Investment Banking Services

Investment banks are financial institutions that provide a comprehensive suite of services to corporations, governments, and other clients. These services play a critical role in facilitating the flow of capital and supporting economic growth. Let’s delve into the diverse array of offerings provided by investment banks.

Capital Raising

One of the core services of investment banks is capital raising. They assist companies in raising funds from investors through various channels, such as equity offerings, bond issuances, and private placements. Investment banks act as intermediaries between issuers and investors, ensuring that the capital-raising process is conducted efficiently and effectively.

The capital-raising process typically begins with the investment bank conducting thorough due diligence to assess the company’s financial health, business plan, and market potential. Based on this assessment, the investment bank structures the appropriate financing strategy and identifies potential investors. Throughout the process, they provide guidance and support to the company, ensuring a successful capital raise.

Investment banks play a crucial role in facilitating the flow of capital to companies. They help businesses access the necessary financing to expand their operations, invest in new technologies, and pursue growth opportunities. Without the services of investment banks, companies would face significant challenges in raising capital, which would hinder their ability to grow and compete in the global marketplace.

The capital-raising process involves several key steps. Firstly, the investment bank conducts a detailed analysis of the company’s financial position, business model, and market prospects. This analysis forms the basis for determining the appropriate financing strategy and identifying potential investors.

Next, the investment bank structures the financing transaction. This involves determining the type of securities to be issued, the terms of the offering, and the pricing. The investment bank also prepares marketing materials and conducts investor presentations to attract potential investors.

Once the offering is launched, the investment bank acts as the intermediary between the company and investors. They facilitate the subscription process, ensuring that all necessary documentation is completed and that the funds are raised successfully.

Investment banks play a vital role in the capital-raising process. They provide expertise, market knowledge, and access to investors, which enables companies to raise capital efficiently and effectively. Without the services of investment banks, companies would face significant challenges in accessing the funding they need to grow and compete.

Imagine a company looking to expand its operations but lacking the necessary capital. An investment bank, acting as a financial bridge, can connect the company with investors who are willing to provide the required funding. Through its expertise and market knowledge, the investment bank ensures that the company secures the financing it needs to achieve its growth aspirations.

Furthermore, investment banks provide ongoing support to companies after the capital raise. They monitor the company’s performance, advise on financial matters, and assist with future capital-raising needs. This ongoing relationship helps companies maintain financial stability and navigate the complexities of the capital markets.

Investment Banks: A Comprehensive Guide to Their Services

Investment banks, often referred to as the gatekeepers of the financial world, play a crucial role in the seamless functioning of capital markets. These financial powerhouses offer a comprehensive suite of services that cater to the diverse needs of corporations, governments, and high-net-worth individuals. From raising capital to facilitating mergers and acquisitions, investment banks are an indispensable cog in the financial landscape.

Let’s delve deeper into the spectrum of services provided by investment banks, exploring each one in detail:

Underwriting: The Cornerstone of Capital Raising

Underwriting, the cornerstone of investment banking, involves taking on the risk of selling newly issued securities on behalf of clients. Investment banks act as intermediaries between corporations or governments seeking to raise capital and investors eager to acquire these securities. They assess the risk associated with the offering, determine a fair price, and underwrite or guarantee the sale of the securities.

The underwriting process is meticulously orchestrated, commencing with a thorough due diligence review of the client’s financial standing and business prospects. This in-depth analysis allows investment banks to evaluate the viability of the proposed offering and determine an appropriate pricing structure. Subsequently, the investment bank syndicates or pools together a group of investors, ensuring broad distribution of the securities.

Underwriting may encompass a range of securities, including equity (stocks) and debt (bonds). Equity underwriting involves issuing new shares of a company’s stock to raise capital for expansion, acquisitions, or other strategic initiatives. Debt underwriting, on the other hand, involves issuing bonds to raise capital for various purposes, such as infrastructure development or debt refinancing.

Investment banks play a pivotal role in the underwriting process, leveraging their expertise in market analysis, risk assessment, and investor relations to ensure successful capital raising. Their ability to attract and engage a diverse pool of investors is paramount to the success of an underwriting offering.

Moreover, investment banks provide value-added services throughout the underwriting process, including advising clients on structuring the offering, preparing marketing materials, and navigating regulatory requirements. They act as trusted advisors, guiding clients through the intricacies of the capital markets and helping them achieve their strategic objectives.

Underwriting is a complex and multifaceted service, requiring a deep understanding of financial markets, risk management, and investor psychology. Investment banks, with their specialized teams and extensive experience, are ideally positioned to execute successful underwriting transactions, enabling clients to access the capital they need to fuel growth and innovation.

A Deep Dive into Investment Banking’s Diverse Service Offerings

Investment banks play a pivotal role in the financial ecosystem, offering a wide array of services to assist their clients in achieving their financial goals. These services encompass everything from raising capital to managing risk, providing expert guidance and tailored solutions to meet the unique needs of each client.

Financial Advisory

Investment banks serve as financial advisors, providing expert counsel to clients on a range of strategic and financial matters. These services encompass:

- Capital Raising: Investment banks act as intermediaries, helping companies raise funds through various methods such as issuing bonds or equity.

- Financial Planning: They assist clients in developing comprehensive financial plans that align with their long-term goals, considering factors such as investment strategies, retirement planning, and tax optimization.

- Risk Management: Investment banks provide guidance on managing financial risks, offering expertise in areas such as interest rate hedging, portfolio diversification, and credit analysis.

Capital Markets

Investment banks play a central role in capital markets, facilitating the flow of capital between investors and companies. Their services include:

- Underwriting: Investment banks act as underwriters, evaluating and pricing new securities offerings, ensuring they are distributed to investors efficiently.

- Trading: They provide liquidity to the markets by trading various financial instruments, including stocks, bonds, and currencies, on behalf of clients.

- Market Making: Investment banks serve as market makers, providing continuous quotes for specific securities, thereby facilitating trading and price discovery.

Sales and Trading

Investment banks maintain active sales and trading desks, offering a range of services to institutional and individual investors. These services encompass:

- Equity Research: Investment banks produce in-depth research reports on companies, providing insights into their financial performance, industry trends, and investment recommendations.

- Fixed Income Sales: They facilitate the buying and selling of fixed income securities, such as bonds, for institutional clients seeking to manage their investment portfolios.

- Derivatives Trading: Investment banks provide access to derivatives markets, enabling clients to hedge risks or speculate on the future direction of interest rates, currencies, or commodities.

Investment Management

Investment banks offer investment management services, providing clients with tailored investment solutions to meet their specific financial goals. These services include:

- Portfolio Management: Investment banks manage client portfolios, constructing and rebalancing them based on investment objectives, risk tolerance, and market conditions.

- Asset Allocation: They provide guidance on asset allocation, helping clients diversify their investments across various asset classes, such as stocks, bonds, real estate, and commodities.

- Private Equity: Investment banks offer access to private equity funds, which invest in unlisted companies with high growth potential, providing clients with the opportunity to participate in these investments.

Mergers and Acquisitions

Investment banks play a crucial role in mergers and acquisitions (M&A), advising on and executing transactions between companies. Their services include:

- Advisory: Investment banks provide strategic advice to clients on M&A transactions, evaluating potential targets or acquirers, conducting due diligence, and negotiating terms.

- Execution: They lead the execution of M&A transactions, managing the entire process from planning to closing, ensuring a smooth and successful implementation.

- Financing: Investment banks arrange financing for M&A transactions, structuring debt or equity offerings to fund acquisitions or provide liquidity to sellers.

Restructuring

Investment banks offer restructuring services to companies facing financial or operational challenges. These services include:

- Financial Restructuring: Investment banks help distressed companies restructure their debt and equity, providing solutions to improve their financial health and avoid bankruptcy.

- Operational Restructuring: They advise companies on operational improvements, such as cost reductions, process enhancements, and organizational realignment, to enhance efficiency and profitability.

- Bankruptcy Advisory: Investment banks provide guidance to companies navigating bankruptcy proceedings, offering expertise in legal and financial matters to maximize recoveries for creditors and shareholders.

Conclusion

Investment banks provide a comprehensive suite of services that cater to the diverse financial needs of their clients. From advising on complex financial transactions to managing investment portfolios, they play a vital role in the smooth functioning of financial markets. Whether you are a seasoned investor or a business looking to raise capital, investment banks offer tailored solutions to help you achieve your financial goals.

Services Provided by Investment Banks: A Comprehensive Guide

Investment banks are specialized financial institutions that offer a wide range of services. They play a crucial role in facilitating capital formation, providing advisory services, and executing transactions for corporations, governments, and institutional investors.

Sales and Trading

Sales and Trading

Investment banks assist clients with the buying and selling of securities. This includes both equity and debt securities, as well as derivatives and other financial instruments. Investment banks typically have large trading desks with dedicated teams that specialize in different asset classes and markets. They provide liquidity to the markets and help clients execute their investment strategies.

Investment banks also provide research and analysis to help clients make informed investment decisions. They employ teams of analysts who cover different industries and sectors, providing in-depth reports on company fundamentals, industry trends, and economic conditions.

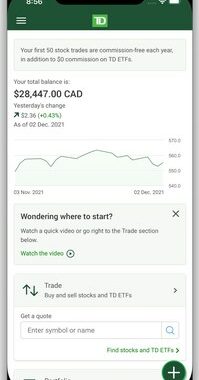

Initial Public Offerings (IPOs)

Initial Public Offerings (IPOs)

Investment banks play a key role in helping companies go public through initial public offerings (IPOs). An IPO is the process by which a private company sells shares to the public for the first time. Investment banks act as underwriters for IPOs, managing the entire process from pricing the shares to marketing the offering to investors.

Investment banks provide expertise in structuring and executing IPOs, ensuring that companies raise the necessary capital and achieve a successful listing on the stock exchange. They also provide ongoing support to companies after they go public, helping them navigate the regulatory landscape and maintain investor relations.

Mergers and Acquisitions (M&A)

Mergers and Acquisitions (M&A)

Investment banks advise corporations on mergers, acquisitions, and divestitures. They provide strategic counsel, financial analysis, and transaction execution services to help clients achieve their business objectives. Investment banks help companies identify potential targets, negotiate deals, and manage the integration process.

Investment banks also assist companies with raising debt and equity capital to finance mergers and acquisitions. They provide advice on the most appropriate financing structure and help clients access the capital markets efficiently.

Financial Advisory

Financial Advisory

Investment banks provide a range of financial advisory services to corporations, governments, and institutional investors. These services include strategic planning, capital structure optimization, and risk management. Investment banks help clients develop and implement long-term financial strategies that align with their business objectives.

Investment banks also provide specialized advisory services in areas such as derivatives, structured finance, and real estate. They offer expert advice and help clients navigate complex financial transactions and investment decisions.

Capital Markets

Capital Markets

Investment banks play a vital role in the capital markets, facilitating the issuance and trading of securities. They act as intermediaries between issuers and investors, providing expertise in pricing, structuring, and distributing securities. Investment banks help companies raise capital through bonds, loans, and other financial instruments.

Investment banks also provide liquidity to the capital markets by trading securities and facilitating secondary market transactions. They help ensure that investors have access to a wide range of investment opportunities and that issuers can efficiently raise capital.

Other Services

Other Services

In addition to the core services listed above, investment banks offer a variety of other services, including:

- Asset Management: Investment banks manage investment portfolios for clients, providing investment advice and tailored financial solutions.

- Private Equity: Investment banks invest in private companies and provide capital and advisory services to help businesses grow and expand.

- Real Estate Advisory: Investment banks provide advisory services to real estate investors and developers, helping them identify and execute investment opportunities.

- Technology Investment Banking: Investment banks specialize in providing financial services to technology companies, assisting with IPOs, mergers and acquisitions, and capital raising.

- ESG Advisory: Investment banks assist clients with developing and implementing environmental, social, and governance (ESG) strategies and investments.