Best Small Business General Liability Insurance

Small business general liability insurance can be a lifesaver for your company. It can protect you from financial ruin in the event of a lawsuit, and it can give you peace of mind knowing that you’re covered. But with so many different insurance companies out there, it can be tough to know which one to choose. That’s why we’ve put together this guide to help you find the best small business general liability insurance for your needs.

In this guide, we’ll cover everything you need to know about general liability insurance, including what it is, what it covers, and how much it costs. We’ll also provide you with a list of the best small business general liability insurance companies, so you can make an informed decision about which one is right for you.

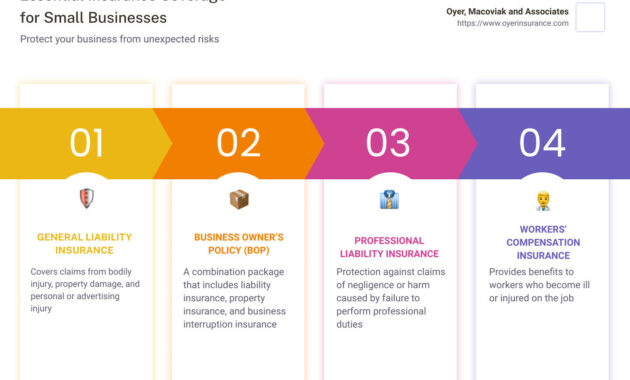

What is General Liability Insurance?

General liability insurance (GLI) is a type of insurance that protects businesses from financial losses due to claims of bodily injury, property damage, or personal injury. It’s an essential coverage for any small business, as it can help you cover the costs of legal defense, medical expenses, and property repairs.

GLI is typically required by landlords and other businesses that you work with. It’s also a good idea to have GLI even if you don’t have any employees, as it can protect you from lawsuits from customers or clients.

There are many different types of GLI policies available, so it’s important to find one that meets your specific needs.

What Does General Liability Insurance Cover?

GLI typically covers the following:

- Bodily injury

- Property damage

- Personal injury

- Advertising injury

- Legal defense costs

Bodily injury coverage can help you pay for medical expenses if someone is injured on your property or as a result of your business operations. Property damage coverage can help you pay for repairs or replacement of property that is damaged or destroyed due to your business operations. Personal injury coverage can help you pay for damages if someone sues you for libel, slander, or other types of non-physical harm.

Advertising injury coverage can help you pay for damages if someone sues you for false advertising or other types of advertising-related harm. Legal defense costs coverage can help you pay for the costs of defending yourself in a lawsuit, even if you’re ultimately found not liable.

How Much Does General Liability Insurance Cost?

The cost of GLI varies depending on a number of factors, including the size of your business, the type of business you operate, and the amount of coverage you need. However, you can expect to pay anywhere from $500 to $1,500 per year for GLI coverage.

If you’re a small business owner, it’s important to weigh the cost of GLI against the potential risks of not having it. Even a small lawsuit can cost thousands of dollars to defend, so it’s worth investing in GLI to protect your business.

How to Find the Best Small Business General Liability Insurance

There are a few things you can do to find the best GLI policy for your business:

- Shop around and compare quotes from different insurance companies.

- Read the policy carefully before you buy it.

- Make sure you understand the coverage limits.

- Ask your insurance agent any questions you have.

By following these tips, you can find the best GLI policy for your small business and protect your business from financial ruin.

Best Small Business General Liability Insurance: A Comprehensive Guide for Entrepreneurs

In the ever-evolving landscape of small business ownership, safeguarding your enterprise against unforeseen liabilities is paramount. General liability insurance stands as a cornerstone of any comprehensive risk management strategy, providing a financial safety net against claims arising from bodily injury, property damage, and other mishaps. But with countless insurance providers vying for your attention, navigating the market can be a daunting task. Fear not, intrepid entrepreneur, for this comprehensive guide will empower you with the knowledge to secure the best general liability insurance policy for your small business. Join us as we delve into the intricacies of coverage, delve into cost-saving strategies, and empower you to make informed decisions to protect your business’s future.

Understanding General Liability Insurance: A Shield Against Unforeseen Perils

General liability insurance is an indispensable tool for shielding your small business from a wide spectrum of potential legal liabilities. Whether a customer slips and falls on your premises, your product causes unintentional harm, or your operations inadvertently damage someone’s property, this insurance policy serves as your financial guardian angel. By covering the costs of legal defense, settlements, and judgments, general liability insurance ensures that your business remains financially stable in the face of adversity.

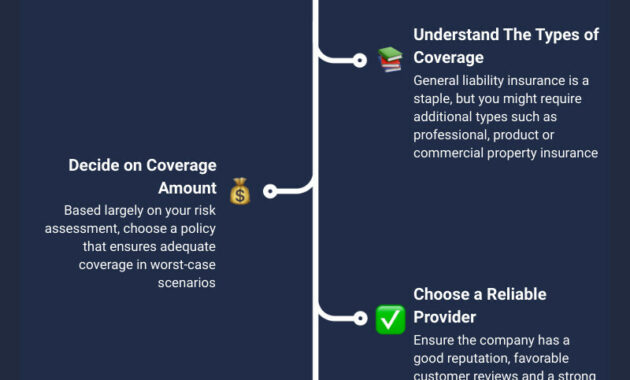

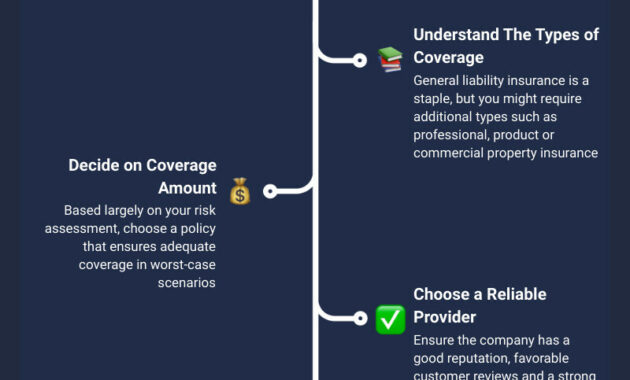

Essential Considerations: Tailoring Your Coverage to Your Business’s Needs

Selecting the right general liability insurance policy for your small business is akin to crafting a bespoke suit – it must fit your unique needs and circumstances perfectly. Begin by evaluating your business’s potential risks. Are you exposed to frequent customer traffic? Do you handle hazardous materials? Do you offer professional services that could give rise to errors and omissions claims? Once you have a clear understanding of your risk profile, you can determine the appropriate coverage limits. Remember, it’s always prudent to err on the side of caution and opt for higher limits to ensure comprehensive protection.

Affordable Options for Small Businesses: Striking a Balance Between Cost and Coverage

Budget constraints are a reality for many small businesses, but that doesn’t mean you should compromise on insurance coverage. There are several strategies you can employ to find affordable general liability insurance without sacrificing protection. Start by comparing quotes from multiple insurance providers. Don’t be afraid to negotiate and ask about discounts for bundling policies or implementing safety measures. Additionally, consider raising your deductible – the amount you pay out-of-pocket before insurance kicks in – to lower your premiums. Remember, it’s not just about finding the cheapest policy; it’s about finding the best value that meets your coverage needs.

Vetting Insurance Providers: Trustworthy Partners for Your Business Journey

Selecting an insurance provider is akin to choosing a trusted advisor for your small business. Look for providers with a proven track record of financial stability and excellent customer service. Read online reviews and testimonials from other business owners to gauge their experiences. Consider the provider’s claims handling process and ensure they have a reputation for prompt and fair settlements. Remember, the insurance provider you choose will be your ally in the event of a claim, so it’s crucial to establish a strong and mutually beneficial relationship.

Beyond the Basics: Exploring Specialized Coverage Options

While general liability insurance provides a solid foundation of protection, you may need additional coverage depending on the nature of your business. If you employ staff, consider adding workers’ compensation insurance to protect them against workplace injuries. For businesses that handle sensitive data, cyber liability insurance is a must-have to safeguard against data breaches and cyberattacks. Commercial property insurance is essential for protecting your business’s physical assets, such as your building, equipment, and inventory. By carefully assessing your unique risks and tailoring your insurance portfolio accordingly, you can create a comprehensive safety net for your small business.

Claim Prevention: Proactive Measures to Mitigate Risks

Just as an ounce of prevention is worth a pound of cure, proactive risk management can significantly reduce the likelihood of general liability claims. Implement clear safety protocols and train your staff on best practices to minimize accidents. Regularly inspect your premises and equipment to identify potential hazards and address them promptly. By fostering a culture of safety and vigilance, you can not only protect your business but also create a positive and supportive work environment for your employees.

Conclusion: Empowering Small Businesses with Peace of Mind

Securing the best general liability insurance for your small business is not merely a financial decision; it’s an investment in your business’s future. By carefully considering your coverage needs, comparing options, and partnering with a reputable insurance provider, you can create a robust shield against unforeseen liabilities. Remember, peace of mind is priceless, and with the right general liability insurance policy, you can focus on what truly matters – growing your business and achieving your entrepreneurial dreams.