Introduction

When it comes to managing and growing your wealth, PNC Bank is here to lend a helping hand. With a comprehensive suite of investment services, PNC Bank has everything you need to achieve your financial goals.

Whether you’re a seasoned investor or just starting out, PNC Bank has a team of experts ready to guide you every step of the way. They’ll work closely with you to understand your unique financial situation and develop a personalized investment plan that aligns with your goals and risk tolerance.

So, what are you waiting for? Let PNC Bank help you reach your financial aspirations. With their expertise and personalized approach, you can feel confident that your money is in good hands.

Investment Services Offered by PNC Bank

PNC Bank offers a wide array of investment services to meet the diverse needs of its clients. These services include:

- Financial planning

- Investment management

- Retirement planning

- Trust and estate planning

- Brokerage services

With such a comprehensive suite of services, PNC Bank can help you with every aspect of your financial life. Whether you’re saving for retirement, planning for your child’s education, or simply looking to grow your wealth, PNC Bank has the expertise and experience to help you achieve your goals.

Financial Planning

Financial planning is the foundation of any sound investment strategy. It involves setting financial goals, assessing your risk tolerance, and developing a plan to achieve your objectives. PNC Bank’s financial planners can help you create a personalized financial plan that will guide you on your journey to financial success.

Here are just a few of the benefits of working with a financial planner from PNC Bank:

- Personalized advice tailored to your unique financial situation

- A comprehensive financial plan that outlines your goals and strategies

- Ongoing support and guidance as your financial situation evolves

If you’re serious about achieving your financial goals, working with a financial planner from PNC Bank is a smart move. They can help you create a roadmap for your financial future and provide the support you need to stay on track.

Investment Management

Once you have a financial plan in place, you can start thinking about how to invest your money. PNC Bank’s investment managers can help you create a diversified portfolio that meets your risk tolerance and investment objectives. They’ll also monitor your portfolio’s performance and make adjustments as needed to help you stay on track to reach your goals.

Here are some of the benefits of working with an investment manager from PNC Bank:

- Professional portfolio management

- Diversification to reduce risk

- Ongoing monitoring and adjustments

If you don’t have the time or expertise to manage your investments, working with an investment manager from PNC Bank is a great option. They can help you create and manage a portfolio that meets your specific needs and goals.

Retirement Planning

Retirement planning is essential for ensuring that you have a comfortable retirement. PNC Bank’s retirement planners can help you create a plan that will help you reach your retirement goals. They’ll consider your income, expenses, and risk tolerance to develop a plan that is tailored to your specific needs.

Here are some of the benefits of working with a retirement planner from PNC Bank:

- Personalized retirement plan

- Tax-efficient savings strategies

- Ongoing monitoring and support

If you’re nearing retirement or are already retired, working with a retirement planner from PNC Bank can help you ensure that you have the financial resources you need to live comfortably in your golden years.

Trust and Estate Planning

Trust and estate planning is important for protecting your assets and ensuring that your wishes are carried out after you pass away. PNC Bank’s trust and estate planners can help you create a plan that will meet your specific needs and goals.

Here are some of the benefits of working with a trust and estate planner from PNC Bank:

- Personalized trust and estate plan

- Asset protection

- Estate tax minimization

If you have a complex estate or have specific wishes for how your assets should be distributed after you pass away, working with a trust and estate planner from PNC Bank is a smart move. They can help you create a plan that will protect your loved ones and ensure that your wishes are carried out.

Brokerage Services

If you’re comfortable managing your own investments, PNC Bank’s brokerage services can provide you with the tools and resources you need to succeed. PNC Bank offers a variety of brokerage accounts, including self-directed trading accounts and managed accounts.

Here are some of the benefits of using PNC Bank’s brokerage services:

- Access to a wide range of investment products

- Competitive commissions and fees

- Online trading platform and mobile app

Whether you’re a seasoned investor or just getting started, PNC Bank’s brokerage services can help you reach your investment goals.

PNC Bank Investment Services: A Comprehensive Guide

For those seeking to secure their financial futures, PNC Bank stands as a beacon of stability, offering an array of investment services tailored to meet every need. From discerning individuals to seasoned investors, PNC empowers you to make informed decisions, grow your wealth, and achieve your financial aspirations.

Investment Accounts

At PNC Bank, we understand that every investor has unique goals and circumstances. That’s why we offer a diverse selection of investment accounts designed to accommodate a wide range of needs:

Checking Accounts

Imagine your checking account as a financial hub, a central point for managing your daily transactions. PNC checking accounts offer unparalleled convenience, allowing you to easily deposit checks, make withdrawals, and pay bills. Plus, with PNC’s digital banking tools, you can access your funds 24/7, from anywhere in the world.

Savings Accounts

Think of your savings account as a sanctuary for your financial aspirations. It’s the perfect place to stash away funds for a rainy day, a dream vacation, or a major life event. PNC savings accounts offer competitive interest rates, helping your savings grow steadily over time.

Money Market Accounts

Consider a money market account as a hybrid between a checking and savings account. It offers easy access to your funds while earning higher interest rates than traditional savings accounts. Ideal for short-term savings goals, money market accounts strike a delicate balance between liquidity and growth potential.

Certificates of Deposit (CDs)

CDs are the financial equivalent of a time capsule. You lock away your funds for a predetermined term, earning a fixed interest rate in return. They’re a low-risk option for those seeking a stable return on their investments.

Traditional IRAs

Traditional IRAs are like financial tax havens. Contributions to these accounts are tax-deductible, and withdrawals during retirement are taxed at a lower rate. Traditional IRAs are a smart choice for those looking to save for the long haul.

Roth IRAs

Roth IRAs are the polar opposites of traditional IRAs. While contributions are made on an after-tax basis, withdrawals during retirement are tax-free. They’re a great option for those seeking tax-advantaged growth on their retirement savings.

401(k) Plans

401(k) plans are employer-sponsored retirement plans that offer tax-advantaged savings. Employees can contribute a portion of their paycheck to these plans, with the employer often matching a certain percentage. 401(k) plans are a fantastic way to build a nest egg for retirement.

Annuities

Annuities are financial contracts that provide a guaranteed stream of income during retirement. They’re ideal for those seeking a stable and predictable income source in their golden years.

Mutual Funds

Mutual funds are investment vehicles that pool money from multiple investors to buy a diversified portfolio of stocks, bonds, or other securities. They offer a convenient way to spread risk and gain exposure to a wider range of investments.

ETFs

ETFs (exchange-traded funds) are similar to mutual funds, but they trade on stock exchanges like stocks. They offer lower costs and greater flexibility than traditional mutual funds.

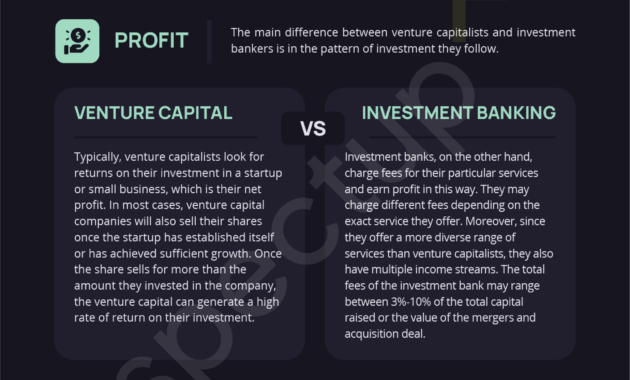

Hedge Funds

Hedge funds are actively managed investment pools that employ complex strategies to generate high returns. They’re suitable for sophisticated investors with a high risk tolerance.

Private Equity

Private equity involves investing in privately held companies that are not listed on public stock exchanges. It’s a complex asset class that offers high-risk, high-return potential.

Real Estate

Real estate investments can take various forms, from direct ownership of properties to investing in real estate mutual funds or REITs (real estate investment trusts). They offer diversification and the potential for capital appreciation and rental income.

PNC Bank Investment Services

PNC stands tall as one of the nation’s leading financial institutions, offering a comprehensive suite of investment services tailored to meet the diverse needs of its clientele. With a reputation built on trust and expertise, PNC provides customized investment strategies, personalized advice, and cutting-edge technology to empower investors in achieving their financial aspirations. Their comprehensive range of investment products and services caters to both seasoned investors seeking sophisticated solutions and novice investors embarking on their financial journey. Read on to delve into the world of PNC Bank’s investment services.

Investment Products

PNC offers a comprehensive array of investment products, empowering investors with a diverse portfolio to meet their unique financial goals. Stocks, bonds, mutual funds, and exchange-traded funds (ETFs) form the cornerstone of PNC’s investment offerings, each carrying distinct characteristics and risk profiles. Stocks represent ownership shares in publicly traded companies, offering investors the potential for capital appreciation and dividend income. Bonds, on the other hand, are fixed-income securities issued by corporations or governments, providing investors with regular interest payments and a return of principal at maturity.

Mutual funds, managed by professional investment managers, offer investors a diversified basket of stocks or bonds, mitigating risk and providing exposure to a broader market. Exchange-traded funds (ETFs) are similar to mutual funds but trade like stocks on exchanges, providing investors with intraday liquidity and the ability to fine-tune their portfolio in real-time. With such a comprehensive range of investment products, PNC ensures that investors can craft a portfolio that aligns seamlessly with their risk tolerance, time horizon, and financial objectives.

Investment Management Services

Beyond its robust product offerings, PNC provides a full spectrum of investment management services, catering to investors seeking professional guidance and tailored solutions. Their team of experienced investment professionals offers personalized advice, helping investors navigate the complexities of the financial markets and make informed investment decisions. PNC’s investment management services span a wide range, including:

-

Portfolio Management: PNC’s portfolio management service provides investors with a comprehensive solution for managing their investments. Experienced portfolio managers construct diversified portfolios tailored to each investor’s unique needs, continuously monitoring and adjusting the portfolio to align with changing market conditions and investment goals.

-

Retirement Planning: Retirement planning is a crucial aspect of financial planning, and PNC offers a suite of services to help investors prepare for their golden years. Their retirement planning services encompass retirement income planning, tax-advantaged investment strategies, and personalized advice to ensure a comfortable and secure retirement.

-

Trust and Estate Planning: PNC’s trust and estate planning services provide investors with peace of mind, ensuring that their wealth is managed and distributed according to their wishes. Their team of experts specializes in trust administration, estate planning, and charitable giving, helping investors preserve and transfer their wealth seamlessly to their beneficiaries.

-

Financial Planning: Financial planning is a holistic approach to managing one’s finances, and PNC offers comprehensive financial planning services to help investors make informed decisions about their financial future. Their financial planners assess investors’ financial situation, identify their financial goals, and develop customized plans to achieve those goals.

With a dedicated team of investment professionals and a comprehensive suite of investment management services, PNC empowers investors to navigate the intricacies of the financial markets and achieve their financial aspirations.

Personalized Advice and Technology

PNC recognizes that every investor is unique, with distinct financial goals and risk tolerance. Their personalized approach to investment advice ensures that investors receive tailored guidance that aligns with their specific needs. PNC’s investment advisors take the time to understand each investor’s financial situation, investment objectives, and risk tolerance, crafting customized investment strategies that maximize returns while minimizing risk.

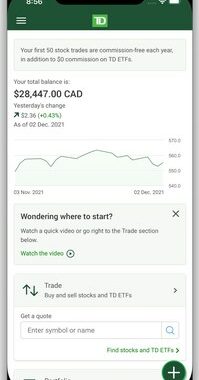

In today’s digital age, technology plays a pivotal role in investment management. PNC’s robust online platform provides investors with real-time access to their investment accounts, market data, and research reports. Their mobile app offers seamless investment management on the go, empowering investors to make informed decisions and monitor their portfolios anytime, anywhere. PNC’s commitment to innovation and technology ensures that investors have the tools and resources to stay informed and make timely investment decisions.

Conclusion

PNC Bank’s investment services are designed to cater to the diverse needs of investors, from those seeking self-directed investment options to those desiring comprehensive wealth management solutions. With a wide range of investment products, personalized advice, and cutting-edge technology, PNC empowers investors to take control of their financial future and achieve their investment goals. Whether you’re a seasoned investor or just starting out on your financial journey, PNC Bank’s investment services provide the guidance, support, and resources you need to succeed in the world of investing.

PNC Bank Investment Services: A Comprehensive Guide

If you’re looking for a trusted financial partner to help you navigate the complexities of investing, PNC Bank’s investment services might be the right choice for you. With a wide range of offerings, including financial advisors, a robust online platform, and competitive investment products, PNC can provide you with the tools and guidance you need to reach your financial goals.

Financial Advisors

PNC’s team of experienced financial advisors can help you create a personalized investment plan tailored to your unique financial situation and goals. They’ll work with you one-on-one to understand your financial needs, risk tolerance, and time horizon. Together, you’ll develop a comprehensive investment strategy that helps you maximize your potential returns while minimizing risk.

Online Investment Platform

If you prefer to manage your investments on your own, PNC’s online investment platform offers a user-friendly interface and a full suite of trading tools. You can access real-time market data, place trades, and track your investments 24/7. The platform also provides educational resources and investment insights to help you make informed decisions.

Investment Products

PNC offers a wide range of investment products to meet the needs of investors of all levels. These include:

- Stocks

- Bonds

- Mutual funds

- Exchange-traded funds (ETFs)

- Certificates of deposit (CDs)

- Money market accounts

Competitive Fees

PNC’s investment fees are competitive with industry standards. The specific fees you pay will depend on the type of investment products you choose and the level of service you require. PNC offers a range of fee-based accounts as well as non-fee-based accounts to suit your individual needs.

Award-Winning Customer Service

PNC has consistently been recognized for its exceptional customer service. The bank’s financial advisors and customer service representatives are available to assist you with any questions or concerns you may have. PNC also offers a variety of online resources and self-help tools to empower you to manage your investments with confidence.

How to Get Started

Getting started with PNC Bank investment services is easy. You can schedule an appointment with a financial advisor or sign up for an online investment account. PNC provides a range of educational resources to help you make informed decisions about your investments. Don’t hesitate to reach out to PNC’s customer service team if you have any questions or need additional support.

PNC Bank investment services can be a valuable tool for investors of all levels. With a team of experienced financial advisors, a user-friendly online investment platform, and a wide range of investment products, PNC can help you achieve your financial goals. Start planning for your financial future today with PNC Bank investment services.

PNC Bank Investment Services: The Ultimate Guide to Online Investing

When it comes to investing, PNC Bank knows a thing or two about it. With a stellar reputation and a commitment to customer satisfaction, PNC Bank stands as a towering figure in the financial industry. Their investment services are nothing short of comprehensive, offering a wide array of options to cater to every investor’s needs and aspirations. If you’re looking to take control of your financial future and embark on a journey toward financial independence, PNC Bank’s investment services beckon you like a siren’s song. But wait, there’s more! PNC Bank’s online investing platform is a game-changer, allowing you to trade stocks, bonds, and mutual funds from the comfort of your own home. Picture this: It’s a lazy Sunday afternoon, you’re lounging on the couch, sipping on a refreshing lemonade, and boom! You can manage your investments with just a few clicks. Convenience at its finest!

Online Investing: Your Gateway to Financial Empowerment

PNC’s online investing platform is not just another cog in the financial machine; it’s a gateway to financial empowerment. It’s like having a dedicated financial wizard at your fingertips, ready to guide you through the complexities of the investment world. With real-time quotes, comprehensive market data, and tailored investment recommendations, you’ll feel like a seasoned pro in no time. Whether you’re a seasoned investor or just starting to dip your toes into the investment waters, PNC’s online investing platform has got you covered. It’s like having a personal finance sherpa, leading you to the summit of financial success.

Investment Options: A Smorgasbord of Choices

PNC Bank’s investment services are like a smorgasbord of choices, offering a delectable array of investment options to suit every taste. Stocks, bonds, mutual funds – the list goes on and on. It’s like being a kid in a candy store, but instead of sugary treats, you’re surrounded by investment opportunities that can potentially sweeten your financial future. Whether you’re looking for steady growth or the thrill of the market’s ups and downs, PNC Bank has an investment option that will tickle your fancy. It’s like having a financial buffet where you can mix and match different investments to create a portfolio that’s uniquely yours.

Research and Education: Unlocking the Secrets of Investing

Just like a master chef needs to understand the intricacies of their ingredients, successful investing requires a deep understanding of the market and its intricacies. That’s where PNC Bank’s research and education tools come into play. It’s like having a financial encyclopedia at your fingertips, empowering you with the knowledge to make informed investment decisions. Webinars, videos, and articles – PNC Bank leaves no stone unturned in their quest to provide you with the financial literacy you need to navigate the investment landscape with confidence. It’s like having a financial GPS, guiding you through the twists and turns of the market.

Personalized Advice: Your Financial Compass

Investing can be a daunting task, but fear not! PNC Bank’s team of financial advisors is like your personal financial compass, guiding you through the uncharted waters of the investment world. They’ll sit down with you, listen to your financial goals and dreams, and tailor an investment plan that’s as unique as your fingerprint. It’s like having a financial confidant, someone you can trust to help you steer your financial ship towards a brighter future. Their expertise is like a beacon of hope, illuminating the path to financial success.

PNC Bank Investment Services: A Comprehensive Guide

Navigating the world of investing can be intimidating, but it doesn’t have to be. PNC Bank, a reputable financial institution, offers a suite of investment services tailored to help you reach your financial goals.

From comprehensive research tools to personalized guidance, PNC has it all. Let’s dive into the world of PNC Bank investment services and explore how they can empower you to make informed decisions and grow your wealth.

Research and Education

PNC provides a vast array of research and educational resources to help you make informed investment decisions. Whether you’re a seasoned investor or just starting out, PNC has something for everyone.

Their online research portal offers in-depth reports, market analyses, and expert insights. You can also access educational webinars, seminars, and workshops designed to enhance your investment knowledge.

Personalized Guidance

If you prefer a more hands-on approach, PNC’s financial advisors can provide personalized guidance. They’ll take the time to understand your financial goals, risk tolerance, and investment preferences.

Together, you’ll create a tailored investment plan that aligns with your unique needs. Your advisor will be there every step of the way, offering ongoing support and guidance.

Tailored Investments

PNC offers a diverse range of investment products to meet your specific requirements. Mutual funds, exchange-traded funds (ETFs), and individual stocks and bonds are just a few of the options available.

Their team of experts will work with you to select investments that fit your goals and risk profile. They’ll also monitor your portfolio and make adjustments as needed.

Retirement Planning

Retirement planning is crucial for securing your financial future. PNC Bank offers a range of retirement accounts, including IRAs and 401(k)s. They’ll help you determine the best account for your needs and guide you through the contribution process.

Their personalized investment plans will help you grow your retirement savings while minimizing risks.

Estate Planning

PNC Bank understands the importance of estate planning. Their experienced professionals can help you create a will, trust, and other legal documents to ensure your assets are distributed according to your wishes.

They’ll work closely with you to ensure your legacy and protect your loved ones.

Staying Ahead of the Curve

The financial landscape is constantly evolving. PNC Bank is committed to staying ahead of the curve and providing its clients with the latest investment strategies and technologies.

Their research team monitors market trends and identifies potential opportunities. They’ll keep you informed of the latest developments and provide insights to help you make informed decisions.

Conclusion

PNC Bank investment services empower you to make informed financial decisions and grow your wealth. With their comprehensive research tools, personalized guidance, tailored investments, retirement planning, estate planning, and commitment to innovation, PNC has everything you need to achieve your financial goals.

So, why wait? Take control of your financial future and explore the world of PNC Bank investment services today.

PNC Bank Investment Services: Your Trusted Guide to Financial Success

Are you ready to embark on a journey toward financial well-being? Look no further than PNC Bank, a trusted provider of investment services that can help you turn your financial aspirations into reality. With a comprehensive suite of offerings tailored to meet your diverse needs, PNC Bank empowers you to invest with confidence and achieve your long-term goals.

1. PNC Bank Investment Services: A Comprehensive Overview

PNC Bank’s investment services are meticulously designed to cater to a wide range of investors, from seasoned professionals to those just starting their financial journey. Whether you seek to grow your wealth, generate income, or preserve your assets, PNC Bank has a solution that aligns with your unique objectives.

2. Investment Planning: Charting Your Course to Success

The path to financial success begins with a well-defined investment plan. PNC Bank’s experienced financial advisors work closely with you to understand your goals, risk tolerance, and investment horizon. Together, you’ll craft a personalized plan that serves as a roadmap for your financial future.

3. Investment Products: A World of Opportunities at Your Fingertips

PNC Bank offers a vast array of investment products to meet the diverse needs of its clients. Whether you prefer stocks, bonds, mutual funds, or exchange-traded funds (ETFs), you’ll find a wide selection to choose from. Our investment professionals can guide you in selecting the right mix of products to optimize your portfolio.

4. Retirement Planning: Securing Your Golden Years

Planning for retirement is crucial to ensure a comfortable and fulfilling later life. PNC Bank offers a range of retirement savings plans, including 401(k)s, IRAs, and annuities. Our experts can help you choose the right plan for your situation and maximize your retirement savings.

5. Trust and Estate Planning: Preserving Your Legacy

Protecting your assets and ensuring the distribution of your wealth according to your wishes are essential aspects of financial planning. PNC Bank’s trust and estate planning services can help you create a comprehensive plan that minimizes taxes, distributes your assets as intended, and provides for your loved ones.

6. Investment Research and Education: Empowering You with Knowledge

PNC Bank believes that informed investors make better decisions. That’s why we provide access to a wealth of research and educational resources. Our team of analysts monitors market trends and provides timely insights to help you stay ahead of the curve. We also offer seminars, webinars, and online resources to empower you with the knowledge you need to succeed.

7. Personal Service and Technology: A Winning Combination

At PNC Bank, we understand that every client is unique, and so is their investment journey. Our dedicated team of financial advisors provides personalized service tailored to your specific needs. They take the time to listen to your concerns, answer your questions, and guide you through every step of the investment process. We seamlessly blend this personal touch with cutting-edge technology that makes investing convenient and accessible. Our online platform and mobile app allow you to monitor your investments, make trades, and stay informed on the go.

Conclusion

PNC Bank is your trusted partner in achieving financial success. With a comprehensive suite of investment services, experienced financial advisors, and a commitment to empowering you with knowledge, PNC Bank is ready to help you navigate the complexities of the financial world and reach your long-term goals. Contact us today to schedule a consultation and embark on a journey of financial well-being.