Most Affordable Individual Health Insurance Plans

Hey there, folks! Are you tired of shelling out an arm and a leg for health insurance? Well, buckle up, because we’re about to dive into the ins and outs of the most affordable individual health insurance plans out there. We’ll break down the who, what, where, and how, so you can make a choice that fits your wallet and your health needs.

Overview

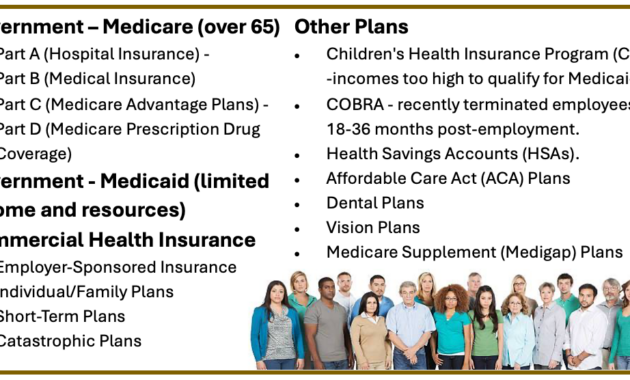

Let’s start with the basics. Individual health insurance plans are designed for folks who don’t have health coverage through an employer or a government program like Medicare or Medicaid. They’re your go-to option if you’re self-employed, a freelancer, or simply looking for a plan that meets your specific needs outside of a group plan.

The key to finding the most affordable individual health insurance plan is to compare plans and shop around. There are a ton of different options out there, so don’t be afraid to do your research. Consider factors like your age, health status, and budget when narrowing down your choices.

Types of Individual Health Insurance Plans

There are two main types of individual health insurance plans: Health Maintenance Organizations (HMOs) and Preferred Provider Organizations (PPOs). HMOs typically have lower premiums but require you to stay within their network of providers. PPOs offer more flexibility and allow you to see any provider you want, but they come with higher premiums.

There are also a few other types of individual health insurance plans, including Point-of-Service (POS) plans and Exclusive Provider Organizations (EPOs). POS plans combine features of HMOs and PPOs, while EPOs are similar to HMOs but offer a slightly wider network of providers.

How to Find the Most Affordable Individual Health Insurance Plans

Ready to start hunting for the most affordable individual health insurance plan? Here are a few tips to help you get started:

- Compare plans from multiple insurers. Don’t just stick with one company. Get quotes from several different insurers to find the best deal.

- Consider your health needs. If you have specific health conditions, make sure the plan you choose covers the treatments and services you need.

- Check your budget. Health insurance can be a big expense, so make sure you can afford the premiums and deductibles before you sign up for a plan.

- Don’t forget about subsidies. If you qualify for subsidies, they can help lower the cost of your health insurance premiums.

The Most Affordable Individual Health Insurance Plans

Now, let’s get down to brass tacks. Here are some of the most affordable individual health insurance plans on the market:

- Cigna HealthSpring Silver HDHP

- Ambetter Silver Value

- Oscar Silver

- Bright Health Silver

- UnitedHealthcare Silver EPO

These plans offer a combination of low premiums and comprehensive coverage, making them a great choice for budget-minded folks who need affordable health insurance.

Conclusion

Finding the most affordable individual health insurance plan can be a daunting task, but it’s definitely doable. By following the tips we’ve outlined, you can find a plan that meets your needs and fits your budget. So, don’t delay. Start comparing plans today and get the coverage you need at a price you can afford.

Most Affordable Individual Health Insurance Plans: A Comprehensive Guide

Navigating the complexities of health insurance can be a labyrinthine endeavor, especially for those seeking affordable individual plans. With rising healthcare costs, finding the right coverage that fits both your budget and health needs is paramount. This comprehensive guide will unravel the intricacies of individual health insurance plans, empowering you with the knowledge to make an informed decision.

Factors to Consider

Before embarking on your insurance quest, take stock of your unique circumstances. Age, health status, and budget play pivotal roles in determining the most suitable plan for you. Consider your age; younger individuals generally enjoy lower premiums, while older adults may face higher costs due to increased healthcare needs. Your health status is another crucial factor; existing medical conditions can impact the premiums and coverage options available to you. Finally, establish a realistic budget, factoring in not only monthly premiums but also potential deductibles and co-pays.

Understanding Health Insurance Terms

To navigate the insurance landscape, it’s essential to decode the jargons frequently encountered. A premium is the monthly payment you make to your insurance provider for coverage. The deductible is the amount you pay out of pocket before insurance starts covering expenses. Co-pays are fixed amounts paid for specific medical services, while co-insurance is the percentage of covered expenses you pay after meeting the deductible.

Types of Health Insurance Plans

Various health insurance plans cater to diverse needs and budgets. Health Maintenance Organizations (HMOs) offer comprehensive coverage within a network of providers, typically at lower premiums. Preferred Provider Organizations (PPOs) provide more flexibility in choosing providers but may come with higher costs. Exclusive Provider Organizations (EPOs) resemble HMOs but offer a more limited provider network. Point-of-Service (POS) plans combine aspects of HMOs and PPOs, allowing you to choose providers outside the network for an additional cost.

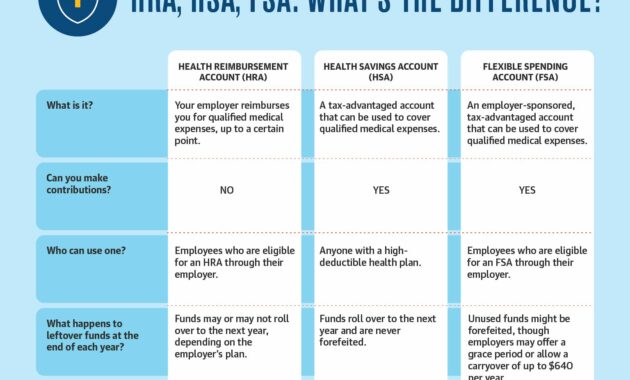

Health Savings Accounts (HSAs)

In conjunction with high-deductible health plans (HDHPs), Health Savings Accounts offer a tax-advantaged way to save for future healthcare expenses. Contributions to an HSA are tax-deductible, and withdrawals for qualified medical expenses are tax-free. This combination can be particularly beneficial for healthy individuals with lower healthcare costs who want to build savings over time.

Affordable Health Insurance Options

Finding the most affordable individual health insurance plan requires research and comparison. Utilize online marketplaces and insurance brokers to compare plans from various providers. Look for plans with low premiums, deductibles, and co-pays that align with your budget. Consider catastrophic plans designed for healthy individuals with infrequent medical expenses. These plans offer lower premiums but higher out-of-pocket costs for covered services.

Conclusion

Securing affordable individual health insurance is a critical step towards financial protection and peace of mind. By understanding your needs, navigating insurance jargon, and exploring the available plans, you can find coverage that meets both your budget and health requirements.

Most Affordable Individual Health Insurance Plans

Navigating the labyrinth of health insurance options can be daunting, especially when seeking affordable individual plans. The rising cost of healthcare has made it imperative to find a plan that meets your needs without breaking the bank. We’ve delved into the complexities of individual health insurance to help you make informed decisions and secure the most cost-effective coverage.

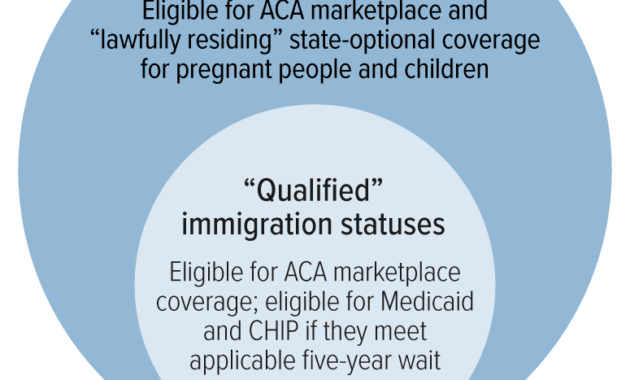

Health Insurance Marketplace

Before diving into specific plans, it’s crucial to understand the Health Insurance Marketplace, also known as Obamacare. This marketplace provides a platform for individuals and small businesses to compare and purchase health insurance plans. The marketplace offers subsidies to eligible individuals and families, making coverage more affordable. It’s essential to explore your eligibility options before making a decision.

Types of Plans

There are several types of health insurance plans, each with its unique benefits and limitations. Understanding the differences is key to choosing the best plan for your needs.

Health Maintenance Organizations (HMOs)

HMOs offer comprehensive coverage within a specific network of healthcare providers. They typically have lower monthly premiums than other plans but restrict your choice of doctors and healthcare facilities. HMOs require referrals to see specialists, which can be a hassle if you need specialized care.

Preferred Provider Organizations (PPOs)

PPOs offer more flexibility than HMOs while still providing a network of preferred providers. You can visit healthcare providers outside the network, but you’ll pay higher out-of-pocket costs. PPOs typically have higher monthly premiums than HMOs but provide greater freedom in selecting your healthcare providers.

Exclusive Provider Organizations (EPOs)

EPOs are similar to HMOs in that they require you to stay within a specific network of healthcare providers. However, EPOs have lower monthly premiums than HMOs and don’t require referrals to see specialists. This makes them a cost-effective option for individuals who don’t mind being limited to a smaller network of providers.

Point-of-Service (POS) Plans

POS plans combine features of HMOs and PPOs. You typically have a lower monthly premium if you stay within the network, but you can also visit out-of-network providers by paying higher out-of-pocket costs. POS plans offer a balance between cost-effectiveness and flexibility.

High-Deductible Health Plans (HDHPs)

HDHPs have lower monthly premiums but higher deductibles. This means you’ll pay more out-of-pocket for healthcare expenses before your insurance coverage kicks in. HDHPs are suitable for individuals who are healthy and don’t anticipate incurring substantial medical expenses.

Other Considerations

In addition to plan type, there are other factors to consider when choosing individual health insurance:

- Monthly premiums: These are the recurring payments you make to maintain your coverage.

- Deductibles: This is the amount you pay out-of-pocket before your insurance coverage begins.

- Copayments: These are fixed amounts you pay for specific medical services, such as doctor’s visits or prescriptions.

- Coinsurance: This is the percentage of the cost of a covered medical service that you pay after meeting your deductible.

Finding the most affordable individual health insurance plan requires a careful assessment of your individual needs and circumstances. By understanding the different types of plans and considering the factors discussed above, you can make an informed decision and secure the most cost-effective coverage.

Most Affordable Individual Health Insurance Plans

Finding the most affordable individual health insurance plan can feel like a daunting task. With so many plans and providers to choose from, it’s easy to get overwhelmed. But don’t worry, we’ve done the legwork for you. We’ve researched and compared plans from across the country to bring you the most affordable options.

These plans offer a variety of coverage options and benefits, so you can find one that fits your needs and budget. Whether you’re looking for a basic plan with low premiums or a more comprehensive plan with higher coverage, we’ve got you covered.

Plan Features

When comparing plans, it’s important to consider the following features:

-

Deductible: The deductible is the amount you have to pay out-of-pocket before your insurance starts covering your expenses. A higher deductible will result in lower premiums, but it will also mean you have to pay more out-of-pocket if you have a medical emergency.

-

Co-pays: Co-pays are fixed amounts that you have to pay for certain medical services, such as doctor’s visits or prescription drugs. Co-pays are typically lower than deductibles, but they can still add up over time.

-

Coverage for specific services: Some plans offer coverage for specific services, such as dental care or vision care. These services may not be covered by all plans, so it’s important to check the details before you enroll.

How to Find the Most Affordable Plan

The best way to find the most affordable individual health insurance plan is to compare quotes from multiple providers. You can do this online or through a licensed insurance agent. Be sure to compare plans with similar coverage and benefits, so you can make an apples-to-apples comparison.

Once you’ve compared quotes, you can choose the plan that best fits your needs and budget. Be sure to read the plan details carefully before you enroll, so you understand what’s covered and what’s not.

Tips for Saving Money on Health Insurance

Here are a few tips for saving money on health insurance:

-

Choose a plan with a high deductible: A higher deductible will result in lower premiums. If you’re healthy and don’t expect to have any major medical expenses, a high-deductible plan could be a good option for you.

-

Increase your coverage: Increasing your coverage will result in higher premiums, but it will also give you more peace of mind knowing that you’re protected against unexpected medical expenses.

-

Shop around: Don’t just stick with the first plan you find. Compare quotes from multiple providers to make sure you’re getting the best deal.

-

Consider a health savings account (HSA): An HSA is a tax-advantaged account that can be used to pay for qualified medical expenses. HSAs are only available to people with high-deductible health plans.

By following these tips, you can find the most affordable individual health insurance plan and save money on your premiums.

Most Affordable Individual Health Insurance Plans: A Comprehensive Guide

Introduction

Finding affordable individual health insurance plans is crucial, especially in today’s uncertain healthcare landscape. The soaring costs of medical expenses can be a burden for many, but fret not! We’re here to navigate the insurance maze and uncover the most cost-effective plans that align with your budget and needs. In this comprehensive guide, we’ll delve into the intricacies of insurance premiums, deductibles, and out-of-pocket costs, empowering you to make an informed decision and safeguard your health.

Understanding the Basics

Before embarking on this journey, it’s essential to understand the language of health insurance. Premiums are the monthly or annual payments you make to keep your plan active. Deductibles represent the amount you pay out of pocket before your insurance coverage kicks in. Out-of-pocket costs encompass the sum of deductibles, copays, and coinsurance, which you’re responsible for before reaching your yearly coverage limit.

Cost Comparison

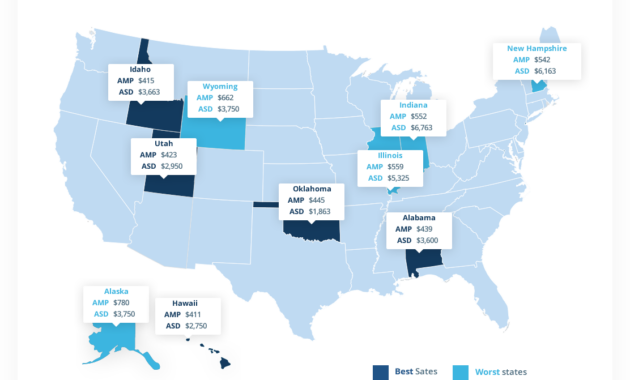

Cost Comparison

To find the most affordable plan, meticulously research and compare the aforementioned factors. Remember, the lowest premium doesn’t necessarily equate to the most economical plan. Carefully consider deductibles and out-of-pocket costs to ascertain the plan that strikes the optimal balance for your budget and healthcare needs.

High-Deductible Health Plans (HDHPs): A Double-Edged Sword

HDHPs entice with alluringly low premiums, but they come with a catch: higher deductibles. Before your insurance coverage kicks in, you’ll need to cough up more of your own hard-earned cash to cover medical expenses. Weigh the pros and cons of HDHPs diligently before committing.

Catastrophic Health Plans: A Last Resort

Catastrophic health plans are the most bare-bones option, catering to young and healthy individuals who rarely seek medical attention. These plans have exceptionally low premiums but sky-high deductibles. They’re designed to cover catastrophic expenses, not routine checkups or minor illnesses.

Bronze, Silver, Gold, and Platinum Plans: Navigating the Metal Tiers

Insurance plans are classified into metal tiers—bronze, silver, gold, and platinum—each offering varying levels of coverage and affordability. Bronze plans have the lowest premiums but the highest out-of-pocket costs. Platinum plans, conversely, provide the most comprehensive coverage but at a hefty premium price.

Factors Influencing Premiums

Factors Influencing Premiums

Premiums are not set in stone; they fluctuate based on several factors that insurers meticulously consider. Age is a significant factor, with older individuals facing higher premiums due to increased healthcare expenses. Location also plays a role, as medical costs and insurance regulations vary from state to state.

Tobacco use can inflate your premiums, as insurers perceive smokers as higher-risk individuals. Similarly, pre-existing medical conditions can influence your premium, as insurers anticipate higher healthcare expenses in the future.

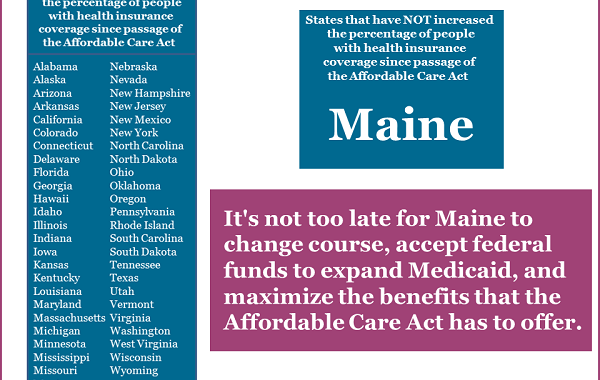

Government Subsidies: A Helping Hand

For those struggling to afford health insurance, government subsidies offer a lifeline. The Affordable Care Act provides tax credits to eligible individuals and families, reducing their monthly premium burden. However, income and household size determine eligibility for these subsidies.

Subsidy Eligibility and Marketplace Enrollment

Subsidy Eligibility and Marketplace Enrollment

To determine your eligibility for government subsidies, you must enroll in a health insurance plan through the Health Insurance Marketplace (or an agent). The Marketplace is a government-run online platform where individuals and families can compare plans, enroll in coverage, and access financial assistance.

Open Enrollment Periods: A Time-Bound Opportunity

There are specific open enrollment periods (OEPs) during which you can enroll in or change your health insurance plan. Missing these deadlines may result in coverage lapses or higher premiums. Stay vigilant about OEP dates to ensure you secure affordable health insurance without interruptions.

Special Enrollment Periods: Exceptions to the Rule

Special Enrollment Periods: Exceptions to the Rule

Life events, such as losing job-based insurance or experiencing a significant life change, can trigger special enrollment periods (SEPs). SEPs allow individuals to enroll in health insurance outside of the regular OEP. These events must be documented and reported to the insurance company to qualify for an SEP.

Plan Exclusions and Limitations: Read the Fine Print

Before signing on the dotted line, meticulously review the plan’s coverage details. Some plans may exclude certain medical services or impose annual limits on coverage. Understanding these exclusions and limitations is crucial to avoid unexpected out-of-pocket expenses.

Provider Networks: A Matter of Access

Provider Networks: A Matter of Access

Insurance plans typically have a network of healthcare providers, including hospitals, clinics, and doctors. In-network providers offer discounted rates for services, while out-of-network providers charge higher fees. If you have specific healthcare providers you prefer, ensure they’re part of the plan’s network before enrolling.

Additional Tips for Savings

Negotiating with Providers: Don’t hesitate to negotiate with healthcare providers for lower rates. Being armed with information and advocating for yourself can yield significant savings.

Generic Medications: Opting for generic medications, rather than brand-name drugs, can substantially reduce costs. Generics are just as effective but come with a much lower price tag.

Wellness Programs: Participating in insurance-offered wellness programs can incentivize healthy habits and potentially lower your premiums.

Stay Informed: Stay updated on healthcare reform and changes in insurance regulations. This knowledge can empower you to make informed decisions and secure the most affordable health insurance plan for your needs.

Conclusion

Finding affordable individual health insurance plans requires research, comparison, and careful consideration of factors that influence premiums. By understanding the basics of health insurance and utilizing the strategies outlined in this guide, you can navigate the insurance marketplace confidently and secure a plan that safeguards your health and fits within your budget. Remember, investing in health insurance is investing in peace of mind and financial security for the future.

Most Affordable Individual Health Insurance Plans

Health emergencies are a big worry for many people, but they shouldn’t be. Thanks to the Affordable Care Act, there are more affordable individual health insurance plans available than ever before. These plans can provide you with essential coverage for a fraction of the cost of traditional health insurance.

In this article, we will discuss the most affordable individual health insurance plans and where to find them. We will also provide tips on how to choose the right plan for your needs. So, if you’re looking for affordable health insurance, read on!

Types of Health Insurance Plans

There are various types of health insurance plans available, each with its own set of benefits and costs. The most common types of health insurance plans include:

- Health Maintenance Organizations (HMOs): HMOs are a type of managed care plan that offers a wide range of health care services for a fixed monthly premium. HMOs typically have a network of providers that you must use, and you may need to get a referral from your primary care physician before you can see a specialist.

- Preferred Provider Organizations (PPOs): PPOs are similar to HMOs, but they offer more flexibility. With a PPO, you can see any provider you want, but you will pay less if you see a provider within the plan’s network.

- Exclusive Provider Organizations (EPOs): EPOs are like HMOs, but they offer a more limited network of providers. EPOs typically have lower premiums than HMOs, but you may have to travel further to see a provider.

- Point-of-Service (POS) Plans: POS plans are a hybrid of HMOs and PPOs. With a POS plan, you can see any provider you want, but you will pay less if you see a provider within the plan’s network. You may also need to get a referral from your primary care physician before you can see a specialist.

How to Choose the Right Plan

When choosing a health insurance plan, there are several factors to consider, including:

- Your budget: Health insurance premiums can vary significantly, so it’s important to find a plan that fits your budget. Keep in mind that you may also have to pay deductibles, copayments, and coinsurance.

- Your health needs: If you have any health conditions, you’ll need to make sure that the plan you choose covers those conditions. You should also consider the plan’s network of providers to make sure that you can see the doctors you need.

- Your lifestyle: If you’re healthy and don’t use a lot of medical services, you may be able to get away with a plan with a higher deductible and lower monthly premium. However, if you have a chronic condition or use a lot of medical services, you’ll need a plan with a lower deductible and higher monthly premium.

Where to Find Plans

Once you know what type of plan you need, you can start shopping for plans. Here are a few places to find affordable individual health insurance plans:

- Online marketplaces: Online marketplaces such as HealthCare.gov and Covered California offer a variety of health insurance plans from different insurers. You can compare plans and prices side-by-side and find a plan that fits your needs and budget.

- Insurance brokers: Insurance brokers can help you find and compare health insurance plans from different insurers. They can also help you enroll in a plan and answer any questions you have. You usually don’t have to pay a fee for an insurance broker’s services.

- Insurance companies: You can also buy health insurance directly from insurance companies. This is a good option if you know what type of plan you want and you’re comfortable shopping for insurance on your own.

Tips for Finding Affordable Health Insurance

Here are a few tips for finding affordable health insurance:

Shop around: Don’t just buy the first plan you find. Take some time to compare plans and prices from different insurers. Keep in mind that you may be able to get a lower rate if you buy your plan through an online marketplace or an insurance broker.

Consider a higher deductible: A higher deductible means you’ll pay less for your monthly premium. However, you’ll have to pay more out-of-pocket if you need medical care. So, make sure you have enough money saved to cover a high deductible before you choose a plan with one.

Look for discounts: Many health insurance companies offer discounts for healthy lifestyles, such as non-smokers or those who exercise regularly. If you can qualify for a discount, it can save you money on your monthly premium.

Get help: If you’re having trouble finding affordable health insurance, you can get help from an insurance broker or a community health center. These organizations can help you find a plan that fits your needs and budget.

Most Affordable Individual Health Insurance Plans

Finding the most affordable individual health insurance plans can feel like a daunting task. With myriad options and varying costs, it’s easy to get lost in the maze of choices. But don’t fret! We’ve done the legwork for you and compiled a comprehensive guide to help you navigate the complexities of health insurance and secure the best coverage that fits your budget.

Types of Health Insurance Plans

Before delving into the affordability aspect, let’s briefly touch upon the types of health insurance plans available. Each plan type offers a unique combination of coverage and costs:

- Health Maintenance Organizations (HMOs): HMOs provide comprehensive coverage through a network of contracted healthcare providers. Premiums are typically lower, but you may have limited flexibility in choosing your doctors.

- Preferred Provider Organizations (PPOs): PPOs offer more flexibility than HMOs, allowing you to seek care from both in-network and out-of-network providers. Premiums are generally higher, but you have more choice.

- Exclusive Provider Organizations (EPOs): EPOs resemble HMOs in that they limit your coverage to a specific network of providers. However, EPOs typically offer higher coverage limits and lower deductibles than HMOs.

- Point-of-Service (POS) Plans: POS plans combine features of HMOs and PPOs. You generally pay a lower premium if you stay within the network, but you can still seek care from out-of-network providers at a higher cost.

- High-Deductible Health Plans (HDHPs): HDHPs have lower premiums but higher deductibles. They are often paired with a Health Savings Account (HSA), which allows you to save tax-free dollars to cover healthcare expenses.

Factors that Affect Affordability

Now that you’re familiar with the types of health insurance plans, let’s explore some of the key factors that influence affordability:

- Age: Younger individuals generally pay lower premiums than older individuals.

- Location: Healthcare costs vary by region, affecting insurance premiums.

- Tobacco Use: Smoking can significantly increase insurance costs.

- Health Status: Pre-existing conditions can lead to higher premiums.

- Plan Type: As mentioned earlier, different plan types carry different costs.

- Deductible: The deductible is the amount you pay out-of-pocket before insurance starts covering costs. Higher deductibles typically result in lower premiums.

- Coinsurance and Copayments: These are fixed amounts you pay for covered services after meeting your deductible.

Finding Affordable Health Insurance

With these factors in mind, here are some practical tips for finding affordable individual health insurance plans:

- Shop Around: Compare plans from various insurers to find the best combination of coverage and cost.

- Consider a High-Deductible Plan: HDHPs offer lower premiums if you’re generally healthy and don’t expect high medical expenses.

- Increase Your Deductible: If possible, opt for a higher deductible to reduce your monthly premiums.

- Use a Health Savings Account (HSA): An HSA allows you to save tax-free dollars for healthcare expenses, potentially lowering your overall healthcare costs.

- Seek Discounts: Many insurers offer discounts for non-smokers, healthy lifestyles, and online enrollment.

Affordable Individual Health Insurance Plans

Based on our research, here are some of the most affordable individual health insurance plans available in the market:

- Cigna Essential Plus (HMO): This plan offers basic coverage at a budget-friendly price.

- Humana Gold Plus (PPO): This plan provides more flexibility and coverage than Cigna Essential Plus, but with slightly higher premiums.

- UnitedHealthcare Navigate (POS): This plan combines features of HMOs and PPOs, offering a balance of affordability and flexibility.

- Oscar Individual Bronze 200 (HDHP): This HDHP has a low premium and a high deductible, making it suitable for individuals with low healthcare expenses.

- Kaiser Permanente Silver 70 (HMO): This plan offers comprehensive coverage at a competitive price, but only available in certain regions.

Additional Resources

To further your research, consider utilizing these resources:

- Kaiser Family Foundation: Provides in-depth analysis and data on healthcare issues.

- healthcare.gov: The official website of the Health Insurance Marketplace, offering comparison tools and enrollment assistance.

- State Insurance Departments: Regulate health insurance and provide resources for consumers.

Conclusion

Finding affordable individual health insurance doesn’t have to be a daunting task. By understanding the types of plans available, considering the factors that affect affordability, and shopping around, you can secure the coverage you need at a price that fits your budget. Remember, the most important thing is to have peace of mind knowing that you’re protected against unexpected healthcare expenses.