A-Rated Commercial Truck Insurance Companies: A Comprehensive Guide

When it comes to commercial truck insurance, you want to be sure you’re getting the best possible coverage from a reputable and financially stable provider. That’s where A-rated commercial truck insurance companies come in. These companies have earned an “A” rating from AM Best, an independent credit rating agency, indicating their exceptional financial strength and ability to meet their policyholder obligations. Let’s dive into the details of why you should consider an A-rated insurer for your trucking business.

Financial Stability: The Bedrock of Reliability

Financial stability is paramount in the insurance industry. When choosing a commercial truck insurance company, you want one that has the financial wherewithal to pay claims promptly and in full. A-rated companies have demonstrated a proven track record of financial strength, consistently meeting their policyholder obligations even during challenging economic times. This financial stability provides peace of mind, knowing that you can count on your insurer to be there when you need them most.

Exceptional Claims Handling: Resolving Issues Swiftly and Fairly

Claims handling is a critical aspect of the insurance experience. A-rated commercial truck insurance companies are known for their exceptional claims handling practices. They have dedicated and experienced claims adjusters who work diligently to resolve claims quickly and fairly. These companies prioritize customer satisfaction, ensuring that policyholders receive the coverage they deserve without unnecessary delays or hassle. By choosing an A-rated insurer, you can rest assured that your claims will be handled promptly and professionally.

Competitive Rates: Affordability without Compromising Quality

Contrary to popular belief, A-rated commercial truck insurance companies don’t necessarily charge higher premiums. They often offer competitive rates while maintaining superior coverage. This is because A-rated companies have a strong understanding of the trucking industry and can tailor their policies to meet specific risks and needs. By partnering with an A-rated insurer, you can secure comprehensive protection without breaking the bank. It’s a win-win situation: peace of mind at a reasonable cost.

Broad Coverage Options: Tailoring Protection to Your Needs

A-rated commercial truck insurance companies offer a wide range of coverage options to meet the diverse needs of trucking businesses. Whether you operate a small fleet of box trucks or a large fleet of semis hauling hazardous materials, you can find an A-rated insurer that can customize a policy to fit your unique requirements. From liability coverage to physical damage coverage, and everything in between, A-rated companies provide tailored protection plans that give you the confidence to navigate the road ahead with peace of mind.

Excellent Customer Service: Going the Extra Mile

A-rated commercial truck insurance companies understand the value of excellent customer service. They have dedicated support teams ready to assist you with any questions or concerns you may have. Whether you need to make changes to your policy, file a claim, or simply get advice on risk management, A-rated insurers are committed to providing exceptional service. They go the extra mile to ensure that you have a positive experience throughout your policy term.

In Summary: Why A-Rated Commercial Truck Insurance Companies Matter

Choosing an A-rated commercial truck insurance company is a wise investment for your trucking business. A-rated companies offer a trifecta of benefits: financial stability, exceptional claims handling, and competitive rates. They provide broad coverage options tailored to your specific needs and deliver excellent customer service. By partnering with an A-rated insurer, you can rest assured that your business is protected against a wide range of risks. It’s like wearing a seatbelt for your business—an essential safeguard that gives you peace of mind on the road to success.

A-Rated Commercial Truck Insurance Companies: Essential Protection for Your Business

Navigating the world of commercial truck insurance can be a daunting task. With countless providers vying for your attention, finding a reputable and financially stable insurer is paramount. Enter A-rated commercial truck insurance companies – the gold standard for financial strength and reliability in the industry. These companies have earned the highest rating from AM Best, the leading global credit rating agency for the insurance sector. But what makes an A-rated insurance company so important, and how do you choose the one that’s right for your business?

Why is an A-rated insurance company important?

An A-rated commercial truck insurance company provides peace of mind knowing that your insurer has the financial resources to cover your claims in the event of an accident or other insured event. AM Best’s A rating indicates that the company has a strong financial position and is able to meet its obligations to policyholders. This is especially crucial for businesses that rely heavily on their trucks for transportation and revenue generation.

In the unfortunate event of a major accident, an A-rated insurance company is more likely to be able to pay out claims quickly and efficiently, minimizing disruptions to your business operations. Conversely, an insurer with a lower financial rating may struggle to meet its obligations, potentially jeopardizing your financial stability and reputation.

How to choose an A-rated commercial truck insurance provider

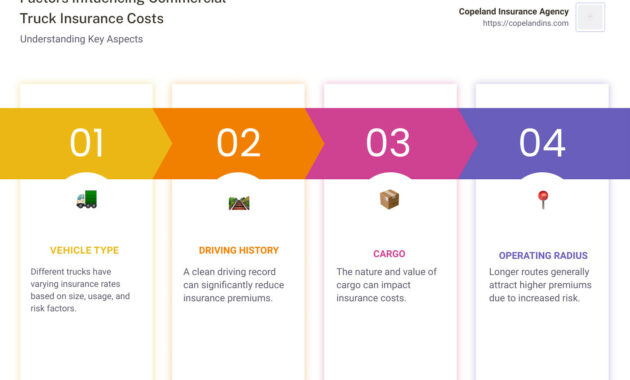

Choosing the right A-rated commercial truck insurance provider requires careful consideration of your specific business needs. Here are some key factors to keep in mind:

1. Coverage and limits:

Consider the types and amounts of coverage you need. Common coverages include liability, collision, comprehensive, and cargo. Make sure your policy limits are sufficient to protect your assets and operations.

2. Premiums and deductibles:

Compare premiums and deductibles from different providers. While premium cost is a factor, it’s important to strike a balance between affordability and adequate coverage. Higher deductibles can lower premiums but increase your out-of-pocket expenses in the event of a claim.

3. Customer service:

Excellent customer service is invaluable when filing claims or seeking support. Look for companies with responsive and knowledgeable representatives who are easy to reach when you need them most.

4. Financial strength rating:

An A-rated insurance company should be the bare minimum for your commercial truck insurance provider. Consider companies with an A+ or A++ rating for even greater financial security.

5. Industry experience and reputation:

Choose providers with a proven track record in the commercial truck insurance market. Check online reviews and industry awards to gauge their reputation and level of expertise.

By following these steps, you can find an A-rated commercial truck insurance provider that offers the right coverage, cost, and service for your business. Remember, protecting your business and assets with reliable insurance is an investment in your company’s long-term success.

A-Rated Commercial Truck Insurance Companies: Ensuring Peace of Mind on the Road

In the competitive realm of commercial trucking, securing reliable insurance coverage is paramount. Among the myriad of insurance providers, A-rated companies stand out as beacons of financial stability, exceptional customer service, and industry-leading expertise. Choosing an A-rated commercial truck insurance company empowers you with the confidence and protection you need to navigate the complexities of the road.

What are the Benefits of Working with an A-Rated Insurance Company?

Partnering with an A-rated commercial truck insurance company offers a multitude of advantages that can positively impact your business operations and provide peace of mind:

- Competitive Rates: A-rated insurance companies enjoy strong financial footing, allowing them to pass on savings to policyholders in the form of competitive premiums. Their ability to spread risk effectively keeps your insurance costs in check.

- Financial Stability: An A-rating signifies financial strength and stability. These companies have the financial reserves and resources to honor claims promptly and effectively, ensuring that you receive the coverage you need when you need it most.

- Superior Customer Service: A-rated insurance companies prioritize customer satisfaction. They employ experienced and knowledgeable agents who provide personalized service, respond quickly to inquiries, and go above and beyond to resolve any issues you may encounter.

A Detailed Dive into the Benefits of A-Rated Commercial Truck Insurance Companies

The benefits of working with an A-rated commercial truck insurance company extend far beyond the surface. Here’s a deeper exploration of how each advantage can positively impact your business:

1. Competitive Rates: A-rated insurance companies are prudent risk managers. Their underwriting processes are rigorous, allowing them to accurately assess the risk associated with your trucking operations. By spreading risk effectively across their vast pool of policyholders, they can offer competitive rates that align with your budget.

2. Financial Stability: Picture an A-rated commercial truck insurance company as a financial fortress. They have substantial assets and reserves, enabling them to withstand even the most significant claims. You can rest assured that your insurance provider will be there for you when the unexpected strikes.

3. Superior Customer Service: A-rated insurance companies recognize that excellent customer service is the lifeblood of their business. They invest heavily in training and empowering their agents to provide exceptional support. From answering your questions promptly to proactively identifying potential risks, they become a valuable partner in your trucking operations.

With an A-rated commercial truck insurance provider by your side, you gain access to competitive rates, financial stability, and unparalleled customer support. These benefits work synergistically to create a solid foundation of protection, empowering you to focus on growing your business and navigating the road ahead with confidence.

A-Rated Commercial Truck Insurance Companies: A Guardian Angel for Your Business

In the fast-paced world of commercial trucking, having A-rated commercial truck insurance is not merely a prudent choice—it’s an absolute necessity. These top-rated insurance providers stand as a sturdy shield, safeguarding your business against unforeseen events that could wreak havoc on your operations. But with a plethora of insurance companies vying for your attention, navigating the insurance landscape can be a daunting task. Fear not, intrepid reader! This comprehensive guide will equip you with the knowledge and strategies to identify the A-rated commercial truck insurance companies that deserve a spot in your business’s corner.

How to Find an A-Rated Commercial Truck Insurance Company

Embarking on the quest to find an A-rated commercial truck insurance company is akin to a treasure hunt. You must possess the keen eye of an eagle and the unwavering determination of a prospector. The AM Best website stands as your trusty compass, guiding you toward a trove of A-rated insurance providers. This esteemed organization meticulously assesses insurance companies, assigning them ratings that reflect their financial strength and ability to honor claims. An A-rated company has demonstrated a rock-solid track record of fulfilling its obligations to policyholders, ensuring peace of mind when the unexpected strikes.

Unraveling the Secrets of A-Rated Insurance Companies

What sets A-rated commercial truck insurance companies apart from their lesser-rated counterparts? It’s all about financial stability. These companies have proven their mettle by maintaining a robust financial foundation. They possess ample assets to cover potential claims, even in the face of catastrophic events. This financial fortitude translates into greater peace of mind for you, knowing that your business is shielded from financial ruin should disaster strike.

Beyond the Rating: Additional Factors to Consider

While an A-rating is an indispensable benchmark, it’s not the sole factor to consider when selecting a commercial truck insurance provider. Other crucial aspects demand your attention:

-

Coverage Options: A comprehensive insurance policy should cover a wide array of perils, from liability to physical damage. Ensure that the policy you’re considering aligns with your business’s specific needs.

-

Premiums: Insurance premiums can vary significantly from one provider to another. Compare quotes from multiple companies to find the best deal without compromising coverage.

-

Customer Service: When you need to file a claim, you want to deal with an insurance company that’s responsive, helpful, and easy to reach. Excellent customer service is paramount.

-

Reputation: Research the reputation of potential insurance companies. Check online reviews and seek recommendations from other businesses in your industry. A solid reputation speaks volumes about a company’s commitment to customer satisfaction.

-

Experience: Consider the company’s experience in insuring commercial trucks. Experience often translates into a deeper understanding of the risks associated with this industry and the ability to provide tailored solutions.

Delving Deeper into the World of A-Rated Insurance Providers

The world of A-rated commercial truck insurance companies is a vast one. To help you navigate this complex landscape, let’s explore some of the top providers in greater detail:

-

Progressive Commercial: Renowned for its competitive rates and tailored coverage options, Progressive Commercial is a formidable player in the industry. Their A+ rating from AM Best attests to their financial stability and commitment to policyholders.

-

Travelers: Travelers Insurance is another A-rated giant in the commercial truck insurance realm. With a long history of providing exceptional insurance solutions, Travelers is known for its comprehensive coverage and responsive customer support.

-

National Interstate Insurance: National Interstate Insurance has earned an A- (Excellent) rating from AM Best. They specialize in providing comprehensive insurance products tailored to the unique needs of the trucking industry.

-

Great West Casualty Company: Great West Casualty Company boasts an A- (Excellent) rating from AM Best. They offer a diverse range of insurance products designed to protect commercial truck businesses from a wide range of risks.

-

Allied Insurance: Allied Insurance has secured an A- (Excellent) rating from AM Best. They are renowned for their commitment to customer service and their ability to provide customized insurance solutions for commercial truck operators.

A-Rated Commercial Truck Insurance Companies: A Guide to Financial Stability and Reliability

In the competitive world of commercial trucking, safeguarding your business against unforeseen circumstances is paramount. A reliable commercial truck insurance policy can serve as a financial lifeline, protecting your assets and ensuring your operations continue uninterrupted. When selecting an insurance provider, it’s crucial to consider their financial strength and reputation. A-rated companies stand out as a beacon of stability and reliability, providing peace of mind and assurance that you’re partnering with a financially sound and dependable insurer.

Financial Strength: The Backbone of Reliability

A company’s financial strength directly impacts its ability to honor claims and fulfill its obligations to policyholders. A-rated commercial truck insurance companies have undergone rigorous evaluations by independent rating agencies, such as A.M. Best, Moody’s, and Standard & Poor’s. These agencies meticulously assess a company’s financial performance, capitalization, and claims-paying ability. By securing an A-rating, these insurers demonstrate their commitment to financial integrity and their unwavering ability to meet their financial commitments.

Reputation: Building Trust Through Consistent Performance

Beyond financial strength, reputation is a cornerstone of reliability in the insurance industry. A-rated commercial truck insurance companies have earned a stellar reputation among policyholders and industry experts alike. Their consistent performance in handling claims fairly, resolving disputes promptly, and providing exceptional customer service has solidified their position as trusted partners in the trucking community. Positive reviews, industry awards, and long-standing customer relationships are testaments to their unwavering commitment to excellence.

Benefits of Choosing A-Rated Companies

Partnering with an A-rated commercial truck insurance company offers a wealth of benefits that can safeguard your business:

- Financial Security: A-rated companies possess ample financial resources to cover claims and ensure financial stability, even in challenging economic conditions.

- Peace of Mind: Knowing that your insurer has the financial strength to meet its obligations provides peace of mind, allowing you to focus on your core business operations without worrying about potential financial setbacks.

- Reduced Costs: A-rated companies often have lower operating expenses due to their financial stability, which can translate into more affordable insurance premiums for policyholders.

- Enhanced Coverage: A-rated insurers are more likely to offer comprehensive coverage options, tailored to the specific risks faced by commercial trucking businesses.

- Exceptional Customer Service: A-rated companies prioritize customer satisfaction, providing prompt and professional service to ensure that policyholders feel supported and valued.

Factors to Consider When Choosing an A-Rated Company

Not all A-rated commercial truck insurance companies are created equal. When selecting a provider, consider the following factors:

- Coverage Options: Ensure that the company offers coverage that aligns with your specific business needs and risk profile.

- Premiums: Compare premiums from multiple A-rated companies to find the most competitive rates while maintaining adequate coverage.

- Deductibles: Understand the deductibles associated with different policies and choose a deductible that balances affordability with financial protection.

- Policy Limits: Determine the appropriate policy limits to protect your business from potential financial losses.

- Customer Service: Inquire about the company’s customer service capabilities, including response times, availability, and dispute resolution mechanisms.

Conclusion

When choosing a commercial truck insurance company, it is imperative to prioritize financial strength and reputation. A-rated companies have proven their ability to withstand economic challenges, honor claims promptly, and consistently deliver exceptional customer service. By selecting an A-rated insurer, you gain peace of mind, financial security, and the confidence that your business is protected by a reliable and trustworthy partner. Remember, protecting your commercial trucking operations is not just a financial decision; it’s an investment in the long-term success and resilience of your business.