Best Liability Insurance for Small Businesses

Every business, big and small, faces risks. From customer injuries to property damage, unexpected events can strike at any moment. That’s where liability insurance comes to the rescue, providing a financial safety net to protect your business from costly lawsuits and claims.

What is Liability Insurance?

Liability insurance is like a fortress, safeguarding your business from potential financial ruin. It covers legal expenses, damages, and settlements resulting from bodily injury or property damage caused by your operations, products, or employees. Imagine it as an umbrella, shielding your business from the storms of lawsuits.

Liability insurance operates on a simple principle: if someone suffers an injury or their property is damaged due to your business’s negligence or actions, the insurance kicks in to cover the financial burden. It’s a crucial safeguard against claims from customers, vendors, or even employees, ensuring that your business remains financially stable even in the face of adversity.

Imagine this scenario: A customer trips and falls in your store, breaking their ankle. The medical bills and legal fees can quickly pile up, putting your business’s finances at risk. But with liability insurance, you can breathe a sigh of relief, knowing that the insurance will cover these expenses, allowing you to focus on what matters most – running your business.

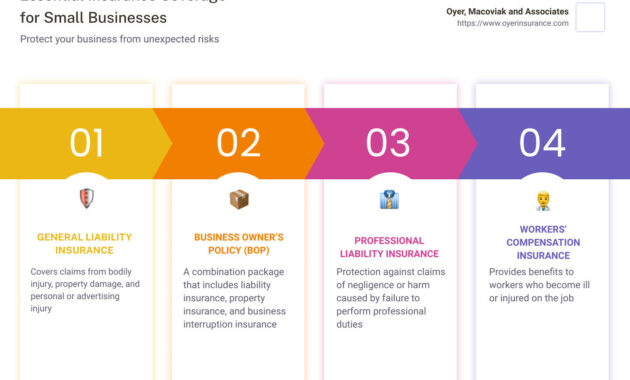

Types of Liability Insurance

Liability insurance comes in various forms, each tailored to specific business needs:

- General Liability Insurance: The cornerstone of liability protection, it covers common risks like customer injuries, property damage, and advertising-related mishaps.

- Product Liability Insurance: Essential for businesses selling products, it shields you from claims alleging injuries or damages caused by defective products.

- Professional Liability Insurance: Designed for professionals offering services, it safeguards against errors, omissions, or negligence.

- Employers Liability Insurance: Protects businesses from lawsuits filed by employees for work-related injuries or illnesses.

- Cyber Liability Insurance: Protects businesses from online risks, such as data breaches, privacy violations, or cyberattacks.

How Much Liability Insurance Do You Need?

Determining the appropriate amount of liability coverage is crucial. Factors to consider include:

- Business Size and Revenue: Larger businesses with higher revenue typically require higher coverage limits.

- Industry: Some industries, like construction or healthcare, pose higher risks and may need more coverage.

- Assets: Businesses with significant assets need sufficient coverage to protect their investments.

- Contractual Obligations: Some contracts may require specific liability insurance limits.

Choosing the Right Liability Insurance Provider

Selecting the right liability insurance provider is essential. Look for:

- Financial Stability: Ensure the provider has a strong financial foundation to honor claims.

- Experience and Reputation: Choose a provider with a proven track record and positive customer feedback.

- Coverage Options: Evaluate the range of coverage options offered to meet your specific business needs.

- Customer Service: Opt for a provider with responsive and helpful customer support.

Conclusion

Liability insurance is an indispensable investment for any small business. It provides peace of mind, protecting your business from unforeseen events that can cripple your finances. By understanding the different types of liability insurance, determining your coverage needs, and choosing the right provider, you can safeguard your business and focus on growth and success.

Best Liability Insurance for Small Businesses

In the realm of entrepreneurship, where passion and ambition ignite, safeguarding your fledgling enterprise against unforeseen risks is paramount. Among the myriad insurance options available, liability insurance stands as an indispensable shield for small businesses, offering a vital layer of protection from potential financial ruin.

Why Small Businesses Need Liability Insurance

Operating a small business entails inherent risks that can materialize in the form of lawsuits and claims. While it may seem like a remote possibility, even the most diligent and well-intentioned businesses can find themselves entangled in legal disputes. Liability insurance serves as a safety net, providing peace of mind and financial protection against claims alleging:

- Bodily injury or property damage caused to third parties

- Libel, slander, or defamation

li>Errors and omissions

Without liability insurance, small businesses may be forced to shoulder the hefty expenses associated with legal fees, settlements, and judgments, which can cripple their financial stability and threaten their very existence.

Third-Party Bodily Injury and Property Damage Liability

Imagine this scenario: A customer slips and falls in your store, sustaining severe injuries. Or, a construction worker accidentally damages a neighboring property while working on your project. In such instances, third-party bodily injury and property damage liability insurance steps in, safeguarding your business from financial liability. It covers medical expenses, pain and suffering, lost wages, and property repair or replacement costs.

The importance of third-party liability insurance cannot be overstated. A single lawsuit alleging negligence or wrongdoing can amount to hundreds of thousands of dollars in compensation. Without insurance, your small business could face financial ruin, leaving you with nothing but shattered dreams and a trail of unpaid debts.

Consider this analogy: Running a business is akin to navigating a stormy sea. Liability insurance acts as a sturdy lifeboat, providing a haven of protection amidst the unpredictable waves of legal challenges. Just as a lifeboat keeps you afloat and safe from drowning, liability insurance shields your business from financial disaster.

The cost of liability insurance varies depending on several factors, including the nature of your business, its size, and the level of coverage desired. However, the peace of mind and financial protection it provides are well worth the investment. Think of it as a small price to pay for safeguarding the future of your hard-earned enterprise.

It’s crucial to note that liability insurance does not cover intentional or criminal acts, nor does it provide coverage for claims arising from employee injuries or property damage to your own business. For these situations, you may need additional insurance policies, such as workers’ compensation and property insurance.

In conclusion, liability insurance is an essential investment for small businesses seeking to protect their financial well-being and mitigate the risks inherent in day-to-day operations. Don’t let unforeseen events steer your business off course. Embrace the safety and peace of mind that liability insurance offers and navigate the entrepreneurial seas with confidence.

Best Liability Insurance for Small Businesses: A Comprehensive Guide

As a small business owner, safeguarding your enterprise against potential liabilities is paramount. A robust liability insurance policy acts as a safety net, protecting your company, assets, and reputation from financial ruin. Choosing the right plan can be overwhelming, given the plethora of options available. Our comprehensive guide will help you navigate the complexities of liability insurance and find the optimal coverage for your business.

Types of Liability Insurance for Small Businesses

Understanding the various liability insurance policies is essential for making an informed decision. Let’s delve into the three main types:

1. General Liability Insurance

General liability insurance is the cornerstone of any small business insurance portfolio. It covers a wide range of common risks, including:

- Bodily injury to others on your premises or due to your operations

- Property damage caused by your business activities

- Libel, slander, and false advertising

For instance, if a customer trips and falls in your store, this policy would cover their medical expenses and legal fees.

2. Professional Liability Insurance

Professional liability insurance, also known as errors and omissions (E&O) insurance, protects businesses that provide professional services. It covers:

- Negligence or errors in your professional services

- Breaches of contract

- Misrepresentation or failure to deliver

For example, if a lawyer gives incorrect advice leading to financial loss, this insurance would provide coverage.

3. Product Liability Insurance

Product liability insurance shields businesses that manufacture, distribute, or sell products. It covers:

- Injuries or damages caused by defective products

- Failure to warn of product hazards

- Breach of warranty

Imagine a toy manufacturer whose faulty product injures a child. This insurance would reimburse compensation and legal expenses.

Best Liability Insurance for Small Businesses: A Comprehensive Guide to Safeguarding Your Enterprise

As a small business owner, you’re probably aware of the vital importance of safeguarding your enterprise against potential financial risks. Among the most significant considerations is selecting the best liability insurance policy that aligns with the unique needs of your business. With a myriad of options available, it can be overwhelming to determine the perfect fit.

This comprehensive guide will delve into the intricacies of liability insurance, empowering you to make informed decisions and protect your business against unforeseen circumstances. By providing an in-depth analysis of essential factors to consider, as well as a deep dive into the top liability insurance providers, we aim to make the selection process seamless and empowering.

Understanding Liability Insurance: A Lifeline for Businesses

Liability insurance serves as a safety net for businesses by providing financial protection against claims alleging bodily injury, property damage, or other forms of harm caused by your business operations or products. Without adequate liability insurance, a single costly lawsuit has the potential to jeopardize your business’s financial stability.

There are two primary types of liability insurance: general liability insurance and professional liability insurance. General liability insurance provides coverage for general business activities, while professional liability insurance, also known as errors and omissions (E&O) insurance, safeguards businesses that provide professional services against claims alleging negligence or mistakes.

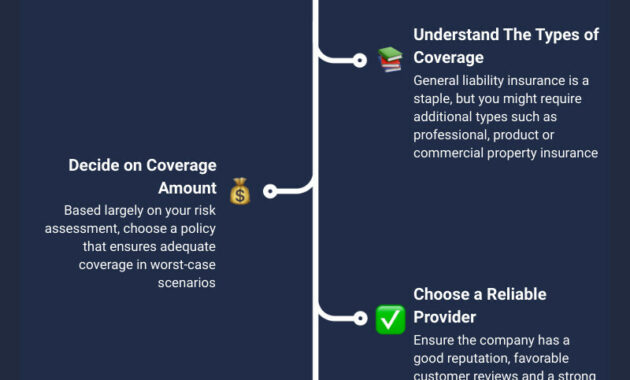

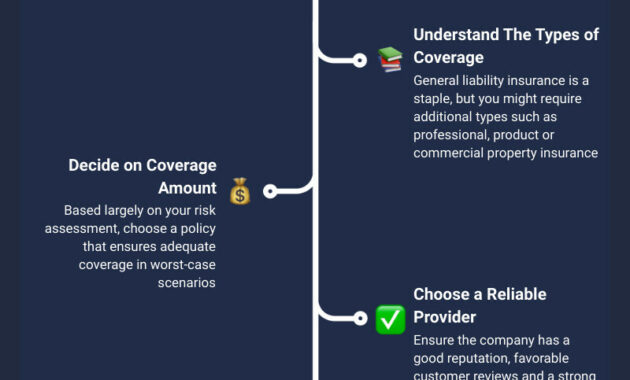

How to Choose the Best Liability Insurance for Your Small Business

Selecting the ideal liability insurance policy for your small business requires careful consideration of various factors, including:

1. Business Size and Industry

The size and industry of your business play a crucial role in determining your liability risks. A small retail store, for instance, faces different risks compared to a manufacturing company with heavy machinery. Assess your business operations and identify potential hazards to gauge the appropriate level of coverage.

2. Risk Factors

Every business has unique risk factors that influence the cost and coverage of liability insurance. Factors such as the number of employees, the type of products or services offered, and the location of your business can impact your risk profile.

3. Coverage Limits

Coverage limits refer to the maximum amount your insurance policy will pay towards a covered claim. It’s essential to select limits that provide sufficient protection without overpaying for unnecessary coverage. Consult with an insurance professional to determine the optimal coverage limits for your business.

4. Exclusions and Endorsements

Exclusions are specific situations or actions that are not covered under your liability insurance policy. Endorsements, on the other hand, are modifications or additions that extend the coverage of your policy. Carefully review the policy language to understand what is and isn’t covered.

Top Liability Insurance Providers for Small Businesses

The market offers numerous liability insurance providers, each with its strengths and offerings. Here are some of the most reputable and highly-rated providers:

1. Hiscox

Hiscox is renowned for its tailored liability insurance solutions for small businesses. They offer a range of coverage options, including general liability insurance, professional liability insurance, and cyber liability insurance. Their policies are known for their comprehensive coverage and excellent customer service.

2. The Hartford

The Hartford is another top-rated provider that offers a comprehensive suite of liability insurance products for small businesses. They specialize in providing customized policies that cater to the specific needs of various industries. The Hartford is known for its financial strength and industry expertise.

3. Travelers

Travelers is a global insurance leader that provides a wide array of liability insurance options for small businesses. They offer both standard and specialized policies, ensuring flexibility and tailored protection. Travelers is recognized for its innovative products and commitment to customer satisfaction.

4. CNA

CNA is a leading provider of liability insurance for small businesses, offering a comprehensive portfolio of coverage options. They specialize in providing customized solutions for businesses in industries such as construction, healthcare, and technology. CNA is known for its robust risk management expertise and exceptional claims handling.

In addition to these top providers, there are numerous other reputable insurers that offer liability insurance for small businesses. It’s advisable to compare quotes from multiple providers to find the best coverage at a competitive price.

Additional Tips for Choosing the Right Liability Insurance

When selecting liability insurance for your small business, keep these additional tips in mind:

- Consult with an Insurance Broker: An experienced insurance broker can provide valuable insights and help you navigate the complexities of liability insurance.

- Read the Policy Carefully: Don’t just rely on verbal assurances; take the time to read and understand the terms and conditions of the policy before signing.

- Consider Deductibles: Deductibles are the amount you pay out-of-pocket before your insurance coverage kicks in. Choose a deductible that you can comfortably afford.

- Review Your Coverage Regularly: Your business needs change over time, so it’s essential to review your liability insurance coverage annually to ensure it still meets your requirements.

By following these guidelines, you can select the best liability insurance for your small business and enjoy peace of mind knowing that your enterprise is protected against financial risks.

Best Liability Insurance for Small Business: A Comprehensive Guide

Staying Protected from Costly Mishaps

Liability insurance is an indispensable safeguard for small businesses, shielding them from financial ruin in the event of lawsuits or claims. Choosing the right policy can be a daunting task, but our comprehensive guide provides all the essential information you need to make an informed decision.

Types of Liability Insurance

There are three primary types of liability insurance:

- General Liability Insurance: Protects against claims arising from bodily injury, property damage, or advertising injuries.

- Professional Liability Insurance: Covers claims related to errors or omissions in professional services.

- Product Liability Insurance: Insures against claims resulting from defects or malfunctions in products sold or manufactured.

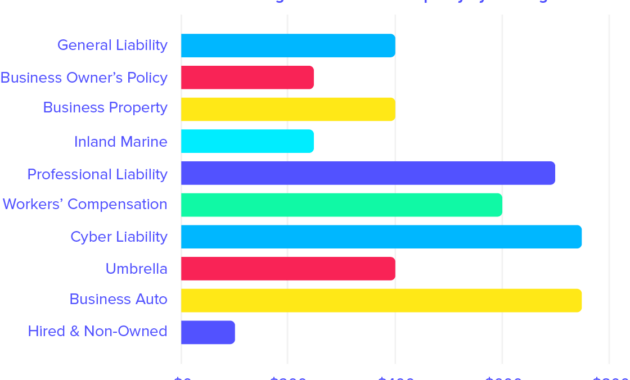

Cost of Liability Insurance for Small Businesses

Liability insurance premiums are influenced by several factors:

- Coverage Level: Higher coverage limits increase premiums.

- Deductibles: Choosing a higher deductible lowers premiums.

- Business Risk Profile: Industries with higher risks typically pay higher premiums.

Determining Your Liability Insurance Needs

Assess your business’s needs by considering:

- Potential Risks: Identify areas where accidents or incidents could occur.

- Industry Standards: Consider the coverage levels recommended for your industry.

- Financial Situation: Determine the maximum amount of financial liability you can afford.

Best Liability Insurance for Small Businesses

Navigating the insurance market can be challenging. To simplify your search, consider the following highly rated providers:

- Hiscox: Known for its tailored coverage options and responsive customer service.

- Chubb: Provides flexible policies with comprehensive coverage and risk management services.

- Travelers: Offers industry-leading insurance products with competitive rates.

Additional Considerations

- Coverage Exclusions: Review the policy carefully to understand what’s not covered.

- Policy Limits: Ensure the coverage limits are sufficient to protect your business.

- Additional Endorsements: Consider adding endorsements to enhance your coverage, such as umbrella insurance.

Conclusion

Liability insurance is not just a smart investment but an essential safety net for small businesses. By carefully assessing your needs and choosing the right policy, you can protect yourself from costly financial setbacks and secure a smoother path to success. Remember, when it comes to insurance, it’s always better to be safe than sorry!

Best Liability Insurance for Small Businesses: A Comprehensive Guide

Liability insurance is an indispensable tool for safeguarding your small business against unexpected legal and financial burdens. With the potential for lawsuits lurking around every corner, it’s crucial to ensure that your enterprise is adequately protected. In this comprehensive guide, we delve into the realm of liability insurance, outlining its critical benefits and providing invaluable insights to help you make informed decisions for your business.

Types of Liability Insurance

There are various types of liability insurance tailored to the specific needs of different businesses. Some common types include:

-

General Liability Insurance: Provides comprehensive coverage for a wide range of risks, including bodily injury, property damage, personal injury, and advertising-related liabilities.

-

Professional Liability Insurance: Protects professionals from potential claims arising from errors or omissions in their services.

-

Product Liability Insurance: Insures against legal liabilities resulting from injuries or damages caused by your products.

-

Commercial Auto Insurance: Covers liabilities associated with vehicles used for business purposes.

-

Cyber Liability Insurance: Provides protection against data breaches, cyberattacks, and other technology-related risks.

Benefits of Liability Insurance for Small Businesses

Liability insurance offers a multitude of tangible benefits that can safeguard your business in countless ways:

-

Financial Protection: Liability insurance serves as a financial safety net, covering legal expenses, settlements, and judgments in the event of a lawsuit, which can potentially save your business from financial ruin.

-

Peace of Mind: Knowing that your business is adequately protected provides peace of mind and allows you to focus on growing your enterprise without constant worry about potential legal entanglements.

-

Enhanced Credibility: Demonstrating that you have liability insurance adds legitimacy to your business and enhances your credibility in the eyes of clients, partners, and investors.

-

Legal Defense: Liability insurance provides access to experienced legal counsel who can guide you through the complexities of a lawsuit and vigorously defend your interests.

-

Coverage for a Wide Range of Risks: Liability insurance offers comprehensive protection against a broad spectrum of potential hazards, ensuring that you’re prepared for unforeseen events that could jeopardize your business.

-

Regulatory Compliance: Many industries require businesses to carry certain types of liability insurance to maintain their licenses or operate legally.

How to Choose the Right Liability Insurance for Your Business

Selecting the right liability insurance policy is crucial for ensuring adequate protection while avoiding unnecessary expenses. Consider the following factors when making your decision:

-

Business Size and Industry: The size, nature, and industry of your business will influence the type and amount of liability insurance you need.

-

Risk Level: Assess the potential risks associated with your business operations to determine the appropriate level of coverage.

-

Coverage Limits: Carefully consider the amount of coverage you need to protect your assets and minimize financial exposure.

-

Deductibles: Determine the appropriate deductible, which is the amount you’ll pay out of pocket before the insurance company begins paying.

-

Reputation and Financial Stability of the Insurance Company: Research the reputation and financial stability of potential insurers to ensure they’re reliable and can fulfill their obligations.

-

Professional Advice: Consult with an experienced insurance agent or broker to gather information, compare policies, and secure the best coverage for your unique needs.

Top 5 Liability Insurance Providers for Small Businesses

Based on industry reputation, financial stability, and customer satisfaction, here are the top 5 liability insurance providers for small businesses:

-

State Farm: A reputable and well-established insurer with a wide range of liability insurance options for small businesses.

-

The Hartford: Known for its tailored coverage and exceptional customer service, providing comprehensive liability solutions for various industries.

-

Travelers: Offers customizable liability insurance policies with flexible coverage options to meet the specific needs of small businesses.

-

Progressive: A leading provider of commercial insurance, Progressive offers competitive rates and innovative coverage solutions for small businesses.

-

Hiscox: Specializing in tailored insurance for small businesses, Hiscox provides comprehensive liability coverage with exceptional underwriting expertise.

Conclusion

Liability insurance is an essential investment for small businesses, safeguarding them against potential financial and legal risks. By carefully considering the benefits, understanding the different types of coverage available, and choosing the right insurance provider, small business owners can ensure the protection and stability of their enterprises. Remember, in the realm of liabilities, it’s always better to be safe than sorry.

The Bedrock of Protection: Best Liability Insurance for Small Businesses

In the dynamic landscape of small businesses, where unforeseen risks lurk around every corner, liability insurance serves as an indispensable safety net. It’s the cornerstone of safeguarding your enterprise and mitigating potential financial disasters. The realm of liability insurance options can be daunting, but with the right approach, you can secure the coverage that perfectly suits your business’s needs.

Navigating the Liability Insurance Maze

1. Identify Your Exposure

The first step towards obtaining liability insurance is to conduct a thorough assessment of your business operations. Pinpoint the potential risks associated with your industry, the products or services you offer, and the nature of your interactions with customers and employees. This analysis will serve as the foundation for determining the coverage limits and policy type that align with your specific needs.

2. Explore Coverage Options

The liability insurance landscape offers a spectrum of coverage options, each tailored to address different risks. General liability insurance, a cornerstone of small business protection, covers a broad range of liabilities, including bodily injury, property damage, and advertising injuries. Professional liability insurance, on the other hand, safeguards professionals and businesses against claims arising from errors or omissions in the services they provide. Other specialized coverage options, such as product liability and cyber liability insurance, may be necessary depending on your business’s industry and activities.

3. Shop Around and Compare Quotes

With a clear understanding of your coverage needs, it’s time to embark on a quest for the most competitive insurance quotes. Don’t limit yourself to a single provider; reach out to multiple insurers to compare their offerings and premiums. Consider factors such as the insurer’s financial stability, reputation, and customer service track record as you evaluate your options. Online insurance marketplaces and brokers can streamline the process of gathering quotes and comparing coverage options.

4. Consider an Insurance Broker

Navigating the complexities of liability insurance can be akin to deciphering ancient hieroglyphics. If the prospect of going it alone leaves you scratching your head, consider partnering with an insurance broker. These professionals serve as your advocates, helping you understand policy details, negotiate coverage, and secure the best possible rates. Their expertise can save you time, hassle, and money in the long run.

5. Read the Fine Print

Before signing on the dotted line, take time to thoroughly review the policy’s terms and conditions. Understand the policy’s coverage limits, exclusions, and deductibles. Avoid the trap of simply accepting the insurer’s default coverage; tailor the policy to your business’s specific needs and risk profile. A comprehensive understanding of the policy will empower you to make informed decisions and avoid unpleasant surprises down the road.

6. Maintain Adequate Coverage

Your business is a dynamic entity, constantly evolving and adapting to changing circumstances. As your operations expand or new risks emerge, it’s crucial to review and adjust your liability insurance coverage accordingly. Regular policy reviews will ensure that your coverage remains aligned with your evolving needs. Neglecting this important task could leave your business vulnerable to financial setbacks.

7. The Overlooked Details: Understanding Policy Exclusions and Endorsements

Liability insurance policies, like intricate tapestries, are woven with a complex interplay of coverages and exclusions. Understanding these nuances is essential for maximizing your protection. Exclusions define the specific circumstances under which the policy does not provide coverage. Common exclusions include intentional acts, criminal activities, and contractual liabilities. Conversely, endorsements serve as add-ons to the policy, extending coverage to specific areas not included in the standard policy. Carefully reviewing exclusions and endorsements will ensure that your policy provides the comprehensive protection your business deserves.

Imagine your business as a sturdy ship sailing through the treacherous waters of potential liabilities. Without adequate liability insurance, your vessel is akin to a craft venturing into a tempestuous sea, vulnerable to devastating storms. But with the protection of a well-crafted liability insurance policy, your business becomes a steadfast galleon, weathering the tempests of risk with confidence and resilience.

Don’t let the specter of liability cast a shadow over your business aspirations. Embrace the wisdom of liability insurance and safeguard your enterprise against the unforeseen hazards that may lie ahead. Remember, it’s not just a smart business decision; it’s an investment in the future of your dreams.