Introduction

Commercial truck insurance rates are influenced by several factors, making it crucial for businesses to understand these factors to secure affordable coverage.

Factors Affecting Commercial Truck Insurance Rates

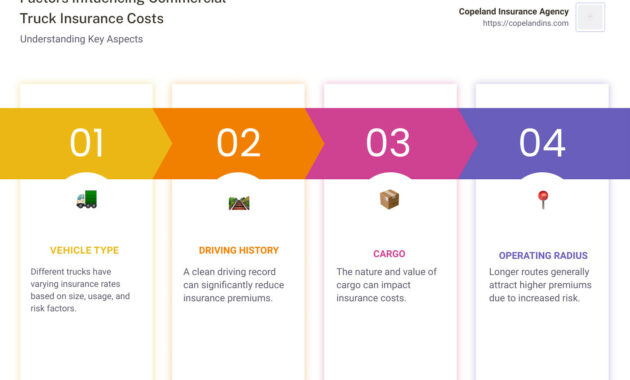

Several factors influence commercial truck insurance rates, including:

Vehicle Type and Usage

Different types of commercial trucks have varying levels of risk associated with them. For example, a tanker truck hauling hazardous materials poses a greater risk than a box truck delivering furniture. Similarly, trucks used for long-distance hauling face different risks than those used for local deliveries.

Driver Age and Experience

Younger drivers with less experience are statistically more likely to be involved in accidents, leading to higher insurance premiums. Insurers consider a driver’s age, driving record, and years of experience behind the wheel when determining rates.

Insurance History

Insurers evaluate a company’s insurance history when setting rates. Businesses with a history of accidents or claims will generally pay higher premiums than those with a clean record. Maintaining a good claims experience is essential for keeping insurance costs down.

Cargo Value

The value of the cargo being transported can significantly impact insurance rates. Trucks hauling high-value goods, such as electronics or pharmaceuticals, will typically pay higher premiums than those carrying less valuable items.

Geographic Location

Insurance rates vary depending on the geographic location of the trucking company. Factors such as traffic density, crime rates, and weather conditions can affect premiums.

Deductible Amount

The deductible is the amount that the business is responsible for paying out-of-pocket before the insurance coverage kicks in. Choosing a higher deductible can lower the insurance premium, but it also increases the financial risk to the business in the event of an accident.

Insurance Coverage Limits

The amount of insurance coverage purchased also affects the premium. Higher coverage limits provide more protection but come at a higher cost. Businesses should carefully consider their insurance needs and purchase the appropriate amount of coverage.

Additional Factors

Other factors can influence commercial truck insurance rates, such as the company’s safety record, the number of drivers employed, and the type of insurance coverage purchased. Insurers may offer discounts for businesses with strong safety programs or those that install safety devices on their trucks.

Securing Affordable Commercial Truck Insurance

Businesses can take several steps to secure affordable commercial truck insurance:

• Shop around and compare quotes from multiple insurance providers.

• Maintain a good safety record and implement a comprehensive safety program.

• Hire experienced drivers with clean driving records.

• Purchase the appropriate amount of insurance coverage to meet the company’s needs.

• Consider raising the deductible to lower the insurance premium.

• Ask about discounts and incentives offered by insurance providers.

By understanding the factors that influence commercial truck insurance rates and taking steps to reduce the risks associated with their operations, businesses can secure affordable coverage that meets their needs and protects their assets.

The Essential Guide to Commercial Truck Insurance Rates

In today’s bustling economy, commercial trucks are the workhorses that keep our supply chains humming. But ensuring these vital vehicles have adequate insurance coverage can be a daunting task. Commercial-truck-insurance-rates vary widely based on a complex web of factors. This article delves into the intricacies of commercial truck insurance rates, empowering you to make informed decisions that protect your business.

Factors Affecting Rates

Just as every truck is unique, so too are the factors that influence its insurance premiums. Understanding these variables is crucial to navigating the insurance landscape and securing the best rates for your operation.

Type of Truck

The type of truck you operate plays a significant role in determining your insurance costs. Heavier vehicles with specialized equipment, such as tankers or flatbeds, typically command higher premiums due to their increased risk profile. Similarly, trucks used for hazardous material transport face higher insurance costs than those used for general freight.

Coverages Needed

The extent of insurance coverage you require also affects your premium. Liability insurance, which protects you from financial claims arising from accidents, is a must-have for any commercial truck operator. However, additional coverages, such as physical damage insurance, cargo insurance, and non-trucking liability insurance, provide extra layers of protection but come at an additional cost.

Driver’s History

Your drivers’ safety records have a significant impact on your insurance rates. Accidents, moving violations, and other traffic offenses can lead to higher premiums. Conversely, drivers with clean records can qualify for discounts and lower rates.

Company’s Safety Record

The insurance industry places great importance on your company’s overall safety record. Companies with a proven track record of safe operations typically enjoy lower insurance costs. Factors such as driver training programs, vehicle maintenance schedules, and accident prevention initiatives are all taken into account.

Commercial Truck Insurance Rates: A Comprehensive Guide to Finding the Best Coverage

For businesses that rely on commercial trucks for transportation, procuring adequate insurance coverage is a crucial expense. In the complex world of truck insurance, the cost of policies can vary significantly depending on several factors. Understanding these variables and employing smart shopping strategies are essential to secure the best possible rates.

What Influences Commercial Truck Insurance Rates?

Just as every truck is unique, so are the factors that determine its insurance premiums. Some of the key variables that insurance companies consider when calculating rates include:

- Type of truck: The size, weight, and configuration of the truck play a significant role in determining its insurance cost.

- Usage: The purpose and frequency of truck use impact premiums. Trucks used for long-haul transportation typically face higher rates than those used for local deliveries.

- Driver’s experience and history: Insurance companies evaluate the age, experience, and driving record of drivers associated with the truck. Drivers with clean records and extensive experience often qualify for lower premiums.

- Location: The geographic location where the truck is operated influences premiums. States with higher accident rates or congested areas tend to have higher insurance costs.

- Coverage options: The level and type of coverage selected significantly affect premiums. Comprehensive coverage, including liability, collision, and cargo insurance, typically comes with higher premiums than basic liability-only coverage.

Shopping for the Best Rates

To secure the best rates on commercial truck insurance, it’s essential to shop around and compare quotes from multiple providers. This process involves:

- Gathering information: Determine the coverage needs and specific requirements for the truck. Collect information on the truck’s specifications, usage, and driver profiles.

- Obtaining quotes: Contact different insurance providers and request quotes based on the gathered information. Be prepared to provide details about the truck, its usage, and the desired coverage options.

- Comparing quotes: Once you have multiple quotes, it’s time to compare them carefully. Review each quote for coverage details, deductibles, and premium amounts. Consider the overall value and suitability of each option in relation to the truck’s needs.

Factors to Consider When Evaluating Quotes

Beyond simply comparing premiums, there are several key factors to consider when evaluating insurance quotes:

- Coverage details: Ensure that the coverage provided by each quote meets the specific needs of the truck and business. Identify any gaps or limitations in coverage.

- Reputation and financial stability: Research the reputation and financial stability of the insurance providers. Consider their claims handling reputation and overall customer satisfaction.

- Deductibles: The deductibles associated with each quote should be carefully evaluated. Higher deductibles typically result in lower premiums, but they also increase the financial responsibility in the event of a claim.

- Endorsements and riders: Endorsements and riders can be added to insurance policies to provide additional coverage or customization. Assess whether these add-ons are necessary and consider their impact on premiums.

- Bundling options: If the business has other insurance needs, such as general liability or workers’ compensation, consider bundling policies with the same provider. This may result in cost savings and streamline insurance management.

By thoroughly evaluating these factors, businesses can make informed decisions about their commercial truck insurance coverage and secure the best possible rates. It’s worth noting that insurance needs can change over time, so it’s advisable to review policies and compare quotes regularly to ensure continued adequacy and cost-effectiveness.

Commercial Truck Insurance Rates: A Comprehensive Overview

In the realm of commercial trucking, insurance rates are pivotal to ensuring financial stability and protecting against exorbitant costs. Understanding the factors that influence these rates is paramount for businesses to effectively manage their risks and optimize their financial resources. With a plethora of variables at play, such as the size of the fleet, the type of cargo being hauled, and the driver’s safety record, navigating the complexities of commercial truck insurance can be a daunting task. However, by leveraging strategies that promote safety, maintain impeccable driving records, and embrace technological advancements, businesses can effectively lower their insurance premiums and secure their financial footing.

So, what are the driving forces behind commercial truck insurance rates? Let’s delve into the nuances of this intricate subject:

Factors Influencing Commercial Truck Insurance Rates

A multitude of factors converge to shape the insurance rates for commercial truck fleets. Among the most influential are:

1. **Fleet size:** The sheer magnitude of a trucking operation directly correlates with the insurance premiums charged. Larger fleets, with their increased exposure to risk, typically face higher insurance costs compared to smaller fleets.

2. **Type of cargo:** The nature of the goods being transported significantly impacts insurance rates. Hauling hazardous materials or specialized commodities entails greater liability and, consequently, higher premiums.

3. **Driver’s safety record:** Impeccable driving records are synonymous with lower insurance premiums. Fleets with a clean history of safe driving practices can expect to pay reduced rates.

4. **Vehicle safety features:** Trucks equipped with advanced safety technologies, such as anti-lock brakes, lane departure warning systems, and adaptive cruise control, can qualify for discounts on insurance premiums.

Strategies for Lowering Rates

To effectively manage insurance costs, trucking businesses should adopt strategies that prioritize safety, promote responsible driving, and harness technological advancements.

1. Implementing Safety Measures

Fostering a culture of safety within the fleet is a cornerstone of reducing insurance rates. Implementing comprehensive safety protocols, including regular vehicle inspections, driver training programs, and adherence to industry best practices, can significantly lower the risk of accidents and, consequently, insurance premiums.

2. Maintaining a Clean Driving Record

Drivers with spotless driving records are highly sought after by insurance companies. Fleets that maintain a clean driving history, free from accidents and traffic violations, are rewarded with lower insurance rates. By encouraging responsible driving habits, implementing driver monitoring systems, and providing incentives for safe driving, businesses can reduce the likelihood of accidents and the associated insurance costs.

3. Installing Telematics Devices

Telematics devices, which monitor vehicle performance, driver behavior, and GPS location, provide invaluable data to insurance companies. By leveraging this data, insurers can accurately assess risk and offer tailored insurance policies with lower premiums for fleets that demonstrate safe driving practices.

4. Additional Strategies for Reducing Insurance Premiums

Beyond these core strategies, a myriad of additional measures can contribute to lowering commercial truck insurance rates:

1. **Increase deductibles:** Raising the deductible, or the amount paid out-of-pocket before insurance coverage kicks in, can reduce premiums. However, it’s essential to strike a balance between lower premiums and the financial burden of higher deductibles in the event of an accident.

2. **Bundle policies:** Combining commercial truck insurance with other business insurance policies, such as general liability or property insurance, can often lead to lower premiums.

3. **Shop around:** Comparing quotes from multiple insurance companies is crucial for securing the most competitive rates. By exploring various options, businesses can identify the insurer that offers the best coverage at the most affordable price.

4. **Maintain good credit:** Insurance companies often consider a business’s credit score when determining insurance rates. Maintaining a solid credit history can positively impact insurance premiums.

5. **Negotiate with insurers:** Don’t hesitate to negotiate with insurance companies to secure the most favorable rates. By presenting a strong safety record, demonstrating a commitment to risk management, and leveraging industry data, businesses can often negotiate lower premiums.

Conclusion

Navigating the complexities of commercial truck insurance rates requires a comprehensive understanding of the influential factors and a strategic approach to lowering costs. By implementing safety measures, maintaining a clean driving record, installing telematics devices, and exploring additional strategies, trucking businesses can effectively reduce their insurance premiums and ensure their financial stability. Remember, every dollar saved on insurance is a dollar invested in the longevity and success of the business.

Commercial Truck Insurance Rates: A Comprehensive Guide for Business Owners

In the realm of transportation, commercial trucks are the backbone of our economy, hauling goods and supplies across vast distances. However, operating these mighty machines comes with a hefty responsibility – ensuring their safety and protecting your business from financial setbacks. That’s where commercial truck insurance comes into play, a crucial safeguard that shields you from the unexpected perils of the road.

If you’re a business owner contemplating commercial truck insurance coverage, navigating the complexities of this vital protection can be a daunting task. But fear not! This comprehensive guide will delve into the inner workings of commercial truck insurance rates, providing you with all the essential information you need to make informed decisions.

Factors Influencing Commercial Truck Insurance Rates

Determining the cost of your commercial truck insurance policy is no trivial matter. Insurers meticulously consider a myriad of factors to tailor your premiums to your specific risks and needs. Here are some of the key elements that shape your insurance rates:

- Business Size and Operations: The规模 of your trucking operation, including the number of trucks you own or lease, the types of goods you transport, and the frequency of your trips, all play a pivotal role in determining your insurance costs.

- Driver History and Experience: Your drivers’ safety records and years of experience behind the wheel have a significant impact on your保险费率. A clean driving record can translate to lower premiums, while accidents or violations can drive up your costs.

- Coverage Limits and Deductibles: The extent of your insurance coverage and the deductibles you choose directly influence your premiums. Higher coverage limits and lower deductibles offer more comprehensive protection but come with a higher price tag.

- Vehicle Age and Condition: The age, make, and model of your trucks, as well as their overall condition and maintenance history, are taken into account when calculating your insurance rates.

- Operating Area and Mileage: The geographic regions you operate in and the annual mileage your trucks accumulate can affect your insurance premiums. High-risk areas with greater traffic congestion and accident rates typically result in higher costs.

Coverage Considerations

Businesses should carefully consider the coverages they need to meet their specific needs. The following are the most common types of commercial truck insurance policies:

- Liability Insurance: Protects you from financial liability in the event your truck causes injury or property damage to others.

- Physical Damage Insurance: Covers repairs or replacement of your truck in the event of an accident, theft, or damage from natural disasters.

- Cargo Insurance: Safeguards the goods you transport from loss or damage during transit.

- Motor Truck Cargo Insurance:* For-hire motor carriers who transport the goods of others for a fee may need motor truck cargo coverage. It provides financial protection in the event of physical loss or damage to the cargo during transit.

- Non-Trucking Liability Insurance:** Provides coverage when your truck is not being used to transport goods, such as when it is parked or undergoing repairs.

Premiums and Discounts

Insurance premiums are the periodic payments you make to maintain your coverage. Discounts can help reduce your premiums, so be sure to ask your insurer about any applicable discounts for:

- Safety Programs: Implementing safety programs for your drivers can demonstrate your commitment to reducing risks and earn you discounts.

- Bundling Policies: Combining your commercial truck insurance with other business insurance policies, such as general liability or workers’ compensation, can often lead to lower overall premiums.

- Telematics: Installing telematics devices in your trucks can provide insurers with data on driver behavior and vehicle performance, potentially qualifying you for discounts.

- Experience Modifiers: A good safety record over an extended period can result in an experience modifier, which is a factor that reduces your insurance premiums.

Comparing Quotes and Choosing the Right Policy

Once you understand the factors that influence commercial truck insurance rates, it’s time to compare quotes from multiple insurers. Provide each insurer with accurate and complete information about your business and operations. Carefully review the coverage, limits, deductibles, and premiums offered by each insurer before making a decision.

Don’t be afraid to ask questions and clarify any uncertainties you may have. Choosing the right commercial truck insurance policy is crucial for protecting your business and ensuring its long-term success.

Frequently Asked Questions

Q: What is the average cost of commercial truck insurance?

A: The cost of commercial truck insurance varies widely depending on the factors discussed above. It’s essential to obtain quotes from multiple insurers to determine the most competitive rates for your specific needs.

Q: What is the minimum amount of liability insurance I need?

A: The minimum liability insurance requirements vary by state. However, it’s generally recommended to carry higher limits of liability coverage to protect your business from catastrophic claims.

Q: Can I negotiate my commercial truck insurance rates?

A: Yes, you may be able to negotiate your insurance rates by demonstrating a strong safety record, implementing risk-reducing measures, or bundling your policies with the same insurer.

Q: What happens if I cancel my commercial truck insurance policy?

A: Canceling your commercial truck insurance policy mid-term may result in penalties or fees. It’s important to notify your insurer in writing and provide a reason for the cancellation.

Commercial Truck Insurance Rates: A Comprehensive Guide

For businesses that rely on commercial trucks for their operations, securing adequate insurance coverage is of paramount importance. Commercial truck insurance is not merely a legal requirement but also a crucial safeguard against potential liabilities and financial risks associated with operating a fleet of vehicles. The cost of commercial truck insurance, however, can vary significantly depending on several factors, making it imperative for businesses to understand these factors and their impact on insurance premiums.

Factors Influencing Commercial Truck Insurance Rates

A multitude of variables come into play when determining commercial truck insurance rates. Understanding these factors can help businesses assess their risk profile and negotiate competitive premiums. The following key factors exert a profound influence on insurance rates:

- Type of Truck: The type of commercial truck plays a significant role in determining insurance premiums. Heavy-duty trucks, such as semi-trailers, typically incur higher premiums compared to smaller trucks due to their increased risk of accidents and liability.

- Usage and Mileage: The frequency and distance a truck is driven directly impact its insurance rates. Trucks used for long-haul operations and covering extensive distances pose a higher risk than those primarily used for local deliveries.

- Driver Factors: The experience, driving history, and safety record of drivers significantly influence insurance premiums. Drivers with a clean driving record and proper training and certifications are likely to qualify for lower rates.

- Claims History: A company’s claims history is a critical determinant of insurance rates. Businesses with a history of frequent or severe accidents will face higher premiums as they pose a greater risk to the insurer.

- Cargo Carried: The type of cargo transported by the truck also affects insurance premiums. High-value or hazardous cargo attracts higher rates due to the increased liability in case of accidents or theft.

- Coverage Options: The extent of coverage chosen by a business, such as liability limits, physical damage coverage, and cargo insurance, directly impacts the insurance premium. Higher coverage limits and additional coverages result in higher premiums.

How to Lower Commercial Truck Insurance Rates

Businesses can take proactive steps to lower their commercial truck insurance rates and save money on their premiums. Here are a few effective strategies:

- Maintain a Clean Driving Record: Encouraging drivers to adhere to traffic regulations, undergo defensive driving courses, and implement driver safety programs can significantly reduce the likelihood of accidents and lower insurance rates.

- Reduce Claims Frequency: Implementing proper maintenance schedules, installing safety devices, and providing training to drivers can help minimize the occurrence of accidents and claims, thereby reducing insurance premiums.

- Shop Around and Compare Quotes: Obtaining quotes from multiple insurance providers and comparing their rates can help businesses secure the most competitive premiums. Negotiating with insurers and exploring discounts and incentives can further reduce costs.

- Raise Deductibles: Increasing the deductible on insurance policies can lower premiums. Businesses should carefully consider their financial capacity and risk tolerance before opting for higher deductibles.

- Consider Telematics: Utilizing telematics devices that track vehicle performance, driver behavior, and location can help insurers assess risk more accurately. Safe driving habits and reduced mileage can lead to lower insurance rates.

Additional Factors to Consider

Beyond the primary factors discussed above, several other considerations can influence commercial truck insurance rates. These factors include:

- Location: The geographic location where the truck operates affects insurance rates. Areas with higher traffic congestion, crime rates, or accident frequencies typically result in elevated premiums.

- Insurance Company: Different insurance providers have varying risk assessment models and pricing structures. Comparing quotes from multiple insurers is essential to find the most favorable terms and rates.

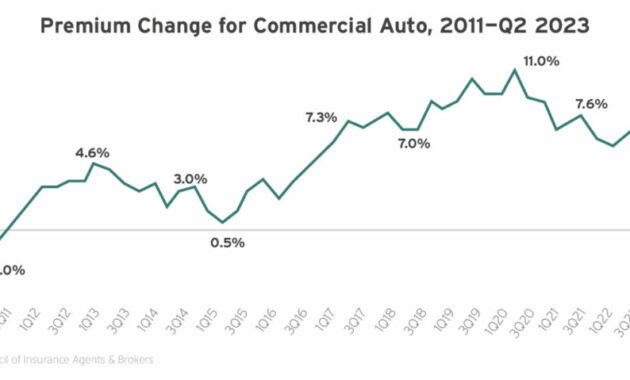

- Market Conditions: The overall insurance market conditions, including industry trends, economic factors, and regulatory changes, can impact commercial truck insurance rates.

Conclusion

Understanding the factors that influence commercial truck insurance rates is crucial for businesses to make informed decisions, negotiate competitive premiums, and protect their investments. By carefully assessing their risk profile, implementing proactive measures to reduce claims, and exploring cost-saving strategies, businesses can optimize their insurance coverage while minimizing their financial burden.