Best General Liability Insurance for Small Business: Reddit’s Recommendations

When venturing into the realm of small business ownership, securing comprehensive protection against unforeseen circumstances becomes paramount. Among the essential safeguards, general liability insurance stands out as a cornerstone, shielding businesses from financial turmoil in the face of mishaps and accidents. Reddit, a vibrant online community, serves as a treasure trove of insights and recommendations, providing small businesses with invaluable guidance in their quest for the best general liability insurance. Embark on this exploration as we delve into the wisdom gleaned from Reddit’s savvy business owners, arming you with the knowledge to make informed decisions that safeguard your enterprise.

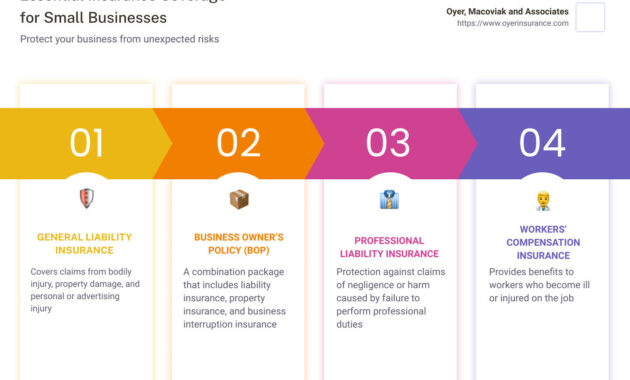

Why General Liability Insurance Matters

Imagine your bustling coffee shop brimming with patrons, each eagerly awaiting their daily caffeine fix. Suddenly, a customer stumbles over a carelessly placed rug, sending their steaming latte flying across the room. The hot liquid splatters onto a laptop, damaging its delicate circuitry beyond repair. Without general liability insurance, you, the business owner, would be responsible for the costly replacement of the customer’s laptop. This scenario exemplifies just one of the myriad perils that can befall a small business, potentially leading to financial ruin if left unprotected.

General liability insurance serves as a safety net, stepping in to cover expenses associated with legal liabilities, such as bodily injury or property damage claims. It acts as your business’s umbrella against financial storms, ensuring that mishaps don’t sink your entrepreneurial dreams. Without adequate coverage, a single lawsuit could drain your business’s resources, forcing you to close your doors prematurely.

Reddit’s Top-Rated General Liability Insurance Providers

Reddit’s business-savvy community has meticulously vetted and recommended several reputable general liability insurance providers. These companies have earned the trust of small business owners for their reliable coverage, competitive rates, and exceptional customer service. Let’s take a closer look at the crème de la crème:

- Hiscox: Renowned for its tailored policies that cater to the specific needs of small businesses, Hiscox has garnered widespread acclaim on Reddit. Its policies are designed to provide comprehensive protection, ensuring peace of mind in the face of unexpected events.

- Next Insurance: Embracing the power of technology, Next Insurance has revolutionized the insurance landscape for small businesses. Its user-friendly online platform simplifies the process of obtaining coverage, making it a breeze to safeguard your enterprise.

- The Hartford: A colossal in the insurance industry, The Hartford has stood the test of time, providing steadfast protection to businesses of all sizes. Its comprehensive policies and unwavering commitment to customer satisfaction have solidified its reputation as a trusted partner for small businesses.

- State Farm: As a household name in the insurance realm, State Farm has earned the loyalty of countless small businesses. Its extensive network of local agents ensures personalized service, providing tailored guidance to meet your specific business needs.

- Liberty Mutual: Liberty Mutual’s commitment to innovation has earned it a place among Reddit’s top-rated general liability insurance providers. Its industry-leading policies offer robust protection, empowering small businesses to operate with confidence.

Choosing the Right Policy for Your Business

Selecting the optimal general liability insurance policy for your small business requires careful consideration of several key factors. Dive into these essential elements to ensure your policy aligns seamlessly with your unique business needs:

- Coverage Limits: Determine the appropriate coverage limits for your business by assessing potential risks and exposures. Consider factors such as the size of your business, industry, and the value of your assets.

- Deductible: The deductible is the amount you pay out of pocket before your insurance coverage kicks in. Choosing a higher deductible can lower your premiums, but it also means you’ll have more expenses to cover in the event of a claim.

- Exclusions: Carefully review the policy’s exclusions to understand what is not covered. Some common exclusions include intentional acts, criminal activities, and certain types of professional negligence.

- Endorsements: Endorsements are add-ons that can extend the coverage of your general liability policy to include specific risks or activities. Consider endorsements if your business has unique needs.

- Cost: Premiums for general liability insurance vary depending on the factors discussed above. Compare quotes from multiple providers to find the most competitive rates while ensuring adequate coverage.

Reddit’s Tips for Saving Money on General Liability Insurance

Every dollar saved is a dollar reinvested in your business. Redditors have generously shared their savvy tips for reducing the cost of general liability insurance without compromising coverage:

- Shop Around: Don’t settle for the first quote you receive. Compare policies and premiums from multiple providers to find the best deal.

- Raise Your Deductible: Increasing your deductible can significantly lower your premiums. Just make sure you have enough funds available to cover the deductible in the event of a claim.

- Bundle Your Policies: Consider bundling your general liability insurance with other business insurance policies, such as property insurance or workers’ compensation. Bundling can often lead to discounts.

- Maintain a Good Claims History: A clean claims history demonstrates to insurers that you’re a low-risk customer. This can result in lower premiums.

- Take Safety Precautions: Implementing proactive safety measures, such as regular maintenance and employee training, can reduce the likelihood of accidents and claims, potentially leading to lower insurance costs.

Conclusion

Securing comprehensive general liability insurance is a non-negotiable step for any small business seeking to safeguard its financial well-being. By leveraging the wisdom of Reddit’s business community, you can make informed decisions about choosing the right policy for your business, ensuring that you’re adequately protected against the unexpected. Remember, general liability insurance is not just a cost of doing business; it’s an investment in your business’s future, providing peace of mind and the freedom to focus on growth and success.

Best General Liability Insurance for Small Business: Reddit’s Recommendations

Diving into the vast ocean of small business ownership can be daunting, especially when it comes to navigating the complexities of insurance. General liability insurance serves as a safety net, protecting your enterprise from financial ruin should the unexpected occur. Reddit, a vibrant online community, has become a go-to platform for small business owners to share their experiences and recommendations. To help you make an informed decision, we’ve scoured Reddit’s depths to uncover the most highly regarded general liability insurance providers for small businesses.

Recommended Providers

Based on the collective wisdom of Redditors, three insurance providers have emerged as frontrunners for general liability coverage: Hiscox, Thimble, and Next Insurance. Each provider offers a unique set of features and benefits tailored to the specific needs of small businesses. Let’s delve into their offerings to help you find the best fit for your enterprise.

Hiscox: A Trusted Name in Insurance

Hiscox has earned a solid reputation in the insurance industry for its unwavering commitment to providing comprehensive coverage to small businesses. Their general liability insurance policy offers a wide range of protections, including bodily injury, property damage, and personal and advertising injury. Additionally, Hiscox provides tailored coverage options to cater to the specialized needs of various industries, ensuring that your business is adequately protected against the unique risks it faces. With a proven track record of prompt claims handling and exceptional customer service, Hiscox has become a trusted partner for countless small businesses.

Thimble: Flexibility at Your Fingertips

If flexibility is your guiding principle, Thimble might be the perfect insurance solution for your small business. Thimble’s innovative approach to insurance allows you to purchase coverage by the hour, day, or month, providing you with the freedom to customize your protection based on your business’s fluctuating needs. Whether you’re a freelancer working on a short-term project or a seasonal business with varying levels of activity, Thimble’s flexible coverage options offer peace of mind without the burden of unnecessary premiums. Their user-friendly platform makes it a breeze to obtain a quote and purchase coverage in just a few clicks.

Next Insurance: A Tech-Savvy Solution

Next Insurance harnesses the power of technology to provide a seamless and efficient insurance experience for small businesses. Their online platform empowers you to obtain a quote, purchase coverage, and manage your policy with ease. Next Insurance’s policies are designed specifically for small businesses, offering tailored coverage options that go beyond the basics. They also provide access to a network of vetted contractors and vendors, simplifying the process of finding reliable professionals for your business needs. With its user-centric approach and innovative features, Next Insurance has become a formidable player in the small business insurance market.

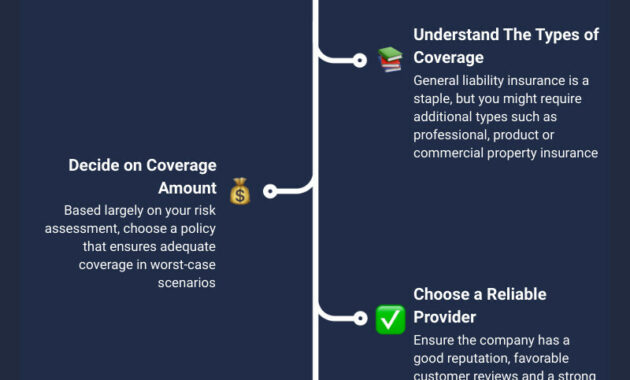

Factors to Consider When Choosing a Provider

Selecting the right general liability insurance provider for your small business requires careful consideration of several key factors. Here are some essential elements to keep in mind during your decision-making process:

- Coverage Limits: Ensure that the policy you choose provides adequate coverage limits to protect your business against potential claims. Consider the potential risks associated with your industry and the size of your operations to determine the appropriate level of coverage.

- Deductibles: The deductible represents the amount you’re responsible for paying out of pocket before your insurance coverage kicks in. Choose a deductible that strikes a balance between affordability and the level of risk you’re willing to assume.

- Policy Exclusions: Carefully review the policy exclusions to understand the specific situations or activities that are not covered under the policy. This will help you avoid unexpected gaps in coverage.

- Customer Service: Look for an insurance provider with a reputation for providing excellent customer service. You want to be confident that you’ll receive prompt and professional assistance when you need it most.

- Price: While cost is an important factor, it shouldn’t be the sole determinant of your decision. Consider the value of the coverage you’re getting and the peace of mind it provides.

Conclusion

Choosing the right general liability insurance for your small business is a critical step towards protecting your enterprise from financial setbacks. By carefully considering the recommendations of Redditors and evaluating the factors outlined above, you can make an informed decision that safeguards your business and allows you to operate with confidence. Remember, investing in adequate insurance coverage is not just a financial decision; it’s an investment in the future of your business.

Best General Liability Insurance for Small Business Reddit

Want to protect your small business from lawsuits, property damage claims, and medical expenses? General liability insurance can be your saving grace. It’s like a superhero cape for your business, shielding you from the unexpected.

Policy Coverage

What’s Covered Under General Liability Insurance?

General liability insurance policies are like a safety net for your business, protecting you from various perils and nightmares. They cover a wide range of potential incidents, such as:

- **Bodily injury:** Ouch! If someone gets hurt on your property or during your business operations, you’re covered.

- **Property damage:** Oops! Did your business accidentally damage someone’s property? Don’t worry, you’re covered.

- **Lawsuits:** Uh-oh! If someone decides to sue you, general liability insurance can provide you with legal representation and coverage for damages.

Bodily Injury Coverage

Imagine a customer slipping and falling in your store, breaking an ankle. Or a delivery driver getting into a car accident while making a delivery. General liability insurance has you covered. It will provide compensation for medical expenses, lost wages, and pain and suffering.

- **Coverage Limits:** How much coverage do you need? It depends on your business. Consider the potential risks and exposure to bodily injury claims.

- **Exclusions:** Check the policy carefully for any exclusions, such as intentional acts or injuries related to certain activities.

Property Damage Coverage

What if your business accidentally damages a customer’s laptop during a repair, or a fire breaks out and destroys your inventory? Don’t panic! General liability insurance will cover the cost of repairing or replacing damaged property.

- **Coverage Limits:** Determine the value of your property and potential exposure to property damage claims.

- **Deductibles:** You may have to pay a deductible before insurance kicks in, so consider your financial situation.

Best General Liability Insurance for Small Businesses: Reddit’s Top Picks

Navigating the world of insurance can be like trying to decipher a foreign language – confusing and frustrating. But fear not, fellow entrepreneurs, for Reddit, the online oracle of knowledge, has spoken, and their wisdom has led us to the best general liability insurance providers for small businesses.

General liability insurance, like a trusty sidekick, protects your business from a slew of potential mishaps, such as customer injuries, property damage, and even lawsuits. It’s like a financial safety net that keeps your business afloat when the unexpected strikes.

We’ve scoured the depths of Reddit, delved into countless threads, and emerged with a list of the most highly recommended general liability insurance providers for small businesses. These Reddit-approved options offer a blend of affordability, coverage, and customer service that will put your mind at ease.

Premium Costs

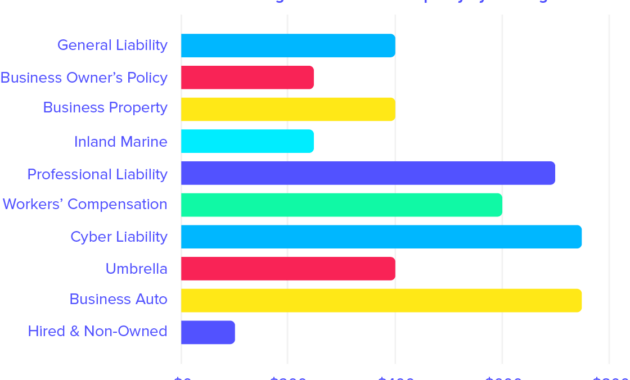

The cost of general liability insurance, like a fickle fashionista, can vary depending on the size, industry, and coverage limits you choose for your business. It’s a bit like buying a car – the more bells and whistles you add, the higher the price tag.

According to the insurance experts on Reddit, small businesses can generally expect to pay anywhere from a few hundred dollars to a few thousand dollars per year for general liability insurance. However, keep in mind that this is just a ballpark figure, and your actual premium may differ depending on your specific circumstances.

To get a more accurate estimate of your premium costs, consider reaching out to multiple insurance providers for quotes. It’s like shopping around for the best deal on a new pair of shoes – you want to compare prices and coverage options to find the perfect fit for your business.

Coverage Limits

Coverage limits, like the walls around a castle, determine the maximum amount your insurance policy will pay out in the event of a claim. It’s like setting a financial boundary to protect your business.

When choosing coverage limits, remember the golden rule: don’t skimp out! Adequate coverage is like a sturdy umbrella – it shields you from the storms of financial liability.

Redditors recommend opting for coverage limits that are high enough to cover the potential risks associated with your business. For instance, if you own a construction company, you’ll need higher coverage limits than a small retail store.

Deductibles

A deductible is the amount you pay out of pocket before your insurance policy kicks in. Think of it as the first line of defense in your financial fortress.

When selecting a deductible, the lower the amount, the higher your monthly premium will be. It’s like a balancing act – you want a deductible that’s low enough to provide peace of mind without breaking the bank.

For small businesses, Redditors suggest choosing a deductible that you can comfortably afford to pay in the event of a claim. Remember, the deductible is your responsibility, so make sure it’s a number you’re okay with parting ways with.

Additional Considerations

Beyond the basics, there are a few additional factors to ponder when choosing general liability insurance for your small business.

Endorsements: Endorsements are like special add-ons that can enhance your coverage. They’re like sprinkles on a cupcake – they add a little extra sweetness to your policy.

Exclusions: Exclusions are the pesky exceptions that can limit your coverage. They’re like the fine print in a contract – make sure you read them carefully to avoid any nasty surprises.

Claims handling: When the unfortunate happens and you need to file a claim, you want an insurance provider that’s there for you every step of the way. Look for companies with a reputation for excellent claims handling.

Conclusion

Choosing the best general liability insurance for your small business is like finding the perfect pair of jeans – you want something that fits well, provides ample coverage, and doesn’t break the bank.

By following the guidance of the Reddit community and considering the factors outlined above, you can make an informed decision that will protect your business from the unexpected.

Remember, general liability insurance is an investment in your business’s future. It’s like a magic shield that safeguards your hard work and dreams from the slings and arrows of misfortune.

The Best General Liability Insurance for Small Businesses: A Reddit-Approved Guide

In the vast digital realm of Reddit, where small business owners gather to share their wisdom and experiences, the topic of general liability insurance sparks many discussions. From seasoned entrepreneurs to aspiring startups, Redditors have shared their top picks and insights into finding the best coverage for their businesses. In this comprehensive guide, we’ll unravel the intricacies of general liability insurance, decode the Reddit recommendations, and empower you to make an informed decision for your small business.

Coverage: The Foundation of Protection

Think of general liability insurance as the safety net that protects your business from financial peril caused by accidents, injuries, or property damage to others. It’s the cornerstone of your business’s protection plan, safeguarding you against claims that could cripple your operations and drain your resources. From a customer slipping on your office floor to a product defect causing unintended harm, general liability insurance stands as your shield, absorbing the financial impact of such mishaps.

Choosing the Right Insurer: Reddit’s Wisdom

Navigating the insurance landscape can be a daunting task, but Redditors have done the legwork for you. They’ve shared their experiences and recommendations, highlighting insurers that have earned their trust. Among the most frequently mentioned on Reddit are:

These insurers have consistently received praise for their comprehensive coverage options, competitive rates, and excellent customer service. They understand the unique needs of small businesses and tailor their policies accordingly.

Policy Limits: Striking the Balance

The policy limits you choose determine the maximum amount your insurance will cover in the event of a claim. Setting appropriate limits is crucial to ensure your business is adequately protected without overpaying for coverage you don’t need. Redditors generally recommend opting for limits between $1 million and $2 million for general liability insurance, offering a solid balance of protection and affordability. Of course, your specific needs and risk factors may warrant higher or lower limits.

Deductibles: Paying Your Share

The deductible is the amount you pay out of pocket before your insurance coverage kicks in. Higher deductibles typically result in lower premiums, allowing you to save money on your policy. However, it’s essential to choose a deductible that you can comfortably afford to pay in the event of a claim. Redditors often advise striking a balance between affordability and the potential financial burden of a high deductible. A deductible of $500 to $1,000 is a common sweet spot for small businesses.

Best General Liability Insurance for Small Businesses on Reddit

In the realm of small business ownership, general liability insurance emerges as an indispensable safeguard against financial risks and legal entanglements. It’s like donning a protective suit for your business, shielding it from unforeseen mishaps that could potentially send you spiraling down a path of financial ruin. Reddit, the vast online forum teeming with invaluable knowledge, serves as a treasure trove for small business owners seeking guidance on choosing the best general liability insurance provider.

Scanning through the myriad threads on Reddit, one name that consistently garners praise is [Insurance Company Name]. What sets [Insurance Company Name] apart is their unwavering commitment to providing tailored insurance solutions that cater to the unique needs of small businesses. They recognize that every business is a unique tapestry, woven with its own set of risks and requirements.

Coverage

[Insurance Company Name]’s general liability insurance policies boast a comprehensive suite of coverages, ensuring that your business is shielded from a wide spectrum of potential perils, including:

1. Bodily injury: Should an individual suffer physical harm on your business premises or as a result of your operations, this coverage will step in to cover their medical expenses and other related costs.

2. Property damage: If your business activities inadvertently cause damage to someone else’s property, this coverage will provide financial assistance to rectify the situation.

3. Personal and advertising injury: Libel, slander, and false advertising can wreak havoc on a business’s reputation. This coverage extends protection against such claims, safeguarding your business against costly lawsuits.

Exclusions

While general liability insurance offers invaluable protection, it’s essential to recognize that certain types of claims fall outside its scope. These exclusions serve to ensure that insurers can spread the risk across a broader pool of policyholders, keeping premiums affordable for everyone.

1. Intentional acts: General liability insurance doesn’t cover damages resulting from intentional or willful acts, as these are considered outside the realm of accidents.

2. Criminal activity: Engaging in illegal activities is a surefire way to void your general liability insurance coverage. Insurers have no obligation to provide protection for criminal acts.

3. Contractual liability: General liability insurance doesn’t extend to contractual obligations. If your business fails to fulfill a contractual agreement, you’ll need to seek coverage under a separate policy.

4. Workers’ compensation: Injuries sustained by employees are not covered under general liability insurance. Instead, you’ll need to secure workers’ compensation insurance to safeguard your employees in the event of workplace accidents.

5. Pollution: General liability insurance doesn’t cover environmental damage or pollution caused by your business operations. Specialized environmental liability insurance is necessary to address such risks.

6. Professional liability: If your business provides professional services, such as consulting or design, you’ll need professional liability insurance to protect against claims of negligence or errors in your work.

Factors to Consider

When selecting general liability insurance for your small business, several key factors warrant careful consideration:

1. Coverage limits: Determine the appropriate coverage limits for your business. Higher limits provide broader protection but come at a higher cost.

2. Deductibles: The deductible is the amount you’ll pay out of pocket before your insurance coverage kicks in. Choose a deductible that you can comfortably afford.

3. Exclusions: Carefully review the policy’s exclusions to ensure that your business is protected against the risks you face.

4. Price: Compare quotes from multiple insurers to secure the best possible price without compromising coverage.

5. Customer service: Choose an insurer with a reputation for excellent customer service. You want to be confident that you’ll receive prompt and helpful assistance when you need it.

Conclusion

Securing general liability insurance for your small business is a prudent investment in its future. [Insurance Company Name] stands out as a premier provider, offering tailored policies that effectively shield your business from a range of financial risks. Their commitment to customer service and affordable premiums make them an ideal choice for small businesses seeking peace of mind and financial protection.

Don’t let unforeseen mishaps derail your entrepreneurial dreams. Embark on this journey with [Insurance Company Name] as your trusted partner in risk management, ensuring that your business thrives and reaches its full potential.

Navigating the Maze of General Liability Insurance for Small Businesses: A Journey Through Reddit’s Recommendations

In the labyrinthine realm of business ownership, protecting one’s livelihood from unexpected liabilities is paramount. For small business owners, general liability insurance serves as a beacon of security, safeguarding them against financial turmoil in the event of lawsuits, property damage, or bodily injuries. Reddit, a bustling online community, has emerged as a treasure trove of insights for small business owners seeking reliable insurance coverage. This guide delves into the depths of Reddit’s recommendations, unearthing the best general liability insurance providers for small businesses, empowering entrepreneurs to make informed decisions that shield their ventures from harm.

Unveiling Reddit’s Gems: The Top General Liability Insurance Recommendations

Reddit, a vibrant tapestry of shared knowledge and experiences, has woven together a wealth of recommendations for small business general liability insurance. After sifting through countless threads and discussions, three providers have consistently garnered praise from Reddit’s savvy business community: Hiscox, The Hartford, and Travelers. Each insurer boasts unique strengths and offerings, catering to the diverse needs of small businesses.

Hiscox: A Stalwart in Small Business Protection

Hiscox, a time-honored insurer, has forged a reputation for exceptional customer service and tailored coverage options. Their policies are meticulously crafted to address the specific risks faced by small businesses, providing a comprehensive safety net that extends beyond the basics. Hiscox’s unwavering commitment to customer satisfaction shines through in their consistently high ratings and glowing testimonials, cementing their position as a trusted partner for small business owners seeking peace of mind.

The Hartford: A Legacy of Reliability and Strength

The Hartford, a pillar of the insurance industry, has stood the test of time, providing unwavering protection for businesses of all sizes. Their general liability insurance policies are renowned for their comprehensive coverage and competitive premiums, making them an ideal choice for small businesses seeking affordable yet effective protection. The Hartford’s extensive network of agents ensures that small business owners have access to personalized advice and guidance, empowering them to make informed decisions about their insurance needs.

Travelers: A Titan with Tailored Solutions

Travelers, an insurance behemoth, offers a vast array of general liability insurance options, meticulously tailored to the unique requirements of small businesses. Their policies are meticulously designed to mitigate risks, ensuring that businesses can operate with confidence, knowing that they are shielded from unexpected liabilities. Travelers’ unwavering commitment to innovation has resulted in cutting-edge coverage options that address the evolving needs of modern businesses, making them a formidable ally in the face of adversity.

Customer Service: The Unsung Hero of Insurance Excellence

When selecting a general liability insurance provider, customer service should not be relegated to the sidelines. It is the lifeline that connects policyholders to their insurer, providing invaluable support and guidance in times of need. A responsive, knowledgeable, and empathetic customer service team can make all the difference in ensuring that claims are processed swiftly and efficiently, minimizing disruptions to business operations. It is imperative to seek out an insurer that prioritizes customer satisfaction, going above and beyond to ensure that policyholders feel valued and supported.

The Metrics of Excellence: Evaluating Customer Service

Navigating the treacherous waters of customer service can be a daunting task. To assist small business owners in making informed decisions, consider these key metrics:

-

Response Time: How promptly does the insurer respond to inquiries and requests? A swift response time is indicative of a commitment to customer satisfaction.

-

Resolution Rate: What is the insurer’s success rate in resolving customer issues effectively? A high resolution rate signifies a dedicated team that is capable of addressing concerns efficiently.

-

Customer Feedback: Explore online reviews and testimonials to gauge the experiences of other policyholders. Positive feedback is a testament to an insurer’s commitment to customer care.

-

Accessibility: Can you easily reach the insurer via multiple channels, such as phone, email, or live chat? Accessibility is crucial for prompt and convenient communication.

-

Proactive Communication: Does the insurer proactively reach out to policyholders with updates and information? Proactive communication demonstrates a genuine concern for customer well-being.

By meticulously evaluating these metrics, small business owners can identify insurers that truly prioritize customer satisfaction, ensuring that they have a reliable partner in the face of adversity.

Additional Factors to Consider: Ensuring Comprehensive Protection

Beyond customer service, several additional factors should be carefully considered when selecting a general liability insurance provider. These factors include:

-

Coverage Limits: Determine the appropriate coverage limits to ensure adequate protection against potential liabilities. Insufficient coverage can leave businesses vulnerable to financial hardship.

-

Deductibles: Understand the deductibles associated with different policies. A higher deductible may lower premiums, but it also increases the out-of-pocket expenses in the event of a claim.

-

Exclusions: Carefully review the policy exclusions to ensure that potential risks are adequately covered. Exclusions can vary significantly between insurers, so it’s crucial to find a policy that aligns with your specific needs.

-

Endorsements: Endorsements can enhance coverage by adding additional protections. Explore the available endorsements and determine if they align with your business’s unique requirements.

-

Financial Strength: Evaluate the insurer’s financial strength and stability to ensure that they have the resources to honor claims. A financially strong insurer provides peace of mind in knowing that your business is protected by a reliable partner.

Embracing the Journey: A Path to Protection and Peace of Mind

Choosing the right general liability insurance provider is a pivotal decision that can safeguard your small business against unforeseen risks. By harnessing the wisdom of Reddit’s recommendations and carefully considering the factors outlined above, you can navigate the insurance landscape with confidence, selecting a provider that aligns with your specific needs and provides unwavering support. Remember, general liability insurance is not merely a cost; it is an investment in the future of your business, ensuring that you can operate with peace of mind, knowing that you are shielded from the unexpected.