Small Business Liability Insurance: Protecting Your Business’s Foundation

In the ever-evolving landscape of business, it’s essential to have a solid foundation to weather the storms of potential risks. One cornerstone of this foundation is business liability insurance, a safety net that shields your company from financial catastrophes stemming from third-party claims. This type of insurance coverage is not just a “nice-to-have” for small businesses; it’s a necessity for safeguarding your assets, reputation, and peace of mind.

Picture this: a customer slips and falls in your store, sustaining a serious injury. Or, a faulty product you sold causes property damage to a customer’s home. In such scenarios, you could face substantial legal costs and damages that could cripple your business. But with liability insurance, you have a financial cushion to help cover these expenses, preventing them from sinking your company.

It’s a bit like wearing a helmet when you’re riding a bike. You may not always need it, but when you do, it can make all the difference. Liability insurance acts as a helmet for your business, protecting it from the potential financial impact of unexpected accidents or mishaps.

Understanding Small Business Liability Insurance

Liability insurance is a type of coverage that protects your business from claims alleging bodily injury, property damage, or other harm caused by your business operations, products, or employees.

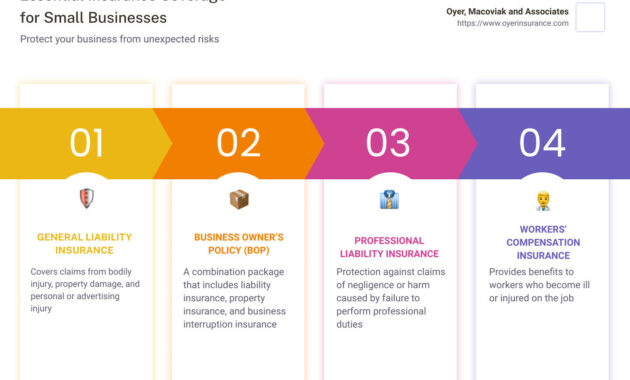

There are various types of liability insurance policies tailored to meet the specific needs of different businesses. The most common types include:

- General liability insurance: Covers a wide range of third-party claims, including bodily injury, property damage, and personal injury.

- Product liability insurance: Protects your business from claims alleging injuries or damages caused by your products.

- Professional liability insurance: Protects professionals from claims of negligence or errors and omissions in their services.

When choosing a liability insurance policy, it’s crucial to assess your business’s specific risks and coverage needs. Consider factors such as the nature of your operations, the products or services you offer, and the number of employees you have.

Why Small Business Liability Insurance is Indispensable

Small business liability insurance is an invaluable investment in the long-term success of your company. Here are some compelling reasons why you should consider obtaining this type of coverage:

- Financial protection: Liability insurance provides a financial safety net to cover the costs of legal defense, settlements, and judgments in the event of a covered claim.

- Peace of mind: Knowing that your business is protected from potential financial ruin can give you peace of mind and allow you to focus on growing your business.

- Customer confidence: Liability insurance demonstrates to your customers that you’re a responsible business that takes their safety and well-being seriously.

- Contractual requirements: Many contracts with clients or vendors may require you to carry liability insurance as a condition of doing business.

Finding the Right Small Business Liability Insurance

Selecting the right liability insurance policy for your small business requires careful consideration. Here are some tips to help you navigate the process:

- Assess your risks: Identify the potential risks your business faces and determine the types of coverage you need.

- Compare quotes: Obtain quotes from multiple insurance providers to compare coverage and premiums.

- Read the fine print: Carefully review the policy documents to ensure you understand the coverage limits, exclusions, and deductibles.

- Consider your budget: Liability insurance premiums can vary depending on your business’s risk profile. Factor in the cost of coverage when making your decision.

Recommended Small Business Liability Insurance

Based on extensive research and analysis, we wholeheartedly recommend the following liability insurance provider for small businesses:

- [Best Small Business Liability Insurance Provider Name]: Renowned for their comprehensive coverage, exceptional customer service, and competitive pricing, [Provider Name] is our top choice for small business liability insurance.

Best Small Business Liability Insurance Options

Owning a small business is an exciting adventure, but it also comes with its fair share of risks. It’s like navigating a stormy sea, where unexpected legal squalls can strike at any moment. That’s why having the right liability insurance is like donning a life jacket – it keeps you afloat when the going gets rough.

Liability insurance acts as a financial safety net, protecting your business from the consequences of accidents, mistakes, or claims made against it. Without proper coverage, a single lawsuit could potentially bankrupt your business, jeopardizing your financial stability and operations.

Investing in liability insurance is not just a smart move; it’s a necessity for any small business that values its future. It’s like a trusty umbrella that shields you from the rain of legal troubles.

Why Do You Need Small Business Liability Insurance?

Imagine this: a customer slips on a wet floor in your store and breaks their leg. Or perhaps an employee accidentally damages a valuable piece of equipment during a repair. These are just a few examples of the mishaps that could lead to costly lawsuits against your business.

Without liability insurance, your business would be on the hook for all legal expenses, including settlements, judgments, and attorney fees. These costs can quickly add up, potentially wiping out your hard-earned savings and putting your business at risk.

Liability insurance provides a crucial buffer between your business and financial ruin. It covers the costs associated with claims made against your business, allowing you to focus on what matters most – running your enterprise.

Types of Small Business Liability Insurance

There are various types of liability insurance available for small businesses, each designed to address specific risks. Here’s a breakdown of the most common types:

General Liability Insurance:

This is the most comprehensive type of liability insurance and covers a wide range of potential claims, such as bodily injury, property damage, and personal injury. It’s like a protective blanket that wraps around your business, shielding it from a multitude of risks.

Professional Liability Insurance:

Also known as errors and omissions (E&O) insurance, this type of coverage protects businesses that provide professional services, such as accountants, lawyers, and consultants. It safeguards against claims alleging negligence or mistakes in the performance of professional duties.

Product Liability Insurance:

If your business manufactures or sells products, this insurance is crucial. It protects you against claims that your products caused injury or damage to consumers. Think of it as a safety guard for your products, ensuring that any mishaps won’t sink your business.

Commercial Auto Insurance:

If you or your employees use vehicles for business purposes, this insurance is essential. It covers accidents involving your business vehicles, protecting you from financial liability. It’s like a seatbelt for your business, keeping you safe on the road ahead.

Workers’ Compensation Insurance:

This type of insurance is mandatory in most states. It provides benefits to employees who suffer work-related injuries or illnesses. Think of it as a helping hand for your injured workers, ensuring they receive the support they need.

How Much Small Business Liability Insurance Do I Need?

The amount of liability insurance you need depends on several factors, including the type of business you operate, the number of employees you have, and the potential risks associated with your industry. It’s like determining the size of a life jacket – you need one that fits snugly to keep you afloat.

A good rule of thumb is to start with a liability limit of $1 million. However, you may need more coverage depending on your specific circumstances. It’s always wise to consult with an insurance professional to determine the right amount of insurance for your business.

Remember, liability insurance is like a financial airbag for your business. It helps you bounce back from unexpected events and protects your hard-earned assets. Don’t leave your business exposed – get the liability coverage you need to weather any storm.

Choosing The Best Small Business Liability Insurance

Finding the best liability insurance for your small business is like embarking on a treasure hunt. There are many options out there, and it’s essential to compare and choose the one that aligns with your unique needs. Here are some factors to consider:

Coverage:

Make sure the policy covers the types of risks your business faces. Don’t settle for a one-size-fits-all approach. Tailor your coverage to your specific industry and operations.

Limits:

The liability limits you choose will determine the maximum amount the insurance company will pay in the event of a claim. Don’t underestimate your potential risks – choose limits that provide adequate protection.

Premiums:

Insurance premiums vary depending on the coverage and limits you select. Compare quotes from multiple insurers to find the best value for your money. Don’t break the bank on insurance, but don’t skimp on coverage either.

Reputation:

Choose an insurance company with a strong reputation for financial stability and customer service. You want a partner that will be there for you when you need them most.

Exclusions:

Carefully review the policy exclusions to understand what’s not covered. Make sure there are no surprises lurking in the fine print.

Conclusion

Liability insurance is not just a box to tick on your to-do list; it’s a lifeline for your small business. With the right coverage, you can sleep soundly knowing that your business is protected from financial ruin in the face of unexpected events. So, don’t wait until the storm hits – invest in liability insurance today and set your business on a course towards success.

The Best Small Business Liability Insurance for Your Peace of Mind

As a small business owner, you wear many hats. From product development to customer service, you’re responsible for a lot. But one thing you shouldn’t have to worry about is liability. That’s where small business liability insurance comes in. It’s like a safety net that protects your business from financial ruin in case of a lawsuit.

But finding the best small business liability insurance can be a daunting task. There are so many different policies out there, and it’s tough to know which one is right for you. That’s why we’ve put together this guide to help you understand the different types of liability insurance available and choose the one that’s right for your business.

Types of Small Business Liability Insurance

There are four main types of liability insurance that small businesses need to consider:

- General liability insurance

- Professional liability insurance

- Errors and omissions insurance

- Directors and officers insurance

General liability insurance

General liability insurance is the most basic type of liability insurance. It protects your business from claims of bodily injury, property damage, and personal injury. This type of insurance is essential for all businesses, regardless of their industry or size.

Professional liability insurance

Professional liability insurance, also known as errors and omissions insurance, protects your business from claims of negligence or mistakes in your professional services. This type of insurance is especially important for businesses that provide professional services, such as accountants, lawyers, and doctors.

Errors and omissions insurance

Errors and omissions insurance is a type of professional liability insurance that specifically covers mistakes or errors that result in financial losses. This type of insurance is often purchased by businesses that provide financial services, such as banks and investment firms.

Directors and officers insurance

Directors and officers insurance protects the directors and officers of a business from personal liability for claims of negligence or mismanagement. This type of insurance is often purchased by businesses that are publicly traded or have a large number of shareholders.

How to choose the right small business liability insurance

Now that you know the different types of liability insurance available, it’s time to choose the one that’s right for your business. Here are a few factors to consider:

- The size of your business

- The industry you’re in

- The risks your business faces

- Your budget

Once you’ve considered these factors, you can start shopping for liability insurance. Be sure to compare quotes from multiple insurers to find the best rate. And don’t forget to read the policy carefully before you buy it. You want to make sure you understand what’s covered and what’s not.

Don’t wait until it’s too late

Liability insurance is a critical part of protecting your small business. Don’t wait until it’s too late to get the coverage you need. Contact an insurance agent today to learn more about your options and get a quote.

The Ultimate Guide to the Best Small Business Liability Insurance

As an entrepreneur, you pour your heart and soul into building your business. But even the most well-intentioned ventures can face unexpected risks. That’s where small business liability insurance steps in, acting like a safety net to protect your assets and your peace of mind.

What Does Small Business Liability Insurance Cover?

Liability insurance shields your business from financial fallout if you’re held legally responsible for injuries or damages caused by your operations, products, or employees. It covers a wide range of scenarios, such as:

- Customer accidents on your premises

- Professional errors or omissions

- Product defects

- Bodily injuries to third parties

Why You Need Small Business Liability Insurance

Like a seatbelt for your business, liability insurance is a crucial safeguard against the unexpected. Here’s why:

- Legal Protection: Protects you from costly lawsuits and legal fees.

- Financial Safety: Pays for damages and settlements, preventing your business from going under.

- Customer Confidence: Shows clients that you prioritize their safety and well-being.

Choosing the Right Policy

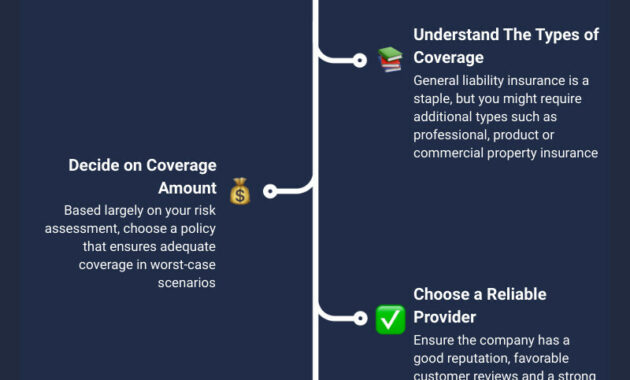

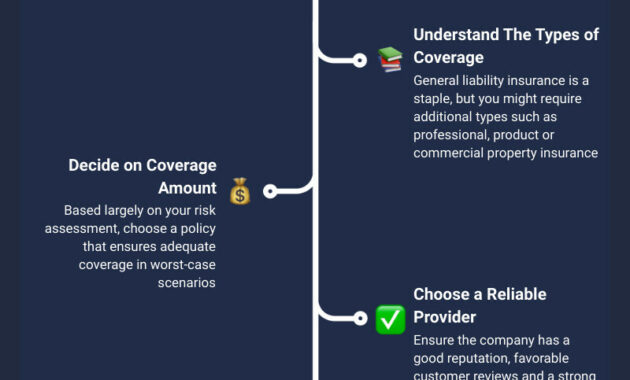

Navigating the insurance landscape can be a daunting task. Here’s how to find the best coverage for your business:

- Identify Your Risks: Determine the potential liabilities you face based on your industry, operations, and assets.

- Compare Quotes: Get quotes from multiple insurers to find the most comprehensive coverage at a competitive price.

- Read the Policy Carefully: Understand the policy limits, exclusions, and any conditions that apply.

How Much Does Small Business Liability Insurance Cost?

The cost of liability insurance depends on a few key factors:

- Industry: High-risk industries, such as construction, typically have higher premiums.

- Location: Business location also influences premiums, with urban areas generally having higher rates.

- Revenue: Premiums may increase as your business revenue grows.

- Coverage Limits: The amount of coverage you choose will affect the premium.

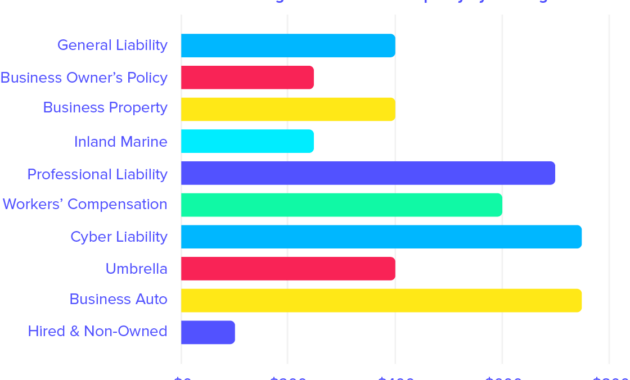

Additional Coverages to Consider

Beyond basic liability insurance, here are some additional coverages you may want to consider:

- Property Coverage: Protects your business property from damage or theft.

- Business Interruption Insurance: Provides coverage for lost income if your business is forced to close due to a covered event.

- Cyber Liability Insurance: Protects against cyberattacks and data breaches.

Protecting Your Future

Liability insurance is a cornerstone of small business protection. By choosing the right coverage, you can shield your business from financial risks, maintain customer trust, and focus on what really matters: growing your venture. Remember, it’s not just about protecting against the worst-case scenario, it’s about ensuring your business thrives, no matter what life throws your way.

The Ultimate Guide to Securing the Best Small Business Liability Insurance

Owning a small business is a dream for many, but with great potential comes great responsibility—including safeguarding your venture with the right insurance coverage. Small business liability insurance is a crucial lifeline that protects your business from financial ruin caused by unexpected events. In this comprehensive guide, we’ll delve into the world of small business liability insurance, empowering you to make an informed decision that ensures your enterprise thrives for years to come. By the end of our journey together, you’ll be armed with the knowledge to choose the best small business liability insurance that fits your unique needs like a glove.

How to Choose the Best Small Business Liability Insurance

Finding the best small business liability insurance is like embarking on a treasure hunt—it requires careful consideration and a keen eye for value. Here’s a step-by-step guide to help you navigate the insurance maze with confidence:

**1. Understand Your Business’s Unique Needs:**

Every small business is a unique tapestry woven with different risks and challenges. The first step in choosing the best liability insurance is to conduct a thorough risk assessment. What are the potential hazards your business faces? Consider the nature of your operations, the industry you’re in, and the location of your business. By painting a clear picture of your exposures, you’ll be better equipped to identify the coverage you need.

**2. Compare Coverage Options and Costs:**

The insurance marketplace offers a smorgasbord of coverage options, each tailored to specific business needs. General liability insurance, for example, provides broad protection against common risks like bodily injury, property damage, and libel. Professional liability insurance, on the other hand, shields you from claims related to errors or omissions in your services. The key is to compare different policies and premiums to find the coverage that fits your budget and risk profile.

**3. Prioritize Reputable Insurers:**

Choosing a reputable insurance company is like selecting a trusted guide on your business journey. Look for insurers with a solid track record, financial stability, and a commitment to customer service. Do your research, read reviews, and talk to other businesses to gauge the insurer’s reputation and responsiveness. After all, you want an insurance partner that will be there for you when the chips are down.

**4. Don’t Neglect Umbrella Insurance:**

Umbrella insurance is like a superhero’s cape, providing an extra layer of protection beyond your standard liability limits. It kicks in when your primary coverage reaches its cap, safeguarding you from catastrophic losses that could cripple your business. Consider umbrella insurance if you have high-value assets, face significant risks, or simply want peace of mind knowing you’re fully covered.

**5. Consider Your Business Specific Exposures:**

Now, let’s dive deeper into the specific factors that can influence your small business liability insurance needs. Here’s a comprehensive breakdown to help you tailor your coverage accordingly:

**a. Industry-Specific Risks:**

Different industries come with their own unique set of hazards. For instance, a construction company faces different risks compared to a software development firm. Make sure your insurance policy aligns with the specific exposures inherent to your industry.

**b. Number of Employees:**

The number of employees you have can also impact your liability exposure. As your workforce grows, so does the potential for accidents, injuries, and lawsuits. Consider increasing your liability limits as your team expands.

**c. Location of Your Business:**

The location of your business can influence insurance costs. Factors such as crime rates, weather patterns, and local laws can affect your risk profile. Be sure to consider these factors when choosing your coverage.

**d. Value of Assets:**

If your business owns valuable equipment, inventory, or property, you need to ensure adequate coverage to replace or repair these assets in case of damage or loss.

**e. Contractual Obligations:**

Some contracts may require you to carry specific types of liability insurance. For example, if you’re working on a construction project, the contract may mandate you to have builder’s risk insurance. Always review your contracts carefully to understand your insurance obligations.

**6. Seek Professional Advice:**

Navigating the world of small business liability insurance can be a complex task. If you’re feeling overwhelmed, don’t hesitate to seek professional advice from an insurance broker or agent. They can help you assess your risks, compare policies, and find the coverage that best suits your needs.

**Conclusion:**

Choosing the best small business liability insurance is a strategic move that can protect your business and give you peace of mind. By following the steps outlined in this guide, you’ll be well-equipped to make an informed decision that safeguards your enterprise and sets you up for continued success. Use this knowledge to shop confidently and secure the coverage that’s right for your business. Remember, the right insurance is like a safety net—it’s there to catch you when you need it most, allowing you to focus on what you do best: growing your business!