Understanding Affordable Health Insurance Plans

In the labyrinthine world of healthcare costs, affordable health insurance plans serve as a beacon of hope, providing individuals and families with a financial lifeline to access essential medical care without sinking into a sea of debt. These plans are meticulously designed to strike a delicate balance between comprehensive coverage and budget-friendly premiums, ensuring that even those navigating the financial choppy waters can secure the medical protection they rightfully deserve.

Navigating the complexities of health insurance can be akin to deciphering a foreign language, particularly if you lack fluency in the medical jargon maze. Affordable health insurance plans simplify this enigma by offering straightforward coverage options that cater to your unique needs and circumstances. No longer must you grapple with confusing terms or decipher intricate policy wordings; these plans provide clarity and peace of mind, allowing you to focus on what truly matters – your health and well-being

Types of Affordable Health Insurance Plans

The landscape of affordable health insurance plans is as diverse as the individuals they serve, encompassing a kaleidoscope of options tailored to meet a wide spectrum of needs and preferences.

- Health Maintenance Organizations (HMOs): HMOs operate on the principle of a closed network of healthcare providers, ensuring seamless access to care within their established network. With HMOs, you’ll enjoy the convenience of selecting a primary care physician (PCP) who will serve as your gatekeeper, guiding you through your healthcare journey and coordinating your care. This structured approach streamlines the process, making it easier to navigate the healthcare system and receive the necessary medical attention.

- Preferred Provider Organizations (PPOs): PPOs offer greater flexibility compared to HMOs, allowing you to seek care from both in-network and out-of-network providers. While utilizing in-network providers comes with lower out-of-pocket costs, you have the freedom to venture outside the network if necessary. PPOs provide a middle ground, striking a balance between cost-effectiveness and choice.

- Exclusive Provider Organizations (EPOs): EPOs share similarities with HMOs in terms of their closed network structure. However, EPOs differ in that they do not require you to select a PCP. Instead, you have the autonomy to choose any provider within the network, providing greater flexibility than HMOs while maintaining the cost-saving benefits of a closed network.

- Point-of-Service (POS) Plans: POS plans combine elements of HMOs and PPOs, offering a hybrid approach to healthcare coverage. With POS plans, you typically select a PCP within the network, but you also have the option to seek care from out-of-network providers if necessary. However, utilizing out-of-network providers comes with higher out-of-pocket costs compared to in-network care.

Factors Affecting the Cost of Affordable Health Insurance Plans

The cost of affordable health insurance plans is not a one-size-fits-all proposition; it varies depending on a multitude of factors that intertwine to determine your premium.

- Age: Age plays a significant role in shaping the cost of health insurance plans. Younger individuals typically pay lower premiums compared to their older counterparts, as they are generally considered to be lower risk.

- Health Status: Your overall health status has a direct bearing on your insurance premiums. Individuals with pre-existing medical conditions or chronic illnesses may face higher premiums as they are deemed to be at a higher risk of utilizing healthcare services.

- Tobacco Use: Indulging in tobacco use can lead to increased health insurance premiums. Insurance companies recognize the correlation between tobacco use and various health ailments, which influences their pricing decisions.

- Plan Type: The type of health insurance plan you choose also influences the cost. HMOs typically offer lower premiums compared to PPOs and EPOs, as they restrict access to out-of-network providers.

- Deductibles and Copayments: Deductibles and copayments are integral components of health insurance plans. Higher deductibles and copayments generally result in lower premiums. However, it’s important to strike a balance that aligns with your financial situation and healthcare needs.

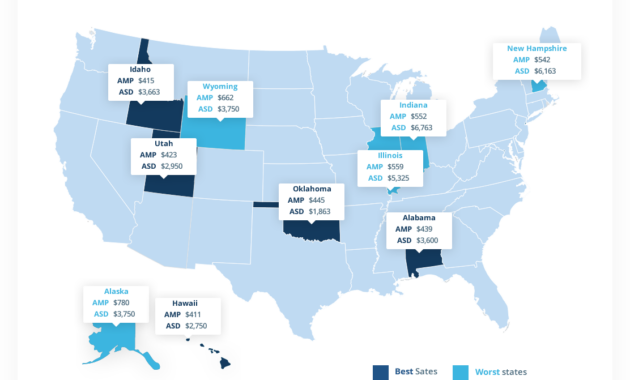

- Location: The geographical location where you reside can also impact the cost of health insurance plans. Healthcare costs and availability vary across regions, influencing insurance premiums.

Finding the Right Affordable Health Insurance Plan

Navigating the maze of affordable health insurance plans can be a daunting task, but with a strategic approach, you can find a plan that aligns seamlessly with your needs and budget.

- Assess Your Needs: Begin by taking stock of your current health status, lifestyle, and financial situation. Determine the level of coverage you require and the amount you can comfortably allocate towards premiums.

- Research Different Plans: Explore the various types of affordable health insurance plans and compare their coverage options, deductibles, copayments, and premiums. Utilize online resources and consult with insurance agents to gather comprehensive information.

- Consider Your Budget: Health insurance premiums can vary significantly, so it’s crucial to establish a realistic budget. Determine how much you can afford to spend on monthly premiums and factor this into your decision-making process.

- Read the Fine Print: Before committing to a plan, meticulously review the policy details, including coverage exclusions and limitations. Ensure you fully understand the terms and conditions to avoid any unpleasant surprises down the road.

- Seek Professional Advice: If you encounter any complexities or uncertainties, don’t hesitate to seek guidance from an insurance agent or financial advisor. They can provide expert insights and help you navigate the complexities of health insurance.

Government Assistance for Affordable Health Insurance

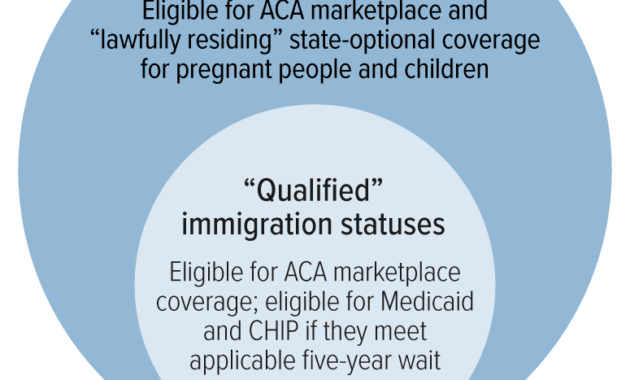

Recognizing the financial burden of healthcare costs, the government has implemented various programs to provide assistance to low- and moderate-income individuals and families.

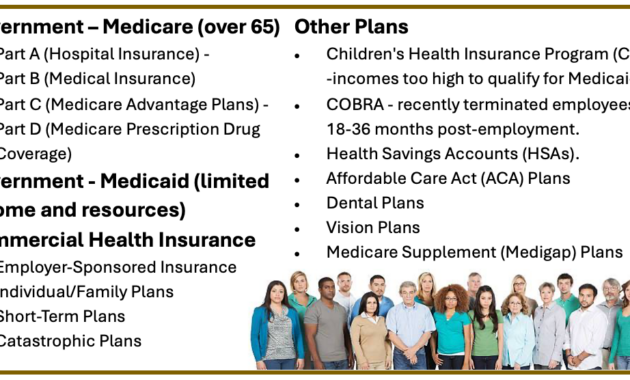

- Medicaid: Medicaid is a government-sponsored health insurance program designed for low-income individuals and families, as well as certain disabled individuals and seniors. Medicaid provides comprehensive coverage for a wide range of healthcare services.

- Medicare: Medicare is a government health insurance program primarily intended for individuals aged 65 and older, as well as younger individuals with certain disabilities. Medicare consists of Part A (hospital insurance) and Part B (medical insurance), and it offers various coverage options to meet diverse needs.

- CHIP (Children’s Health Insurance Program): CHIP is a government-sponsored health insurance program specifically designed for children from low-income families. CHIP provides comprehensive coverage for a wide range of pediatric healthcare services.

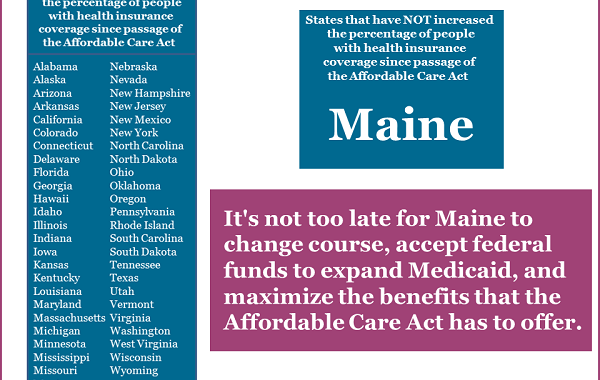

- Affordable Care Act (ACA): The Affordable Care Act (ACA), also known as Obamacare, has significantly expanded access to affordable health insurance. The ACA provides subsidies and tax credits to help low- and moderate-income individuals and families purchase health insurance through the Health Insurance Marketplace.

Conclusion

Navigating the complexities of health insurance can be a daunting task, but with careful planning and a comprehensive understanding of the available options, you can secure affordable health insurance that meets your needs and safeguards your financial well-being. Remember, healthcare is not a luxury; it is a fundamental human right that should be accessible to all.

Affordable Health Insurance Plans: A Lifeline for Your Health and Wallet

In today’s uncertain healthcare landscape, it’s more important than ever to have access to affordable health insurance plans. These plans provide a safety net that can protect you from the financial burden of medical expenses and ensure that you have access to the care you need to stay healthy. Whether you’re a young professional just starting out, a family with growing children, or a senior on a fixed income, there are affordable health insurance plans available to meet your needs.

Benefits of Affordable Health Insurance Plans

The benefits of having affordable health insurance are numerous and far-reaching.

-

Peace of Mind: Knowing that you’re covered in case of an unexpected illness or injury can provide priceless peace of mind. You won’t have to worry about how you’ll pay for medical bills or whether you’ll be able to afford the care you need.

-

Financial Protection: Medical expenses can be astronomical, and even a minor illness can put a strain on your finances. Health insurance can help you protect your savings and avoid going into debt if you need medical care.

-

Access to Quality Medical Care: Affordable health insurance plans give you access to a wide range of medical services, including preventive care, doctor’s visits, hospital stays, and prescription drugs. This ensures that you can get the care you need to stay healthy and avoid costly complications down the road.

Finding an Affordable Health Insurance Plan

There are a number of ways to find an affordable health insurance plan.

-

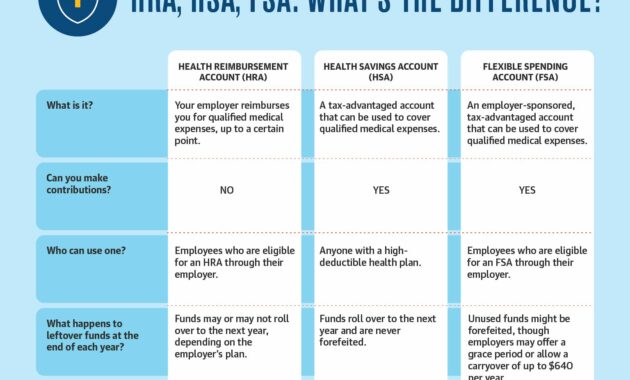

Employer-Sponsored Plans: If you’re employed, your employer may offer health insurance as a benefit. This is often the most affordable option, as your employer will typically contribute to the cost of your premiums.

-

Government Subsidies: The Affordable Care Act (ACA) provides subsidies to help low- and moderate-income individuals and families afford health insurance. These subsidies can significantly reduce the cost of your monthly premiums.

-

Private Health Insurance: You can also purchase health insurance directly from a private insurer. There are a number of different plans available, so it’s important to compare costs and coverage before you choose one.

How to Choose the Right Health Insurance Plan

When choosing a health insurance plan, there are a few key factors to consider:

-

Coverage: Make sure the plan covers the services you need, such as doctor’s visits, hospital stays, and prescription drugs.

-

Cost: Compare the monthly premiums and deductibles of different plans to find one that fits your budget.

-

Network: Consider the network of doctors and hospitals that the plan covers. You’ll want to choose a plan that includes providers in your area.

-

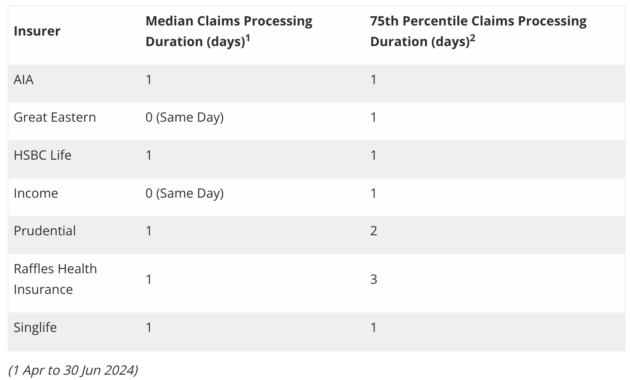

Customer Service: Make sure the insurer has a good reputation for customer service. You’ll want to be able to get help when you need it.

Affordable Health Insurance Plans: Essential for Your Health and Wallet

Having affordable health insurance is essential for your health and financial well-being. It provides peace of mind, protects you from financial ruin, and ensures that you have access to the care you need to stay healthy. By carefully considering your needs and budget, you can find an affordable health insurance plan that meets your needs and helps you live a healthier, more secure life.

Choosing the Right Affordable Health Insurance Plan

Affordable healthcare is like a safety net that protects you from unexpected medical expenses that could wipe out your savings or put you into debt. The right plan can give you peace of mind, knowing that you’re covered if you get sick or injured. But with so many different plans available, it can be tough to find one that fits your needs and budget.

That’s where we come in. We’ve done the research and compared the plans to help you find the best affordable health insurance plan for you. We’ll walk you through the different types of plans available, what to look for when comparing plans, and how to get the most out of your coverage.

Step 1: Determine Your Needs

The first step to finding the right affordable health insurance plan is to determine your needs. What are your health risks? Do you have any pre-existing conditions? How often do you see the doctor? What kind of coverage do you need?

Once you have a good understanding of your needs, you can start shopping for plans.

Step 2: Compare Plans

Now it’s time to compare plans. There are a few things you should keep in mind when comparing plans:

- Premiums: Premiums are the monthly payments you make for your health insurance. The premium you pay will vary depending on the plan you choose, your age, and your health status.

- Deductibles: Deductibles are the amount you have to pay out-of-pocket before your insurance starts to cover costs. The higher your deductible, the lower your premium will be.

- Co-pays: Co-pays are the fixed amount you pay for certain services, such as doctor visits or prescription drugs. The co-pay you pay will vary depending on the plan you choose and the type of service you’re receiving.

- Co-insurance: Co-insurance is the percentage of the cost of a covered service that you pay after you meet your deductible. The higher your co-insurance, the lower your premium will be.

It’s important to compare plans carefully and find one that fits your needs and budget. Don’t just go for the cheapest plan. Make sure the plan covers the services you need and that you can afford the premiums and deductibles.

Step 3: Get the Most Out of Your CoverageOnce you have a health insurance plan, there are a few things you can do to get the most out of your coverage.

- Get preventive care. Preventive care, such as regular checkups and screenings, can help you stay healthy and avoid costly medical problems down the road.

- Use in-network providers. If you see doctors or other health care providers who are in your plan’s network, you’ll pay less for your care.

- Ask about discounts. Many health insurance plans offer discounts for things like enrolling in a wellness program or getting a flu shot. Take advantage of these discounts to save money on your health care costs.

By following these tips, you can find the right affordable health insurance plan for you and get the most out of your coverage.

Affordable Health Insurance Plans: A Budget-Friendly Guide

Navigating the labyrinthine world of health insurance can be daunting, especially when you’re on a tight budget. But don’t despair; there are affordable health insurance plans that can provide you with the coverage you need without breaking the bank. In this article, we’ll provide you with expert tips and strategies to help you find the most affordable health insurance plans that meet your needs.

Saving Money on Affordable Health Insurance Plans

Once you’ve secured an affordable health insurance plan, there are ways to further reduce your out-of-pocket costs. Here are a few tips:

-

Generic Medications: Opt for generic medications over brand-name drugs whenever possible. They’re just as effective but can save you a bundle.

-

Negotiate with Providers: Don’t be afraid to negotiate with healthcare providers. You may be able to secure a lower rate if you pay upfront or agree to a payment plan.

-

Wellness Programs: Participate in wellness programs offered by your health insurance provider. These programs often provide incentives for healthy habits, such as discounts on premiums or gym memberships.

-

Tax Credits and Subsidies: Explore tax credits and subsidies available through government programs. These can significantly reduce your monthly premiums.

-

Health Savings Accounts (HSAs): Consider contributing to a Health Savings Account (HSA). Contributions are tax-deductible, and withdrawals for qualified medical expenses are tax-free.

-

High-Deductible Health Plans (HDHPs): HDHPs come with lower premiums but higher deductibles. If you’re generally healthy and don’t anticipate major medical expenses, an HDHP could be a cost-effective option.

-

Catastrophic Health Plans: Catastrophic health plans are bare-bones plans that cover only major medical expenses. They have lower premiums but higher deductibles and out-of-pocket costs. These plans are only suitable for individuals who are young and healthy.

-

Short-Term Health Insurance: Short-term health insurance plans provide temporary coverage for a limited period. They’re often less expensive than traditional health insurance plans but may have limited benefits and coverage.

-

Faith-Based Health Plans: Faith-based health plans are offered by religious organizations. They often provide affordable coverage for individuals and families who meet certain religious criteria.

-

Community Health Centers: Community health centers provide affordable health care services to low-income individuals and families. They may offer discounted or free health insurance plans.

Affordable Health Insurance Plans: A Comprehensive Guide

In today’s healthcare landscape, affordable health insurance plans are no longer a luxury but a necessity. They serve as a lifeline for individuals and families, ensuring access to quality medical care without breaking the bank. Finding the right plan can be a daunting task, but understanding the basics can make all the difference. This comprehensive guide will delve into the ins and outs of affordable health insurance plans, empowering you to make informed decisions for your health and financial well-being.

Types of Health Insurance Plans

Navigating the world of health insurance plans can be like stepping into a maze. There are various types to choose from, each with its unique benefits and drawbacks. Let’s explore the most common options:

- Health Maintenance Organizations (HMOs): HMOs offer comprehensive coverage within a network of providers. You’ll typically have a primary care physician who coordinates your care and refers you to specialists as needed.

- Preferred Provider Organizations (PPOs): PPOs provide more flexibility than HMOs. You can see providers both inside and outside the network, but you’ll pay less for in-network services.

- Exclusive Provider Organizations (EPOs): EPOs are similar to HMOs but offer even stricter provider networks. You’ll have to stay within the network for all your care, except in emergencies.

- Point-of-Service (POS) Plans: POS plans combine features of HMOs and PPOs. You’ll have a primary care physician who coordinates your care, but you can also see out-of-network providers at a higher cost.

Factors to Consider When Choosing a Plan

Choosing the right health insurance plan is like finding the perfect pair of shoes—it should fit your individual needs and budget. Here are some key factors to consider:

- Monthly premiums: This is the amount you’ll pay each month for your coverage.

- Deductibles: This is the amount you’ll have to pay out-of-pocket before your insurance starts covering costs.

- Copays: These are fixed amounts you’ll pay for specific services, such as doctor’s visits or prescriptions.

- Out-of-pocket maximum: This is the most you’ll have to pay for covered medical expenses in a year.

- Provider network: Make sure the plan includes providers you trust and who are conveniently located.

The Affordable Care Act: Expanding Access to Coverage

The Affordable Care Act (ACA), also known as Obamacare, brought about significant changes to the healthcare landscape. It aimed to expand access to affordable health insurance, particularly for low- and middle-income Americans. Key provisions of the ACA include:

- Individual mandate: Most Americans are required to have health insurance or pay a penalty.

- Subsidies: Income-eligible individuals and families can receive subsidies to help cover the cost of health insurance.

- Medicaid expansion: The ACA expanded Medicaid eligibility to cover more low-income adults.

Finding Affordable Health Insurance Plans

Securing affordable health insurance doesn’t have to be a mission impossible. Here are some tips to help you find a plan that fits your budget:

- Shop around: Compare plans from multiple insurance companies to find the best deal.

- Consider your budget: Determine how much you can afford to spend on health insurance each month.

- Take advantage of subsidies: If you qualify for subsidies, they can significantly reduce the cost of your health insurance.

- Explore employer-sponsored plans: If your employer offers health insurance, it may be a more affordable option.

Conclusion

Affordable health insurance plans are essential for individuals and families to access quality medical care without facing financial strain. By understanding the types of plans available, considering the factors that matter most to you, and exploring the resources available, you can find a plan that meets your needs and budget. Remember, health insurance is an investment in your well-being and peace of mind. It’s a safety net that protects you from the unexpected costs of healthcare and ensures that you can get the medical care you need, when you need it.