Commercial Truck Insurance Rates: A Comprehensive Guide

Navigating the commercial truck insurance landscape can be a daunting task, especially when trying to secure affordable rates. The average annual premium for commercial truck insurance in the United States ranges from $8,000 to $12,000, depending on the size and type of vehicle, as well as the coverage limits and the driver’s safety record. While these costs may seem substantial, there are strategies businesses can implement to lower their insurance expenses and protect their bottom line.

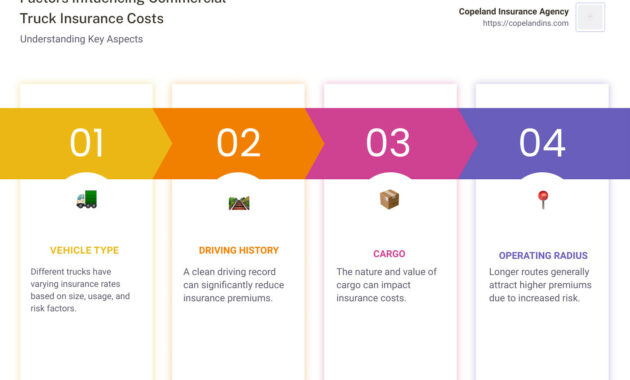

Factors Influencing Commercial Truck Insurance Rates

Type of Vehicle: The type of commercial truck being insured significantly impacts the insurance rates. Larger trucks that haul heavier loads generally require higher insurance premiums than smaller trucks.

Coverage Limits: The amount of coverage you choose for your commercial truck insurance will directly affect the premium. Higher coverage limits mean higher premiums, as they provide broader financial protection in case of an accident.

Driver’s Safety Record: The driving history of the individuals operating the commercial truck is a key factor in determining insurance rates. Drivers with clean driving records pay lower premiums than those with accidents or traffic violations on their record.

Strategies for Lowering Costs

Loss Prevention Measures: Implementing proactive measures to reduce the likelihood of accidents can go a long way in lowering insurance rates. These measures include conducting regular vehicle inspections, providing safety training to drivers, and installing safety devices such as lane departure warning systems and anti-lock brakes.

Maintaining Good Safety Records: Companies with a strong safety record are seen as lower risks by insurance providers, resulting in lower premiums. Maintaining a fleet of well-maintained vehicles, enforcing strict safety policies, and rewarding safe driving practices can help businesses maintain a positive safety record.

Negotiating with Insurance Providers: Insurance companies are not always willing to offer the lowest rates upfront. Businesses can negotiate with insurance providers by comparing quotes from multiple providers, exploring discounts and coverage options, and working with an insurance broker who can advocate on their behalf.

Additional Tips for Reducing Premiums

Increase Deductible: A higher deductible means you will pay more out of pocket in the event of an accident. However, it also lowers your monthly premiums.

Consider Usage-Based Insurance: If your fleet operates primarily in low-risk areas and during off-peak hours, usage-based insurance can be a cost-effective option. Premiums are based on actual driving habits, potentially reducing costs for businesses with safe drivers.

Shop Around: As with any insurance purchase, it’s important to comparison shop before you buy. Get quotes from multiple insurance providers to ensure you are getting the best rate for the coverage you need.

Conclusion

Commercial truck insurance rates can vary significantly depending on a range of factors. By implementing loss prevention measures, maintaining good safety records, and negotiating with insurance providers, businesses can lower their insurance costs and protect their financial well-being. Remember, every dollar saved on insurance is a dollar that can be invested back into your business’s growth and success.

Commercial Truck Insurance Rates: The Complete Guide

The trucking industry is the backbone of our economy, transporting goods across the country and keeping businesses running smoothly. But operating a commercial truck comes with its own set of risks, and having the right insurance coverage is essential to protect yourself, your business, and others on the road. Commercial truck insurance rates can vary widely depending on a number of factors, including the type of truck you operate, the size of your fleet, and your driving history.

According to the Insurance Information Institute, the average annual premium for commercial truck insurance is $1,500. However, rates can range from as low as $500 to as high as $10,000 or more. The best way to get an accurate quote is to shop around and compare rates from multiple insurance companies.

Choosing an Insurance Provider

When choosing an insurance provider, it’s important to do your research and find a company that is reputable and experienced in commercial truck insurance. You’ll also want to make sure that the company offers the coverage you need at a price you can afford.

Here are some factors to consider when choosing an insurance provider:

- Reputation: Do some research online to see what other customers have said about the company. You can also check with the Better Business Bureau to see if there have been any complaints filed against the company.

- Experience: How long has the company been in business? Do they have experience insuring commercial trucks?

- Coverage: Does the company offer the coverage you need? Make sure to compare the different policies offered by different companies to find the one that best meets your needs.

- Price: Get quotes from multiple insurance companies to compare rates. Be sure to compare the coverage offered by each company as well as the price.

Types of Commercial Truck Insurance

There are a variety of different types of commercial truck insurance available, including:

- Liability insurance: This coverage protects you if you are sued for causing injuries or property damage to others.

- Collision insurance: This coverage pays for damage to your truck if you are involved in an accident.

- Comprehensive insurance: This coverage pays for damage to your truck from non-collision events, such as theft, vandalism, or fire.

- Cargo insurance: This coverage protects the cargo you are hauling in your truck.

- Workers’ compensation insurance: This coverage provides benefits to employees who are injured on the job.

Factors Affecting Commercial Truck Insurance Rates

A number of factors can affect your commercial truck insurance rates, including:

- Type of truck: The type of truck you operate will affect your rates. For example, dump trucks and semi-trucks typically have higher rates than pickup trucks.

- Size of fleet: The size of your fleet will also affect your rates. The more trucks you have, the higher your rates will be.

- Driving history: Your driving history will affect your rates. If you have a history of accidents or traffic violations, your rates will be higher.

- Location: The location of your business will also affect your rates. Rates tend to be higher in urban areas than in rural areas.

- Deductible: The deductible is the amount you pay out of pocket before your insurance coverage kicks in. The higher your deductible, the lower your rates will be.

How to Lower Your Commercial Truck Insurance Rates

There are a number of things you can do to lower your commercial truck insurance rates. Here are a few tips:

- Shop around: Get quotes from multiple insurance companies to compare rates.

- Increase your deductible: Increasing your deductible can lower your rates. However, be sure to choose a deductible that you can afford to pay.

- Take a defensive driving course: Taking a defensive driving course can help you improve your driving skills and lower your rates.

- Install safety devices: Installing safety devices on your truck, such as a dash cam or a GPS tracking device, can lower your rates.

- Maintain a good driving record: Keeping your driving record clean is the best way to lower your rates.

Commercial Truck Insurance Rates: A Comprehensive Guide

The trucking industry is the backbone of our economy, transporting goods and materials across the country. However, operating a commercial truck comes with inherent risks, and protecting your business from financial liability is paramount. Commercial truck insurance provides a safety net, ensuring you can recover from accidents, lawsuits, and other unexpected events. Understanding commercial truck insurance rates and implementing cost-saving strategies are essential for trucking businesses to protect their financial interests and ensure compliance with regulations.

Commercial truck insurance rates vary widely, depending on several factors. These include the size and type of your truck, the value of your cargo, the number of miles you drive, your driving history, and your location. The average cost of commercial truck insurance is around $1,500 per year, but it can range from $500 to $5,000 or more.

Factors Affecting Commercial Truck Insurance Rates

Several factors influence commercial truck insurance rates. By understanding these factors and taking steps to mitigate risks, you can potentially lower your premiums.

- Type of Truck: Larger trucks and those carrying hazardous materials typically have higher insurance rates.

- Cargo Value: The value of the goods you transport affects your rates. High-value cargo requires more extensive coverage.

- Mileage: The more miles you drive, the greater the risk of an accident, resulting in higher rates.

- Driving History: A clean driving record can significantly lower your insurance costs. Accidents and traffic violations increase premiums.

- Location: Insurance rates vary by state, with higher rates in areas with higher accident rates and congestion.

Cost-Saving Strategies for Commercial Truck Insurance

Insurance premiums can be a significant expense for trucking businesses. By implementing cost-saving strategies, you can reduce your overall insurance costs without sacrificing coverage.

- Shop Around: Compare quotes from multiple insurance companies to find the best rates.

- Raise Your Deductible: Increasing your deductible can lower your premiums. However, ensure you choose a deductible you can afford to pay if necessary.

- Maintain a Good Driving Record: Avoid accidents and traffic violations to keep your rates low.

- Install Safety Devices: Equipping your truck with safety features like anti-lock brakes and lane departure warnings can demonstrate your commitment to safety and potentially reduce premiums.

- Telematics: Using telematics devices to track your driving habits can help you identify areas for improvement and may qualify you for discounts.

Types of Commercial Truck Insurance Coverage

Commercial truck insurance policies typically include various coverage options to protect you from different types of risks. Understanding each type and its significance is crucial for making informed decisions.

- Liability Insurance: Protects you from financial responsibility for injuries or property damage caused to others in an accident.

- Physical Damage Coverage: Covers the cost of repairing or replacing your truck if it’s damaged in an accident or by other events like theft or vandalism.

- Cargo Insurance: Protects the goods you transport in the event of loss or damage.

- Workers’ Compensation Insurance: Provides benefits to employees injured on the job.

- Uninsured/Underinsured Motorist Coverage: Protects you if you’re involved in an accident with a driver who doesn’t have adequate insurance.

Choosing the Right Insurance Company

Selecting the right insurance company is crucial for securing comprehensive coverage at a reasonable cost. Consider the following factors:

- Reputation: Research the company’s financial stability and customer satisfaction ratings.

- Experience: Choose an insurance company with experience in covering commercial trucks.

- Coverage Options: Ensure the company offers the types of coverage you need.

- Claims Process: Inquire about the company’s claims process and the ease of filing and settling claims.

Conclusion

Understanding commercial truck insurance rates and implementing cost-saving strategies are essential for trucking businesses to protect their financial interests and ensure compliance with regulations. By tailoring your insurance coverage to your specific needs and adopting prudent risk management practices, you can minimize premiums and safeguard your business from unexpected events.