Defining Commercial Truck Insurance Rates

Why are commercial truck insurance rates so important? Because they can vary widely depending on a number of factors. These factors include the type of trucking operation, the size of the fleet, the driver’s experience, and the claims history. As a result, it’s important to understand the factors that affect commercial truck insurance rates in order to get the best possible rate.

Commercial truck insurance is a type of insurance that provides financial protection to trucking companies in the event of an accident. It covers a variety of risks, including liability for bodily injury and property damage, physical damage to the truck, and cargo loss or damage. The cost of commercial truck insurance is based on a number of factors, including the type of trucking operation, the size of the fleet, the driver’s experience, and the claims history.

As you might expect, the amount of coverage you need and the type of operation you run will have a big impact on your rates. For example, if you operate a large fleet of trucks, you will likely pay a higher premium than a company that only operates a few trucks. Similarly, if you have a history of accidents or claims, you will likely pay a higher premium than a company with a clean record.

There are a number of things you can do to reduce your commercial truck insurance rates. These include:

- Maintaining a good safety record

- Hiring experienced drivers

- Investing in safety equipment

- Working with a reputable insurance company

By taking these steps, you can help to reduce your commercial truck insurance rates and protect your business.

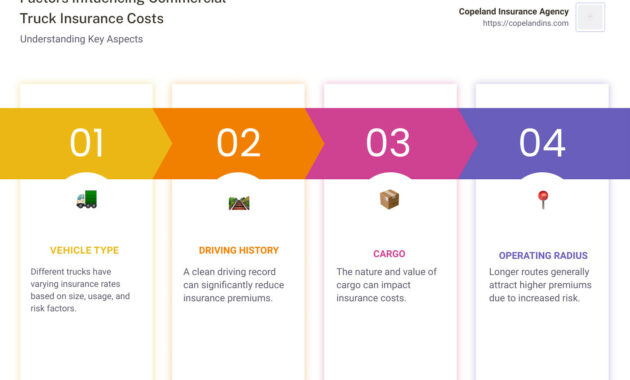

Factors That Affect Commercial Truck Insurance Rates

A number of factors affect commercial truck insurance rates, including the following:

- Type of trucking operation: The type of trucking operation you have will affect your insurance rates. For example, if you operate a long-haul trucking company, you will likely pay a higher premium than a company that only operates locally.

- Size of the fleet: The size of your fleet will also affect your insurance rates. The larger your fleet, the higher your premium will be.

- Driver’s experience: The experience of your drivers will also affect your insurance rates. Drivers with a clean driving record will pay a lower premium than drivers with a history of accidents or violations.

- Claims history: Your claims history will also affect your insurance rates. If you have a history of accidents or claims, you will likely pay a higher premium than a company with a clean record.

- Credit score: Your credit score can also affect your insurance rates. Insurance companies use your credit score to assess your financial risk. A higher credit score will result in a lower premium.

- Location: The location of your business will also affect your insurance rates. Insurance rates are typically higher in urban areas than in rural areas.

- Type of cargo: The type of cargo you haul will also affect your insurance rates. Some types of cargo, such as hazardous materials, are more expensive to insure than others.

- Coverage limits: The amount of coverage you need will also affect your insurance rates. The higher your coverage limits, the higher your premium will be.

It’s important to understand the factors that affect commercial truck insurance rates in order to get the best possible rate. By working with a reputable insurance company and taking steps to reduce your risk, you can help to keep your insurance costs down.

How to Get the Best Commercial Truck Insurance Rates

There are a number of things you can do to get the best commercial truck insurance rates. These include:

- Shop around: Don’t just buy the first insurance policy you’re offered. Take the time to shop around and compare quotes from different insurance companies.

- Increase your deductible: Increasing your deductible can help to lower your premium. However, it’s important to make sure that you can afford to pay your deductible in the event of an accident.

- Maintain a good safety record: The best way to keep your insurance rates low is to maintain a good safety record. This means following all traffic laws and avoiding accidents.

- Hire experienced drivers: Hiring experienced drivers can also help to lower your insurance rates. Drivers with a clean driving record are less likely to be involved in accidents.

- Invest in safety equipment: Investing in safety equipment can also help to lower your insurance rates. This equipment can include things like anti-lock brakes, lane departure warning systems, and dash cams.

By following these tips, you can help to get the best commercial truck insurance rates possible.

Commercial Truck Insurance Rates: A Comprehensive Guide for Informed Decision-Making

The world of commercial truck insurance can be a labyrinthine maze, fraught with complexities and idiosyncrasies that can leave even seasoned drivers scratching their heads. But fret not, intrepid reader, for this definitive guide will illuminate the murky depths of commercial truck insurance rates, empowering you with the knowledge to navigate this intricate landscape with aplomb.

As you embark on this enlightening journey, it’s imperative to grasp the myriad factors that influence the enigmatic tapestry of commercial truck insurance rates. These variables, like threads in a intricate tapestry, weave together to create a unique premium that is tailored to each individual’s circumstances.

Factors Influencing Rates

Insurance companies, like meticulous detectives, delve into a myriad of factors when calculating rates. Each factor, like a brushstroke on a canvas, contributes a unique hue to the overall premium. These factors include:

- **Type of Truck:** The type of truck you operate, whether it’s a nimble box truck or a behemoth semi-trailer, plays a pivotal role in determining your insurance rates. Larger trucks, with their increased potential for damage and liability, typically command higher premiums than their smaller counterparts.

- **Driving History:** Your driving history is a crystal ball into your future insurance rates. A spotless record, devoid of accidents or violations, can significantly reduce your premiums. Conversely, a checkered past, marred by mishaps or infractions, can inflate your rates.

- **Mileage:** The number of miles you traverse each year is a key determinant of your insurance costs. The more miles you drive, the greater the likelihood of an accident, which in turn translates into higher premiums. It’s a simple equation: more miles equal more risk, and more risk equals more money out of your pocket.

- **Cargo Hauled:** The nature of the cargo you transport can also impact your insurance rates. Hauling hazardous materials, for instance, comes with inherent risks that can drive up your premiums. Conversely, transporting less risky cargo, such as household goods, can result in lower rates.

- **Safety Record:** A strong safety record, like a beacon of responsibility, can illuminate your path to lower insurance rates. Companies reward safe drivers with reduced premiums, recognizing their commitment to accident prevention. Conversely, a lackluster safety record can tarnish your reputation and lead to higher insurance costs.

Understanding these factors is the first step towards deciphering the enigmatic code of commercial truck insurance rates. With this knowledge in your arsenal, you can embark on the quest for the most competitive rates, empowering you to protect your business and your financial well-being.

Commercial Truck Insurance Rates: Essential Protection for Your Business

Commercial truck insurance is a crucial investment for any business that relies on these powerful vehicles to transport goods or provide services. However, navigating the world of commercial truck insurance can be daunting, and understanding the various coverages available is essential for making informed decisions. In this comprehensive guide, we’ll delve into the different types of commercial truck insurance, their respective coverages, and the factors that influence insurance rates, empowering you to make the right choices for your business.

Insurance rates for commercial trucks vary widely depending on several factors, including the type of truck, its intended use, the driver’s experience, and the company’s claims history. By understanding these factors and shopping around for the best rates, you can save money and ensure that your business is adequately protected.

Types of Commercial Truck Insurance

There are several types of commercial truck insurance coverages available, each designed to protect different aspects of your business. Understanding the specific coverages and their limitations is crucial for tailoring an insurance plan that meets your unique needs.

Liability Insurance

Liability insurance is a fundamental coverage for commercial trucks, providing financial protection in the event that your vehicle causes injury or property damage to others. It covers legal expenses, settlements, and judgments resulting from accidents for which you are found liable. Liability insurance has two main components: bodily injury liability and property damage liability.

Bodily injury liability covers expenses related to injuries or death caused to others in an accident, including medical bills, lost wages, and pain and suffering. Property damage liability covers damages to property, such as vehicles, buildings, or other objects, caused by your commercial truck.

The coverage limits for liability insurance vary depending on the policy, so it’s essential to choose limits that provide adequate protection for your business’s potential risks. Higher coverage limits may result in higher premiums, but they can offer peace of mind and financial security in the event of a major accident.

Collision Insurance

Collision insurance provides coverage for damages to your commercial truck in the event of an accident, regardless of who is at fault. It covers repairs or replacement of the vehicle up to the policy’s limits. Collision insurance is particularly important if you have financed your truck or have a lease agreement, as it protects your investment in the vehicle.

The amount of coverage you need for collision insurance depends on the value of your truck and your risk tolerance. Higher coverage limits will provide more comprehensive protection but may come with higher premiums. It’s worth considering the deductible, which is the amount you pay out-of-pocket before the insurance coverage kicks in. A higher deductible can lower your premiums but increase your financial responsibility in the event of an accident.

Cargo Insurance

Cargo insurance protects the goods or merchandise you transport in your commercial truck in the event of damage, theft, or loss. It covers the replacement or repair costs of the cargo, providing financial protection for your business against potential losses. Cargo insurance is essential for businesses that transport valuable goods or specialized equipment.

The coverage limits for cargo insurance vary depending on the type and value of the goods you transport. It’s important to accurately estimate the value of your cargo to ensure adequate coverage. Additionally, consider factors such as the routes you travel and the potential risks associated with transporting specific types of goods.

When choosing cargo insurance, you can opt for coverage on a “per-vehicle” basis or a “per-shipment” basis. Per-vehicle coverage provides protection for all cargo transported on the insured vehicle, while per-shipment coverage allows you to specify the value of each shipment and pay premiums accordingly.

Comprehensive Insurance

Comprehensive insurance provides coverage for damages to your commercial truck caused by events other than collisions, such as theft, vandalism, fire, or natural disasters. It’s often bundled with collision insurance to provide a more comprehensive protection package for your vehicle.

Comprehensive insurance can be particularly valuable if you operate your commercial truck in areas with high crime rates or if your truck is exposed to other potential hazards. The coverage limits for comprehensive insurance vary depending on the policy, so it’s important to choose limits that provide adequate protection for your truck’s value and the risks you face.

Now that we’ve explored the different types of commercial truck insurance, let’s delve into the factors that influence insurance rates. Understanding these factors will empower you to make informed decisions and potentially lower your premiums.

Commercial Truck Insurance Rates

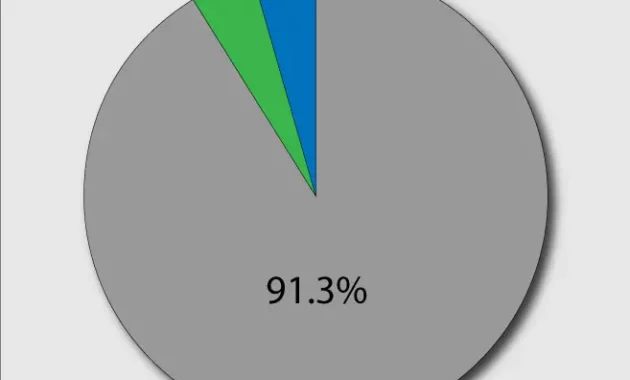

The cost of commercial truck insurance can vary significantly, depending on a number of factors. The average annual premium for a commercial truck is $2,500, but this can range from $1,000 to $5,000 or more. The type of truck you have, the coverage you need, and your driving history can all affect your rates.

Factors That Affect Commercial Truck Insurance Rates

Several factors can affect commercial truck insurance rates. Some of the most important include:

The type of truck you have: The larger and heavier your truck is, the more it will cost to insure. This is because larger trucks are more likely to be involved in accidents, and they can cause more damage when they do. For instance, a semi-truck will cost more to insure than a pickup truck.

The coverage you need: The more coverage you need, the higher your rates will be. This is because the insurance company is taking on more risk. For example, if you need to haul hazardous materials, you will need to purchase additional coverage, which will increase your rates.

Your driving history: Your driving history is a major factor in determining your insurance rates. If you have a clean driving record, you will pay less for insurance. However, if you have a history of accidents or moving violations, your rates will go up. Your insurance company will utilize your record to quantify your risk and calculate your premium.

The age of your truck

The age of your truck can also affect your insurance rates. Older trucks are more likely to be involved in accidents, and they can be more expensive to repair. As a result, insurance companies charge higher rates for older trucks. For instance, a 10-year-old truck will cost more to insure than a brand-new truck.

The location of your truck

The location of your truck can also affect your insurance rates. Trucks that are operated in high-risk areas, such as cities, will cost more to insure than trucks that are operated in rural areas. This is because trucks that are operated in high-risk areas are more likely to be involved in accidents.

The experience and training of your drivers

The experience and training of your drivers can also affect your insurance rates. Drivers who have more experience and training are less likely to be involved in accidents. As a result, insurance companies charge lower rates for drivers with more experience and training. For instance, a driver who has 10 years of experience will cost less to insure than a driver who has only one year of experience.

Additional Factors Affecting Rates

In addition to the factors listed above, several other factors can affect your commercial truck insurance rates. These include:

The number of miles you drive each year: The more miles you drive, the higher your rates will be. This is because the more you drive, the more likely you are to be involved in an accident.

The type of cargo you haul: The type of cargo you haul can also affect your rates. If you haul hazardous materials, you will need to purchase additional coverage, which will increase your rates.

Your credit score: Your credit score can also affect your insurance rates. Insurance companies use your credit score to assess your risk. If you have a good credit score, you will pay less for insurance. However, if you have a poor credit score, your rates will go up.

Your claims history: Your claims history can also affect your insurance rates. If you have a history of filing claims, your rates will go up. This is because insurance companies view you as a higher risk.

Your insurance company: The insurance company you choose can also affect your rates. Different insurance companies have different rates for commercial truck insurance. It is important to shop around and compare rates before choosing an insurance company. What’s more, you should bundle your policies with the same company to save money.

By understanding the factors that affect commercial truck insurance rates, you can take steps to lower your costs. By driving safely, maintaining a good credit score, and shopping around for insurance, you can save money on your insurance premiums.

Navigating the Maze of Commercial Truck Insurance Rates

When you’re behind the wheel of a commercial truck, it’s like balancing a tower of Jenga blocks—one wrong move, and the whole thing comes crashing down. That’s why having the right commercial truck insurance is crucial, and it all starts with understanding the variations in insurance rates.

Understanding Rate Variations

The cost of commercial truck insurance can be as diverse as a pack of playing cards. Factors such as the size of your fleet, the type of cargo you haul, and your driving history all play a role in determining your rates. But the biggest wildcard is the insurance company you choose. Different companies use different algorithms and risk assessment models, so it’s like comparing apples to oranges when it comes to premiums.

Fleet Size: A Numbers Game

The size of your commercial truck fleet is like a symphony orchestra—the more instruments you add, the more complex and expensive it becomes. Insurance companies see it the same way. A larger fleet means more vehicles to insure, more potential risks, and more potential claims. So, as your fleet grows, expect your insurance premiums to follow suit.

Cargo’s Tale: What You Haul Matters

What you haul in your commercial truck isn’t just cargo—it’s a risk assessment for insurance companies. Hauling hazardous materials or high-value goods is like driving a tightrope without a safety net. The higher the risk, the higher your premiums will likely be. On the other hand, hauling less risky items, like office supplies or furniture, can make insurers breathe a sigh of relief and offer you lower rates.

Driving History: A Tale of Caution

Your driving history is like a beacon in the night for insurance companies. A clean record with no accidents or violations is like a golden ticket, earning you the favor of insurers and potentially lower premiums. But if your history is marred by accidents or moving violations, brace yourself for higher rates. Insurance companies see it as a red flag, a sign that you may be more likely to file a claim in the future.

Company Comparisons: A Maze of Options

Shopping for commercial truck insurance is like navigating a labyrinth of choices. With countless insurance companies out there, finding the right one can be daunting. That’s where comparison shopping comes in. Don’t settle for the first quote you receive. Reach out to multiple companies, compare their policies and premiums, and choose the one that fits your needs and budget the best. It’s like comparing apples to apples, but with insurance policies—and who knows, you might just find a hidden gem that gives you the coverage you need at a price that won’t break the bank.

Additional Factors: The Spice of Life

In addition to the key factors we’ve discussed, several other variables can influence your commercial truck insurance rates. Your location, the deductible you choose, and the level of coverage you desire all come into play. It’s like a delicate balancing act, where each adjustment can shift the equilibrium of your premium. So, work closely with your insurance agent to tailor a policy that meets your specific needs and keeps your rates in check.

Negotiation Strategies: A Dance of Diplomacy

Once you have a few quotes in hand, it’s time to channel your inner diplomat and negotiate. Don’t be afraid to ask for discounts or concessions. Many insurance companies offer loyalty discounts, multi-policy discounts, and even safe driving discounts. The worst they can say is no. And who knows, you might just walk away with a better deal than you expected—it’s like haggling at a flea market, but with insurance premiums.

Conclusion: The Road to Insurance Clarity

Navigating the complexities of commercial truck insurance rates can be like driving through a winding mountain road, but with the right knowledge and a little bit of effort, you can find the coverage you need at a price you can afford. Remember to shop around, compare quotes, and negotiate when possible. And don’t forget, a good insurance agent can be your guiding light, helping you navigate the insurance landscape and ensure you’re protected every mile of the way.

Commercial Truck Insurance Rates: A Comprehensive Guide

Commercial truck insurance rates are an essential consideration for any business that operates or depends on commercial vehicles. To ensure adequate coverage without breaking the bank, it’s crucial to understand the factors that influence these rates and explore strategies for managing insurance costs effectively.

Factors Affecting Commercial Truck Insurance Rates

-

Type of Truck: The type of truck you operate plays a significant role in determining your insurance premiums. Larger trucks with higher load capacities and specialized equipment typically attract higher rates.

-

Industry and Usage: The industry you operate in and the intended usage of your trucks can also impact rates. For example, companies transporting hazardous materials or operating in high-risk industries may face higher insurance costs.

-

Mileage and Annual Usage: The number of miles your trucks travel annually is a key factor in determining insurance premiums. Higher mileage generally translates to increased risk and consequently higher rates.

-

Driver History: Insurers evaluate the driving records of your drivers to assess their reliability and risk profile. Drivers with a history of accidents, moving violations, or suspensions can expect higher insurance rates.

-

Coverage Limits: The coverage limits you select, including liability, collision, and cargo insurance, can significantly affect your insurance premiums. Higher coverage limits provide greater protection but come at a higher cost.

-

Additional Factors: Other factors that can influence commercial truck insurance rates include the location of your operation, the age of your trucks, and the claims history of your business.

Managing Insurance Costs

Businesses can implement several strategies to manage commercial truck insurance costs effectively:

-

Implement Safety Measures: Enhancing safety protocols, such as driver training programs, vehicle maintenance schedules, and GPS tracking systems, can help reduce the risk of accidents and lower insurance premiums.

-

Maintain Good Driving Records: Drivers with clean driving records and consistent compliance with traffic laws can qualify for discounts and lower insurance rates. Encourage safe driving practices, such as defensive driving techniques and adhering to speed limits.

-

Explore Discounts and Incentives: Insurers often offer discounts for safety features, such as anti-lock brakes and lane departure warning systems, as well as for voluntary deductibles and bundling multiple policies.

-

Shop Around and Compare Quotes: Don’t settle for the first insurance quote you receive. Obtain multiple quotes from different insurers to compare coverage options, deductibles, and premiums.

-

Work with an Insurance Broker: Consider working with an experienced insurance broker who can provide personalized advice, help you understand your coverage needs, and negotiate the best possible rates on your behalf.

-

Consider Telematics and GPS Tracking: Telematics devices and GPS tracking systems can monitor driver behavior, track vehicle location, and provide valuable data that can help insurers assess risk more accurately, potentially leading to lower insurance premiums.

By following these strategies, businesses can effectively manage commercial truck insurance costs while ensuring adequate protection for their vehicles and operations.