Best Business Liability Insurance: Protecting Your Company from the Unexpected

Every business, regardless of its size or industry, faces potential risks and liabilities. From customer accidents to employee injuries, these risks can lead to costly lawsuits and financial ruin. That’s where business liability insurance comes in as your essential safety net.

With a comprehensive business liability insurance policy, you can rest easy knowing that you’re protected against a wide range of third-party claims, including bodily injury, property damage, and financial losses. But how do you find the best provider for your specific needs?

Finding the Best Provider

Finding the right business liability insurance provider involves a three-pronged approach: research, comparison, and consultation.

First, research reputable insurance providers. Look for companies with a strong financial track record, a positive reputation, and a proven commitment to customer service. Industry ratings and online reviews can provide valuable insights into a provider’s reliability.

Next, compare quotes from multiple providers. Don’t just go with the first offer you receive. Take your time to compare coverage, deductibles, and premiums to ensure you’re getting the best deal without compromising protection.

Finally, consult with an independent insurance agent. A knowledgeable agent can guide you through the complexities of business liability insurance, explaining the different coverage options and helping you choose the right policy for your business.

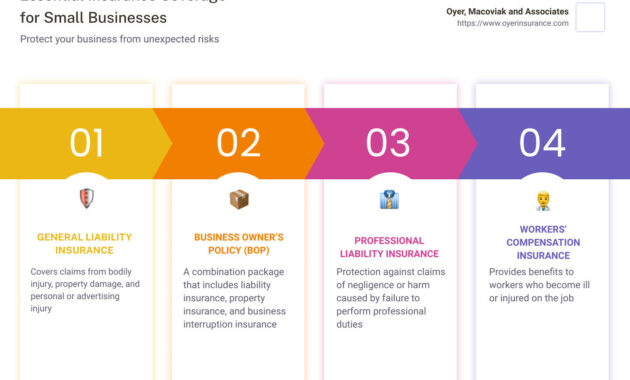

Types of Coverage

Business liability insurance policies typically cover a wide range of potential risks, including:

- Bodily injury: Protection against claims arising from injuries sustained by customers, clients, or other third parties on your business premises.

- Property damage: Coverage for damage to property owned by others, whether caused by your employees, products, or operations.

- Personal and advertising injury: Protection against claims for defamation, libel, slander, or invasion of privacy.

- Medical payments: Coverage for minor medical expenses incurred by non-employees who suffer injuries on your business property, regardless of fault.

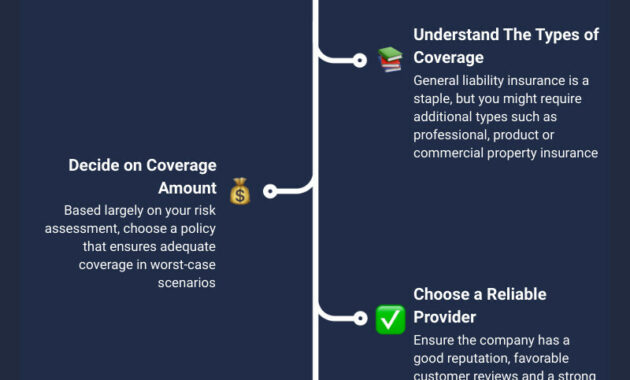

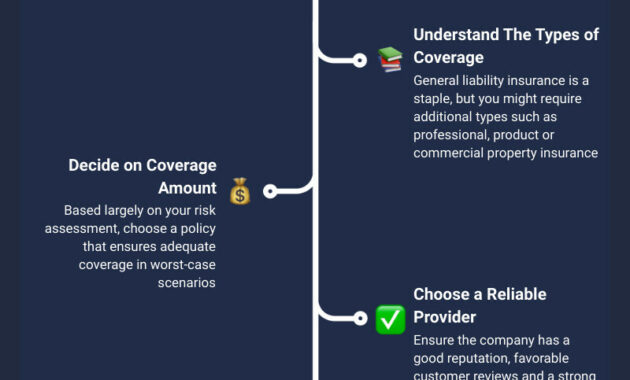

Factors to Consider

When choosing a business liability insurance policy, consider these key factors:

- Coverage limits: Determine the appropriate level of coverage based on the size and risk profile of your business.

- Deductibles: The amount you’re responsible for paying out-of-pocket before the insurance kicks in.

- Exclusions: Understand any limitations or exclusions in the policy to avoid coverage gaps.

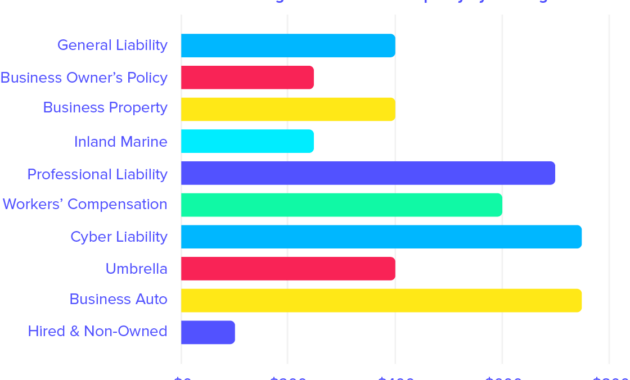

- Additional coverages: Consider additional coverages, such as errors and omissions insurance or cyber liability insurance, to enhance your protection.

- Premium costs: Balance the need for comprehensive coverage with the affordability of premiums.

Importance of Adequate Coverage

Don’t underestimate the importance of having adequate business liability insurance. Without it, a single lawsuit could cripple your business financially and even threaten its very existence.

Consider this analogy: A car without insurance is like a business without liability coverage. If you get into an accident, you’re personally liable for the damages. Similarly, if your business faces a lawsuit, you could be held personally responsible for any financial losses without adequate insurance.

Conclusion

Choosing the best business liability insurance is crucial for protecting your company from potential financial risks. By doing your research, comparing quotes, consulting with an agent, and tailoring your coverage to your specific needs, you can ensure that your business is well-protected from the unexpected.