Regions Bank Investment Services

When it comes to planning your financial future, choosing the right investment services can make all the difference. Regions Bank, a trusted financial institution with over 1,500 branches across the country, offers a comprehensive suite of investment services to help you reach your financial goals. Whether you’re a seasoned investor or just starting out, Regions Bank has the expertise and resources to meet your needs.

Regions Bank’s investment services include managed accounts, financial planning, and brokerage services. With managed accounts, you can delegate your investment decisions to a team of experienced professionals who will tailor your portfolio to your specific goals and risk tolerance. Financial planning services can help you create a roadmap for your financial future, considering factors like retirement planning, college savings, and estate planning. And if you prefer to take a more hands-on approach to investing, Regions Bank’s brokerage services provide access to a wide range of investment products and research.

One of the key benefits of choosing Regions Bank for your investment services is their commitment to personalized service. Unlike some large banks that treat their customers like numbers, Regions Bank takes the time to get to know you and your financial objectives. Their investment advisors will work with you one-on-one to develop a customized investment plan that aligns with your unique needs and aspirations.

Managed Account Services

If you’re looking for a more hands-off approach to investing, Regions Bank’s managed account services may be a great option for you. With managed accounts, you can entrust your investment decisions to a team of experienced professionals who will handle the day-to-day management of your portfolio. This can be a great option for busy individuals who don’t have the time or expertise to manage their own investments.

Regions Bank offers a variety of managed account services, including:

The type of managed account that’s right for you will depend on your investment goals, risk tolerance, and level of involvement you want in the investment process. Regions Bank’s investment advisors can help you choose the managed account service that’s the best fit for your needs.

Financial Planning Services

Financial planning is an essential part of securing your financial future. A comprehensive financial plan can help you make informed decisions about your money, including how to save for retirement, pay for college, and protect your family. Regions Bank’s financial planning services can help you create a customized financial plan that addresses your unique needs and goals.

Regions Bank’s financial planning services include:

Regions Bank’s financial planning services can help you take control of your financial future and make informed decisions about your money. Their financial advisors will work with you one-on-one to create a customized financial plan that meets your unique needs and goals.

Brokerage Services

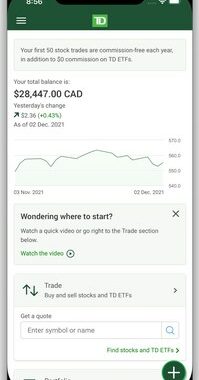

If you’re a more experienced investor who prefers to take a more hands-on approach to investing, Regions Bank’s brokerage services may be a great option for you. With brokerage services, you have access to a wide range of investment products and research, including stocks, bonds, mutual funds, and ETFs. You can also trade online or through a mobile app.

Regions Bank’s brokerage services include:

Regions Bank’s brokerage services can help you take control of your investments and make informed decisions about your money. Their brokerage account managers will work with you one-on-one to help you develop an investment strategy that meets your unique needs and goals.

Guided Investment Services

Regions Bank offers a range of investment services tailored to meet the needs of investors from all walks of life. Whether you’re a seasoned pro or just starting out, Regions Bank has something to offer.

Managed Accounts

Regions Bank’s managed accounts are designed to meet the needs of investors of all levels, providing personalized investment solutions that align with your financial goals.

What are managed accounts?

Managed accounts are investment accounts where a professional money manager makes investment decisions on your behalf. This can be a great option for investors who don’t have the time or expertise to manage their own investments.

How do managed accounts work?

When you open a managed account with Regions Bank, you’ll work with a financial advisor to create an investment plan that meets your specific needs. Your advisor will then make investment decisions on your behalf, based on the parameters you’ve established.

What are the benefits of managed accounts?

There are several benefits to opening a managed account with Regions Bank, including:

- Professional money management: You’ll get access to a team of experienced investment professionals who will manage your investments on your behalf.

- Personalized investment plan: Your investment plan will be tailored to your specific financial goals and risk tolerance.

- Time savings: You won’t have to spend time researching and making investment decisions yourself.

- Peace of mind: Knowing that your investments are being managed by professionals can give you peace of mind.

Who should consider a managed account?

Managed accounts are a good option for investors who:

- Don’t have the time or expertise to manage their own investments

- Want to delegate investment decisions to a professional

- Are looking for a personalized investment plan

- Want peace of mind knowing that their investments are being managed by professionals

How do I open a managed account?

To open a managed account with Regions Bank, you’ll need to contact a financial advisor. Your advisor will work with you to create an investment plan and open an account.

What are the fees for managed accounts?

The fees for managed accounts vary depending on the type of account you open and the amount of money you invest. Your financial advisor will be able to provide you with more information about the fees associated with your account.

Regions Bank Investment Services: A Comprehensive Guide to Your Financial Future

Regions Bank’s investment services are designed to help you reach your financial goals, whether you’re saving for retirement, buying a home, or simply growing your wealth. With a range of investment options and personalized advice from experienced professionals, Regions Bank can help you create a tailored financial plan that aligns with your aspirations.

Financial Planning: Navigating Your Financial Journey

Like a skilled captain charting a course through turbulent waters, Regions Bank’s financial planning services can help you navigate the complexities of your financial future. Their personalized plans are tailored to your unique goals, considering factors such as your risk tolerance, investment horizon, and tax situation. Whether you’re a seasoned investor or just starting your journey, Regions Bank’s financial planners are there to guide you every step of the way.

Investment Options: A Wealth of Choices

Regions Bank offers a comprehensive suite of investment options to suit a wide range of financial needs and goals. From stocks and bonds to mutual funds and annuities, our experts can help you build a diversified portfolio that balances risk and return. They’ll consider your individual circumstances and create a strategy that aligns with your long-term objectives, whether you’re aiming to preserve capital, generate income, or plan for retirement.

Stocks: Investing in Corporate Growth

Stocks represent ownership in publicly traded companies, allowing you to share in their financial success. When a company performs well, its stock price typically increases, potentially providing investors with capital appreciation. However, stocks also carry the risk of losing value, especially in volatile markets.

Bonds: Stable Income and Capital Preservation

Bonds are debt instruments issued by governments and corporations. They offer a fixed income stream over a specific period, providing stability and a potential hedge against market fluctuations. While bonds generally have lower return potential than stocks, they also come with lower risk.

Mutual Funds: Diversification and Risk Management

Mutual funds pool money from many investors and invest it in a diversified portfolio of stocks, bonds, or other assets. This diversification helps spread risk across multiple investments, reducing the impact of any single investment’s performance. Mutual funds offer a range of risk-return profiles, allowing you to choose a fund that aligns with your investment goals.

Annuities: Guaranteed Income for Retirement

Annuities provide a guaranteed stream of income for a specified period or for your lifetime. They can be an attractive option for retirees seeking a predictable income source or individuals looking to supplement their retirement savings. Regions Bank offers a variety of annuity options to help you secure a comfortable financial future.

Regions Bank Investment Services: A Comprehensive Guide

When it comes to managing your wealth, choosing the right financial partner is crucial. Regions Bank, known for its extensive branch network and commitment to customer service, offers a robust suite of investment services tailored to meet diverse financial goals. In this article, we’ll delve into Regions Bank’s investment services, exploring its brokerage services, financial planning capabilities, and investment strategies.

Brokerage Services

Regions Bank’s brokerage services empower investors with a comprehensive array of investment options to grow their portfolios. From seasoned traders to first-time investors, Regions Bank offers a tailored experience. Whether you prefer online trading, in-person guidance, or a combination of both, their experienced brokers are available to assist you. Regions Bank’s brokerage platform provides access to a wide range of investment products, including:

- Stocks: Gain exposure to individual companies and industries by investing in their shares.

- Bonds: Seek fixed income returns through investments in bonds issued by governments, corporations, and municipalities.

- Mutual funds: Diversify your portfolio with professionally managed funds that invest in a basket of stocks, bonds, or other assets.

- Exchange-traded funds (ETFs): Access a broad range of investment themes and sectors through low-cost, passively managed ETFs.

Financial Planning Services

Beyond brokerage services, Regions Bank offers comprehensive financial planning services to help you navigate the complexities of wealth management. Their team of experienced financial planners works closely with you to:

- Assess your financial goals and risk tolerance

- Develop tailored investment strategies

- Create comprehensive financial plans

- Monitor and adjust your investments over time

- Provide ongoing support and guidance

Whether you’re planning for retirement, saving for a child’s education, or managing wealth across multiple generations, Regions Bank’s financial planning services can help you chart a clear path toward financial success.

Managed Investment Strategies

For investors seeking professional management of their investments, Regions Bank offers a range of managed investment strategies. These strategies are designed to meet specific investment objectives, such as growth, income, or capital preservation. Regions Bank’s experienced investment professionals leverage their expertise and in-depth market knowledge to:

- Develop and implement tailored investment portfolios

- Monitor and rebalance portfolios to meet your goals

- Provide regular performance updates and investment insights

By entrusting Regions Bank with your investments, you gain access to a team dedicated to helping you achieve your financial aspirations.

Why Choose Regions Bank for Your Investment Needs?

Regions Bank has earned a reputation for providing exceptional investment services backed by a commitment to customer satisfaction. Here’s what sets them apart from the competition:

- Personalized Service: Dedicated financial professionals provide tailored guidance and support.

- Comprehensive Investment Offerings: Access a wide range of investment products to meet your unique needs.

- Financial Planning Expertise: Experienced financial planners help you achieve your financial goals.

- Managed Investment Strategies: Get professional management for your investments with customized strategies.

- Strong Financial Foundation: Regions Bank’s robust financial standing provides stability and peace of mind.

Whether you’re a seasoned investor or just starting your financial journey, Regions Bank has the experience, expertise, and commitment to help you succeed in your investment endeavors.