Services Offered by Investment Banks

If you’re like most people, you might not know a whole lot about investment banks, but if you’ve been following the latest financial market news, you’ve undoubtedly heard the phrase investment bank or investment banking thrown around, and it’s highly likely that you’re curious about what exactly these firms are and what they do. After all, they play a very vital role in today’s global financial world, but frankly, they’re not the most straightforward entities to understand. So, let’s first begin by trying to answer this very basic question: what is an investment bank? Put very simply, an investment bank is a financial intermediary that assists individuals, corporations, and even governments in raising capital. But what does that really mean? Let’s have a look at this very simple analogy: imagine that you’re a corporation with a fantastic business idea, but you don’t have the necessary capital to bring it to life. This is where investment banks step in. They act as a bridge between companies or governments who need capital, and investors who have the funds to provide it.

Primary Services

Investment banks offer a wide range of services that they can customize to meet specific client requirements, but underwriting, mergers and acquisitions advisory, as well as equity research, are generally considered to be their primary services.

Underwriting

Underwriting is a critical service provided by investment banks that involves assuming the risk of buying newly issued securities from corporations or governments and then reselling these securities to investors. In other words, investment banks act as intermediaries between issuers and investors and are responsible for pricing the securities, structuring the offering, and marketing the securities to potential investors.

Underwriting can be a complex process with many moving parts, but it is essential for companies and governments to raise capital and for investors to have access to new investment opportunities. Without investment banks, the flow of capital in the economy would be severely hampered.

There are two main types of underwriting: firm commitment underwriting and best efforts underwriting. In a firm commitment underwriting, the investment bank agrees to purchase the entire offering from the issuer at a specified price, regardless of whether or not the investment bank is able to resell all of the securities to investors. In a best efforts underwriting, the investment bank agrees to use its best efforts to sell the offering, but does not guarantee that it will be able to sell all of the securities.

Mergers and Acquisitions Advisory

Mergers and acquisitions (M&A) advisory is another key service offered by investment banks. In an M&A transaction, one company acquires another company or combines with another company to form a new entity. Investment banks can provide advice to both buyers and sellers in M&A transactions, helping them to negotiate the terms of the deal, structure the transaction, and obtain financing.

M&A advisory is a complex and challenging field, but it can also be very rewarding. Investment banks that are successful in this area can earn significant fees for their services.

Equity Research

Equity research is a type of financial analysis that focuses on the stocks of publicly traded companies. Equity research analysts use a variety of methods to analyze companies, including financial modeling, industry analysis, and company visits. The goal of equity research is to provide investors with insights into the potential risks and rewards of investing in a particular company.

Equity research is a valuable service for investors, as it can help them to make informed investment decisions. Investment banks that produce high-quality equity research can attract new clients and retain existing clients.

Other Services

In addition to these primary services, investment banks also offer a variety of other services, such as:

- Debt financing: Investment banks can help companies and governments to raise debt financing by issuing bonds or other types of debt securities.

- Financial advisory: Investment banks can provide financial advice to companies and governments on a variety of matters, such as capital structure, risk management, and strategic planning.

- Sales and trading: Investment banks can help clients to buy and sell securities, such as stocks, bonds, and derivatives.

- Asset management: Investment banks can manage investment portfolios for clients, such as pension funds, endowments, and high-net-worth individuals.

Services Offered by Investment Banks: A Deep Dive

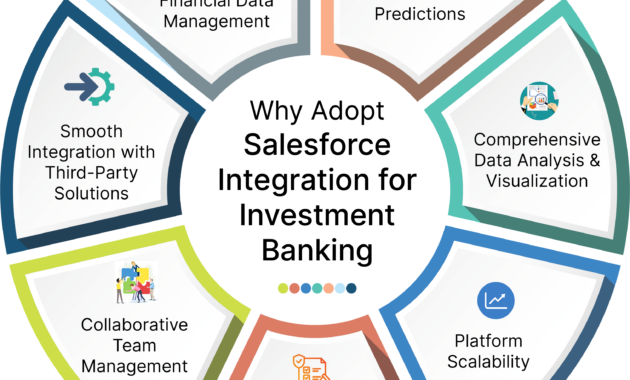

Investment banks play a crucial role in the financial world, facilitating a wide array of transactions and services that are essential for businesses, governments, and individuals. In addition to their core services, investment banks offer a menu of secondary services that complement their primary functions and provide added value to their clients. This article delves into the various secondary services offered by investment banks, exploring their scope, benefits, and relevance in the financial landscape.

Primary Services: The Cornerstone

Before exploring the secondary services, it’s helpful to briefly recap the primary services offered by investment banks. These services form the foundation of their business and include:

- Underwriting: Investment banks act as intermediaries, helping companies and governments raise capital by issuing and selling securities.

- Mergers and Acquisitions (M&A): Investment banks advise clients on strategic transactions, such as mergers, acquisitions, and divestitures.

- Equity and Debt Capital Markets: Investment banks assist clients in accessing capital markets to raise funds through equity offerings (stocks) or debt offerings (bonds).

- Trading and Market Making: Investment banks provide liquidity and facilitate trading in various securities, including stocks, bonds, commodities, and derivatives.

- Financial Advisory: Investment banks offer strategic advice on financial matters, such as capital structure, risk management, and financial modeling.

Secondary Services: A Value-Added Arsenal

In addition to their primary services, investment banks offer a range of secondary services that enhance their value proposition to clients. These services are designed to complement the primary services and provide a comprehensive suite of solutions for clients’ financial needs.

Asset Management

Asset management services involve managing and investing financial assets on behalf of clients. Investment banks offer a range of asset management products, including mutual funds, exchange-traded funds (ETFs), and separately managed accounts. These products provide investors with access to a diversified portfolio of investments, professional management, and risk monitoring.

Custody Services

Custody services involve safeguarding and administering the assets of clients. Investment banks provide secure storage and recordkeeping for physical and electronic assets, such as stocks, bonds, and cash. They also handle the settlement of trades and provide account statements and other reporting.

Prime Brokerage

Prime brokerage services cater to sophisticated investors, such as hedge funds and institutional investors. Investment banks provide a comprehensive suite of services, including customized financing, trade execution, risk management, and research. Prime brokers play a crucial role in facilitating complex trading strategies and managing risk for their clients.

Other Secondary Services

- Research and Analysis: Investment banks produce research reports and provide analysis on various industries, markets, and companies. This information helps clients make informed investment decisions and gain insights into market trends.

- Financial Planning and Wealth Management: Some investment banks offer financial planning and wealth management services to individuals and families. These services encompass financial goal setting, portfolio construction, and investment advice.

Conclusion: A Comprehensive Financial Toolkit

Investment banks offer a comprehensive range of secondary services that complement their primary services and provide added value to clients. These services include asset management, custody services, prime brokerage, research and analysis, and financial planning and wealth management. Investment banks have evolved from specialized financial intermediaries to full-service providers, catering to a wide range of financial needs of businesses, governments, and individuals. By leveraging the expertise of investment banks, clients can access a suite of financial solutions tailored to their unique requirements and objectives.