Affordable Family Health Insurance Plans: A Lifeline for Families

Healthcare expenses can be a crushing burden for any family, but they can be particularly devastating for those without adequate health insurance. That’s why affordable family health insurance plans are so crucial. These plans can provide families with the peace of mind that comes with knowing they’re protected from unexpected medical bills while also keeping their monthly premiums within reach.

In this article, we’ll delve into the importance of affordable family health insurance plans, explore different types of plans available, and offer tips on finding the right plan for your family’s needs. Whether you’re a young family just starting out or an older family facing the challenges of retirement, there’s an affordable family health insurance plan that can meet your needs.

Why Affordable Family Health Insurance Plans Are Imperative

Imagine this: Your child suddenly develops a high fever and severe abdominal pain. You rush them to the emergency room, where they’re diagnosed with appendicitis. The surgery and hospital stay cost tens of thousands of dollars. Without health insurance, you’d be left with a mountain of debt that could take years to pay off.

This is just one example of how unexpected medical expenses can derail a family’s finances. According to a study by the Kaiser Family Foundation, the average American family spends over $20,000 on healthcare each year. For families with children, that number is even higher.

Affordable family health insurance plans can protect families from these financial risks. They can help cover the costs of doctor’s visits, hospital stays, surgeries, and prescription drugs. This can give families the peace of mind that comes with knowing they’re prepared for whatever life throws their way.

In addition to protecting families from financial ruin, affordable family health insurance plans can also improve their health outcomes. Studies have shown that people with health insurance are more likely to get preventive care, such as mammograms and colonoscopies, which can help detect and treat diseases early on. They’re also more likely to have access to prescription drugs, which can help manage chronic conditions and improve quality of life.

For all these reasons, affordable family health insurance plans are an essential investment in the health and well-being of families. They can provide peace of mind, financial protection, and access to quality healthcare. If you’re not currently enrolled in an affordable family health insurance plan, I urge you to explore your options today. Your family’s health and financial security depend on it.

Affordable Family Health Insurance Plans: A Lifeline for Your Loved Ones

In today’s uncertain healthcare landscape, safeguarding your family’s well-being with comprehensive health insurance is paramount. However, finding affordable family health insurance plans can be a daunting task, especially with the rising costs of medical care. Fortunately, with a little research and planning, you can secure the coverage you need without breaking the bank.

The key to finding affordable family health insurance lies in exploring all the options available to you. Let’s dive into the strategies that can help you navigate the complexities of the healthcare market and find the best plan for your budget.

Strategies for Finding Affordable Family Health Insurance Plans

1. Employer-Sponsored Plans: The First Line of Defense

If you’re fortunate enough to have employer-sponsored health insurance, this is often the most cost-effective option for covering your family. Many employers offer group plans that leverage their purchasing power to negotiate lower premiums than you could secure on your own.

Before you venture into the open market, check with your employer to see if they offer family health insurance. If they do, carefully review the plan details and compare them to other options available to you. You may find that employer-sponsored coverage is the most affordable and comprehensive choice.

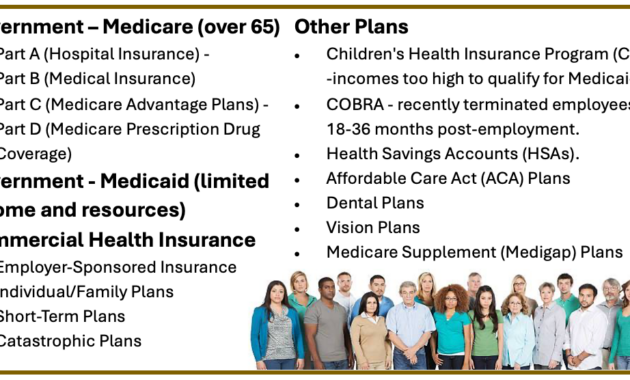

2. Government Programs: A Helping Hand for Those in Need

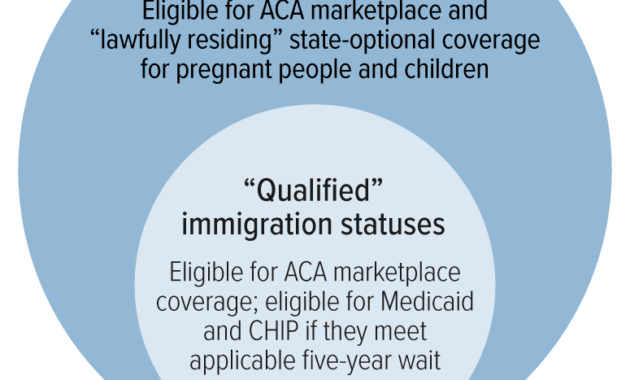

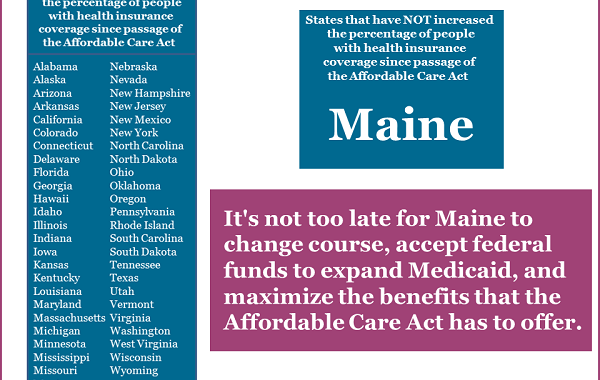

If employer-sponsored insurance isn’t an option, government programs like Medicaid and the Children’s Health Insurance Program (CHIP) can provide affordable health insurance to low-income families. These programs are designed to ensure that essential healthcare services are accessible to all families, regardless of their financial situation.

To qualify for Medicaid or CHIP, you must meet certain income and eligibility requirements. If you’re not sure if you qualify, contact your state’s Medicaid office for more information. These programs can offer significant savings on health insurance premiums, so it’s worth exploring if you meet the criteria.

3. Private Insurers: Navigating the Open Market

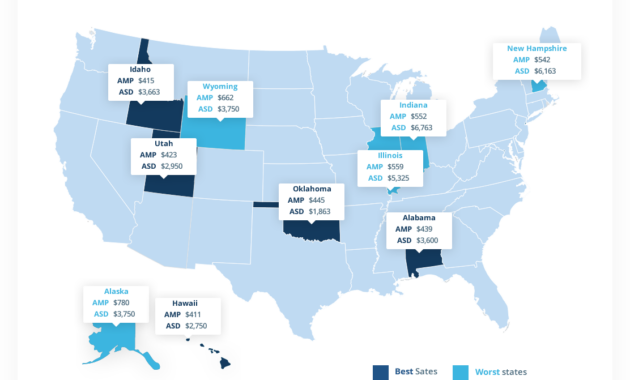

If employer-sponsored and government programs aren’t suitable for your family, you’ll need to explore options in the private insurance market. This can be a daunting task, but with a little research and comparison shopping, you can find affordable family health insurance plans that meet your needs.

When comparing private insurance plans, pay attention to the following factors:

- Premiums: The monthly cost of your health insurance plan.

- Deductibles: The amount you have to pay out-of-pocket before your insurance starts covering costs.

- Copays: The fixed amount you pay for certain medical services, like doctor’s visits or prescriptions.

- Coinsurance: The percentage of medical costs you pay after you’ve met your deductible, usually expressed as a percentage (e.g., 20%).

- Out-of-pocket maximum: The most you’ll have to pay for covered medical expenses in a year.

Shopping for private health insurance can be like navigating a maze, but don’t give up! By doing your research, comparing plans, and seeking professional advice if needed, you can find affordable family health insurance that protects your loved ones and gives you peace of mind.

Affordable Family Health Insurance Plans: A Lifeline for Families

In the labyrinthine world of healthcare, families often find themselves navigating a treacherous path, navigating murky waters of medical expenses and the ever-looming threat of financial ruin. But amidst this uncertainty, a beacon of hope shines—affordable family health insurance plans. These plans serve as a lifeline for families, safeguarding their health and financial well-being. With soaring healthcare costs threatening to engulf family budgets, these plans provide a safety net, ensuring access to quality healthcare without breaking the bank.

Understanding the Basics: What are Affordable Family Health Insurance Plans?

Affordable family health insurance plans are specifically designed to cater to the needs of families, offering comprehensive coverage for a wide range of medical expenses. These plans typically cover preventive care, doctor visits, hospital stays, and prescription drugs. They provide financial protection against unexpected medical emergencies, ensuring that families can seek the care they need without facing crippling financial burdens. Moreover, these plans often include additional benefits such as dental and vision coverage, ensuring that families receive holistic healthcare coverage.

Benefits of Enrolling in an Affordable Family Health Insurance Plan

Enrolling in an affordable family health insurance plan offers a wealth of benefits for families. First and foremost, these plans provide peace of mind, knowing that they have a safety net in place should illness or injury strike. By covering a significant portion of medical expenses, these plans prevent families from being burdened with overwhelming medical bills. Additionally, these plans promote preventive care, encouraging families to seek regular checkups and screenings. This proactive approach helps identify and address potential health issues early on, potentially preventing more serious and costly health conditions down the road.

Furthermore, affordable family health insurance plans offer financial stability. Without insurance, a single medical emergency can wreak havoc on family finances, potentially leading to debt or even bankruptcy. These plans provide a buffer against unexpected medical expenses, ensuring that families can maintain their financial footing even in the face of adversity. By spreading the cost of healthcare over time, these plans make it easier for families to budget for their medical needs.

How to Find an Affordable Family Health Insurance Plan

Finding an affordable family health insurance plan that meets your needs can be a daunting task. However, by following a few simple steps, you can navigate the complexities of the insurance market and secure the coverage you need. Start by comparing plans from multiple insurance providers. Don’t limit yourself to just one company; explore different options to find the best combination of coverage and affordability. Consider the deductibles, copayments, and premiums associated with each plan to determine the most cost-effective option for your family.

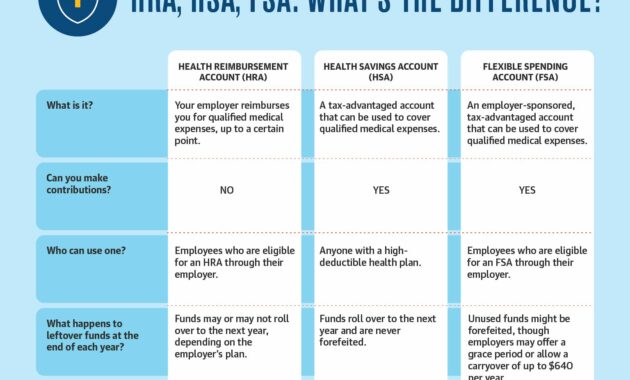

Additionally, take advantage of government programs and subsidies that may be available to help you afford health insurance. Many states offer Medicaid and CHIP programs for low-income families. Additionally, the Affordable Care Act provides tax credits and subsidies to help make health insurance more affordable for families. Utilizing these programs can significantly reduce the cost of health insurance, making it more accessible for families with limited financial means.

Factors to Consider When Choosing an Affordable Family Health Insurance Plan

When selecting an affordable family health insurance plan, it’s essential to consider several key factors. First and foremost, determine the level of coverage you need. Consider your family’s medical history, age, and overall health needs. Some plans offer comprehensive coverage, while others may have more limited benefits. Choose a plan that provides the coverage you need without unnecessary extras that you won’t use.

Next, think about the cost of the plan. Premiums, deductibles, and copayments can vary significantly between plans. Carefully compare the financial implications of each plan to find one that fits your budget. Don’t just focus on the monthly premium; consider the potential out-of-pocket costs you may face in the event of a medical emergency.

Finally, consider the network of providers covered by the plan. Make sure your preferred doctors and hospitals are included in the network to avoid unexpected out-of-network charges. A wider network typically means more choice and flexibility, but it may also come with a higher cost. Weigh the pros and cons to find a plan that meets your needs and preferences.

Conclusion

In the ever-evolving healthcare landscape, affordable family health insurance plans serve as a beacon of hope for families. These plans provide peace of mind, financial stability, and access to quality healthcare. By understanding the basics of these plans, exploring your options, and carefully considering the factors involved, families can secure the coverage they need to protect their health and well-being. Remember, investing in affordable family health insurance is an investment in your family’s future, ensuring their health and happiness for years to come.