with popular financial management tools, allowing clients to consolidate their financial information in one centralized location. This innovative approach to investment technology empowers clients with the knowledge and tools they need to make informed decisions and stay ahead in the ever-evolving financial landscape.

Personalized Approach

At the heart of Regions Bank Investment Services lies a commitment to personalized banking. The bank’s financial advisors take the time to understand each client’s individual needs and goals, tailoring their recommendations and services accordingly. They believe that every client deserves a unique and customized investment plan that aligns with their financial aspirations. Regions Bank’s personalized approach extends beyond investment advice; it encompasses all aspects of the banking relationship, ensuring that clients receive the highest level of service and support.

Conclusion

Regions Bank Investment Services is a trusted partner for individuals and businesses seeking a comprehensive and personalized investment experience. With its wide range of investment products, expert advisory services, cutting-edge technology, and commitment to personalized banking, the bank empowers clients to achieve their financial goals. Whether you’re looking to build wealth, plan for retirement, or navigate the complexities of the financial markets, Regions Bank Investment Services has the expertise and resources to help you succeed.

Regions Bank: A Comprehensive Guide to Investment Services

Investors seeking a trusted and experienced financial partner can turn to Regions Bank. With a wide range of investment services tailored to meet the unique needs of individuals and businesses, Regions Bank stands ready to guide you toward financial success.

Regions Bank’s team of knowledgeable financial advisors is dedicated to providing personalized service and customized investment strategies. Whether you’re an experienced investor or just starting out, Regions Bank has the expertise and resources to help you achieve your financial goals.

Investment Planning

Regions Bank’s financial advisors work with clients to develop comprehensive investment plans designed to meet their specific objectives. These plans consider a range of factors, including your risk tolerance, time horizon, and financial goals. Together with your financial advisor, you’ll create an investment plan that aligns with your unique circumstances and aspirations.

Investment Products and Services

Regions Bank offers a diverse range of investment products and services to meet the diverse needs of its clients. These products include:

- Individual Retirement Accounts (IRAs): Regions Bank offers a variety of IRAs, including Traditional IRAs, Roth IRAs, and SEP IRAs. These accounts provide tax-advantaged investment options to help you save for retirement.

- Brokerage Accounts: Regions Bank’s brokerage accounts give you access to a wide range of investment options, including stocks, bonds, and mutual funds. These accounts are ideal for investors who want to actively manage their investments.

- Managed Accounts: Regions Bank’s managed accounts are ideal for investors who prefer a hands-off approach to investing. With managed accounts, a professional investment manager handles the day-to-day management of your portfolio.

- Trust and Estate Planning: Regions Bank’s trust and estate planning services can help you preserve and distribute your wealth according to your wishes. These services include estate planning, trust administration, and fiduciary services.

Regions Bank’s financial advisors are well-versed in the intricacies of these investment products and services. They can provide guidance and recommendations to help you make informed investment decisions.

Investment Research and Education

Regions Bank provides its clients with access to a wealth of investment research and education resources. These resources include:

- Market Research: Regions Bank’s team of analysts provides timely market insights and research reports to help clients stay informed about the latest economic trends and investment opportunities.

- Webinars and Seminars: Regions Bank hosts webinars and seminars on a variety of investment topics. These events are designed to educate clients and provide them with valuable insights from industry experts.

- Online Learning Center: Regions Bank’s online learning center offers a range of educational resources, including articles, videos, and interactive courses. These resources can help clients enhance their financial knowledge and make informed investment decisions.

Regions Bank’s commitment to education and research empowers clients to make informed investment decisions and achieve their financial goals.

Customer Service and Support

Regions Bank is committed to providing exceptional customer service and support. Its team of knowledgeable representatives is available to answer questions, provide guidance, and assist clients with their investment needs. Whether you’re opening a new account or managing an existing portfolio, Regions Bank’s customer service team is there to help.

Regions Bank offers a range of ways for clients to get the support they need, including online banking, mobile banking, and phone support. Additionally, Regions Bank has a network of branches across the country where clients can meet with a financial advisor in person.

Conclusion

Regions Bank is a trusted and experienced provider of investment services. With a comprehensive range of investment products and services, personalized investment planning, and exceptional customer service, Regions Bank is well-positioned to help you achieve your financial goals.

Whether you’re just starting your investment journey or looking to enhance your existing portfolio, Regions Bank has the expertise and resources to guide you toward financial success.

Regions Bank Investment Services: A Comprehensive Guide to Retirement Planning and More

Regions Bank is a leading financial institution that offers a comprehensive suite of investment services to help individuals and businesses achieve their financial goals. Whether you’re planning for your retirement, saving for a down payment on a home, or investing for your children’s future, Regions Bank has a solution to meet your needs.

Retirement Planning

Retirement planning is one of the most important financial decisions you’ll ever make. Regions Bank offers a variety of retirement planning services to help you get started, including:

-

401(k) plans: 401(k) plans are employer-sponsored retirement savings plans that allow you to save money on a tax-deferred basis. Regions Bank can help you set up a 401(k) plan for your business and provide you with investment advice.

-

IRAs: IRAs are individual retirement accounts that allow you to save for retirement on a tax-advantaged basis. Regions Bank offers a variety of IRA options, including traditional IRAs, Roth IRAs, and rollover IRAs.

Investment Management

Regions Bank offers a variety of investment management services to help you grow your wealth. These services include:

-

Mutual funds: Mutual funds are investment vehicles that pool money from many investors and invest it in a diversified portfolio of stocks, bonds, or other assets. Regions Bank offers a variety of mutual funds to meet your investment goals and risk tolerance.

-

Exchange-traded funds (ETFs): ETFs are similar to mutual funds, but they trade on stock exchanges like individual stocks. ETFs offer a variety of investment opportunities, including exposure to different asset classes, sectors, and countries.

-

Managed accounts: Managed accounts are investment accounts that are managed by a professional investment advisor. Regions Bank offers a variety of managed accounts to meet your investment goals and risk tolerance.

Financial Planning

Regions Bank offers a variety of financial planning services to help you manage your money and achieve your financial goals. These services include:

-

Financial planning: Financial planning is the process of creating a roadmap for your financial future. Regions Bank can help you develop a financial plan that will help you reach your goals, such as saving for retirement, paying for your children’s education, or buying a home.

-

Tax planning: Tax planning is the process of minimizing your tax liability. Regions Bank can help you develop a tax plan that will help you save money on taxes.

-

Estate planning: Estate planning is the process of planning for the distribution of your assets after your death. Regions Bank can help you develop an estate plan that will ensure that your wishes are carried out.

Why Regions Bank?

Regions Bank is a leading financial institution with over 1,500 branches and 2,000 ATMs across the country. Regions Bank offers a wide range of financial products and services, including investment services, banking services, and lending services. Regions Bank is committed to providing its customers with the best possible service and helping them achieve their financial goals.

If you’re looking for a comprehensive suite of investment services, Regions Bank is the right choice for you. To learn more about Regions Bank’s investment services, visit your local Regions Bank branch or call 1-800-REGION-1.

Regions Bank Investment Services: A Comprehensive Guide to Wealth Management

Regions Bank offers a wide range of investment services to meet the diverse needs of its clients. Whether you’re just starting out with investing or have complex financial goals, Regions Bank has a solution that’s right for you.

Brokerage Services

Regions Bank’s brokerage services provide access to a full suite of investment options, including stocks, bonds, mutual funds, and ETFs. Experienced financial advisors can help you create a personalized investment portfolio that aligns with your risk tolerance and financial goals.

Managed Investment Portfolios

If you prefer a more hands-off approach to investing, Regions Bank’s managed investment portfolios offer a convenient and cost-effective solution. These portfolios are professionally managed by experienced investment professionals who actively monitor and adjust the portfolio to meet your specific objectives.

Retirement Planning

Retirement planning is an essential part of long-term financial security. Regions Bank offers a variety of retirement planning services, including IRAs, 401(k) plans, and annuities. Financial advisors can help you choose the right retirement savings vehicle and develop a strategy to meet your retirement income needs.

Tax Planning

Tax planning is a crucial aspect of wealth management. Regions Bank’s financial advisors can help you minimize your tax liability and maximize your after-tax returns. They can provide guidance on a range of tax-saving strategies, including estate planning, retirement account options, and charitable giving.

Personal Trust Services

Regions Bank provides personal trust services to help you manage your assets and protect your legacy. Experienced trust officers can assist with estate planning, trust administration, and investment management. They can also provide guidance on special needs trusts, charitable trusts, and other complex trust arrangements.

Trust and Estate Services

Regions Bank provides trust and estate services to assist with wealth planning, estate administration, and tax minimization strategies.

Wealth Planning

Regions Bank’s wealth planning services can help you create a comprehensive wealth management plan that meets your unique needs and objectives. Advisors consider factors such as your income, expenses, assets, and investment goals to develop a plan that will help you grow and preserve your wealth.

Estate Administration

When a loved one passes away, Regions Bank’s estate administration services can help you navigate the complex legal and financial processes involved in settling the estate. Advisors can assist with tasks such as probate, asset distribution, and tax filings.

Tax Minimization Strategies

Paying more in taxes than necessary can erode your wealth over time. Regions Bank’s financial advisors can help you develop tax minimization strategies that take advantage of available tax deductions and credits. They can also provide guidance on trusts and other estate planning tools that can reduce your tax liability.

Investment Management

Investment management is essential for growing and preserving your wealth. Regions Bank’s experienced investment professionals can manage your investment portfolio according to your specific risk tolerance and return objectives. They will monitor your investments and make adjustments as necessary to stay on track with your financial plan.

Financial Planning

Financial planning is a key component of wealth management. A financial plan can help you create a roadmap for achieving your financial goals. Regions Bank’s financial advisors can help you develop a plan that addresses your needs, such as retirement planning, education savings, and debt management.

Insurance Planning

Insurance is an important part of a comprehensive financial plan. Regions Bank’s insurance specialists can guide you through various insurance coverages, including life, health, disability, and long-term care. They can help you choose the right insurance products to protect yourself and your loved ones from financial risks.

Philanthropic Planning

If you’re interested in giving back to your community, Regions Bank’s philanthropic planning services can help you establish a charitable trust or foundation. Advisors can provide guidance on creating a giving plan that matches your philanthropic goals and aligns with your financial situation.

Special Needs Planning

Individuals with special needs require specialized financial planning considerations. Regions Bank’s special needs planning services can help you develop a plan that provides for your loved one’s care and well-being. Advisors can assist with tasks such as establishing trusts, navigating government benefits, and exploring housing options.

Legacy Planning

Legacy planning is about more than just distributing your assets. It’s about making sure your values and goals are carried on after you’re gone. Regions Bank’s legacy planning services can help you create a legacy that reflects your beliefs and provides a lasting impact on your community and the world.

Regions Bank Investment Services: A Comprehensive Guide to Financial Planning and Wealth Management

Regions Bank, renowned for its commitment to client-centric banking, offers a comprehensive suite of investment services that empowers individuals and businesses to navigate the complex financial landscape. With over 1,900 banking offices spread across 15 states, Regions Bank is well-positioned to provide personalized investment solutions tailored to each client’s unique needs and aspirations.

Investment Services Portfolio

Regions Bank’s investment services portfolio encompasses a wide array of offerings designed to meet the diverse investment goals of its clients. These services include:

- Wealth Management: Comprehensive financial planning and investment advisory services for high-net-worth individuals and families.

- Private Banking: Dedicated banking and wealth management services for affluent clients, offering personalized financial solutions and exclusive benefits.

- Investment Management: Professional investment management services for individuals and businesses, including asset allocation, portfolio construction, and ongoing monitoring.

- Trust and Estate Planning: Expert guidance on estate planning, trust administration, and wealth transfer strategies.

- Retirement Planning: Comprehensive planning and investment strategies to help individuals achieve their retirement savings goals.

- Insurance Solutions: A full range of insurance products, including life insurance, disability insurance, and long-term care insurance.

- Investment Products: Access to a wide variety of investment products, including stocks, bonds, mutual funds, and exchange-traded funds (ETFs).

Investment Philosophy

Regions Bank’s investment philosophy is centered around a disciplined and risk-aware approach. Their investment professionals leverage extensive research and analysis to identify investment opportunities that align with their clients’ objectives and risk tolerance. They believe in diversification and asset allocation as key strategies for mitigating risk and enhancing returns over the long term.

Investment Management Team

Regions Bank’s investment management team comprises experienced professionals with deep knowledge of the financial markets. They hold advanced degrees in finance and economics, and many have earned prestigious industry certifications. Their commitment to continuing education ensures that clients benefit from the latest investment strategies and market insights.

Personalized Investment Planning

Regions Bank understands that every client is unique, with specific financial goals and circumstances. Their investment professionals take a personalized approach to investment planning, working closely with clients to develop customized investment strategies that align with their individual needs. They provide ongoing guidance and support throughout the investment journey, ensuring that clients stay on track and make informed decisions.

Technology and Innovation

Regions Bank leverages technology and innovation to enhance the client experience. Their online investment platform provides clients with real-time access to their accounts, investment performance, and market news. They also offer mobile banking and investing apps, allowing clients to manage their investments on the go.

Community Involvement

Regions Bank is deeply committed to giving back to the communities it serves. Through its community involvement programs, the bank supports financial literacy initiatives, affordable housing, and economic development projects. Their investment services team actively participates in these programs, sharing their financial expertise and providing guidance to individuals and businesses.

Conclusion

Regions Bank’s investment services are a valuable resource for individuals and businesses seeking to achieve their financial aspirations. With a comprehensive portfolio of investment services, a disciplined investment philosophy, and a team of experienced professionals, Regions Bank empowers clients to make informed investment decisions and build a secure financial future. Whether you’re just starting your investment journey or are an experienced investor seeking personalized guidance, Regions Bank has the expertise and resources to help you reach your financial goals.