Affordable Health Insurance Plans in Arizona

Arizona’s diverse landscape offers a range of affordable health insurance plans tailored to its residents’ unique needs. Whether you’re navigating the complexities of the individual market, seeking coverage through your employer, or exploring government-sponsored programs, Arizona has options to help you protect your health and well-being without breaking the bank.

This comprehensive guide will delve into the intricacies of Arizona’s health insurance landscape, empowering you to make informed decisions about your coverage. We’ll explore the different types of plans available, eligibility requirements, and strategies for finding the most affordable options. Let’s dive in and discover how you can secure the peace of mind that comes with knowing you have access to quality healthcare.

Types of Affordable Health Insurance Plans in Arizona

Arizona offers a wide array of health insurance plans to cater to the diverse needs of its residents. Understanding the different types of plans available is crucial for finding the one that best suits your circumstances. Here’s a breakdown of the most common options:

Individual Health Insurance Plans

Individual health insurance plans are designed for people who don’t have access to coverage through an employer. These plans are purchased directly from insurance companies, and premiums are based on factors such as your age, health status, and location. Individual plans offer flexibility and customization, allowing you to tailor your coverage to your specific needs and budget.

Employer-Sponsored Health Insurance Plans

Employer-sponsored health insurance plans are offered by employers as a benefit to their employees. These plans typically cover a portion of the employee’s healthcare costs, with the employer paying the remaining balance. Employer-sponsored plans often offer lower premiums and more comprehensive coverage than individual plans, making them a desirable option for many people.

Government-Sponsored Health Insurance Programs

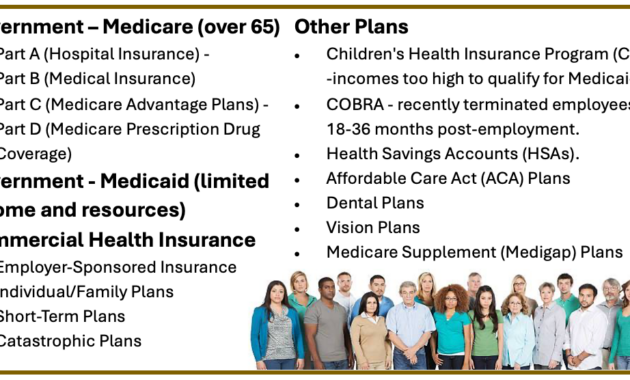

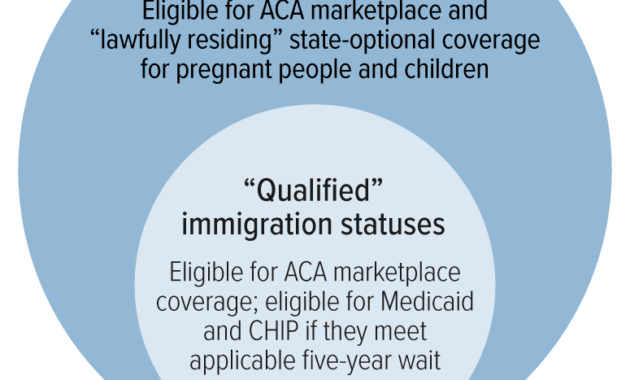

Arizona offers several government-sponsored health insurance programs to help low-income individuals and families access affordable healthcare. These programs include:

- Arizona Health Care Cost Containment System (AHCCCS): AHCCCS is Arizona’s Medicaid program, providing health insurance to low-income individuals and families, children, pregnant women, people with disabilities, and seniors.

- KidsCare: KidsCare is a health insurance program for children from low-income families. It provides comprehensive coverage for doctor visits, hospital stays, prescription drugs, and more.

- Medicare: Medicare is a federal health insurance program for people aged 65 and older, as well as younger people with certain disabilities. Medicare offers a variety of plans, including traditional Medicare, Medicare Advantage, and Medicare Part D for prescription drug coverage.

Eligibility Requirements for Affordable Health Insurance Plans in Arizona

Eligibility for affordable health insurance plans in Arizona varies depending on the type of plan you’re seeking. Here’s a breakdown of the eligibility requirements for each type:

Individual Health Insurance Plans

To be eligible for an individual health insurance plan in Arizona, you must be a U.S. citizen or legal resident and not have access to affordable health insurance through an employer. You can apply for an individual plan during the annual open enrollment period, which runs from November 1st to January 15th. Outside of open enrollment, you may only be eligible for an individual plan if you experience a qualifying life event, such as losing your job or getting married.

Employer-Sponsored Health Insurance Plans

To be eligible for an employer-sponsored health insurance plan, you must be an employee of a company that offers health insurance as a benefit. Eligibility requirements and coverage vary depending on the specific plan offered by your employer. You should contact your employer’s human resources department for more information about eligibility and enrollment.

Government-Sponsored Health Insurance Programs

Eligibility for government-sponsored health insurance programs in Arizona is based on income and other factors. To be eligible for AHCCCS, you must meet certain income and residency requirements. To be eligible for KidsCare, your child must be a U.S. citizen or legal resident and meet certain income requirements. To be eligible for Medicare, you must be aged 65 or older or have certain disabilities.

If you’re unsure whether you qualify for an affordable health insurance plan in Arizona, you can contact the Arizona Department of Insurance at 1-800-325-2548 for assistance.

Strategies for Finding the Most Affordable Health Insurance Plans in Arizona

Finding the most affordable health insurance plan in Arizona requires careful research and comparison shopping. Here are a few strategies to help you get the best deal:

Compare Plans from Multiple Insurance Companies

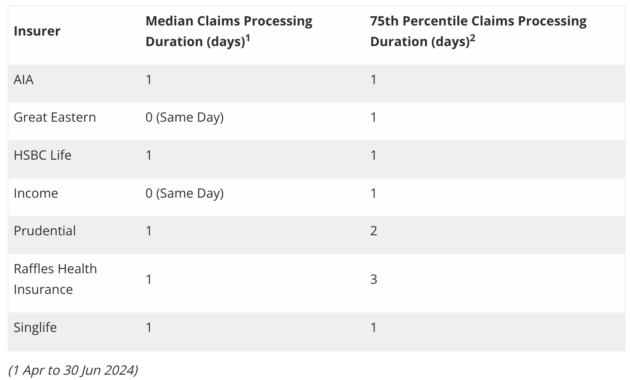

Don’t limit yourself to just one insurance company. Get quotes from several different providers to compare premiums, deductibles, co-pays, and coverage. This will give you a better understanding of the market and help you find the plan that best meets your needs and budget.

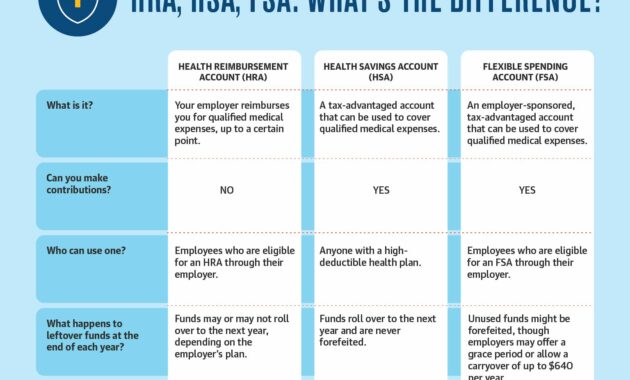

Consider a High-Deductible Health Plan (HDHP)

High-deductible health plans (HDHPs) have lower premiums but higher deductibles. If you’re generally healthy and don’t expect to incur significant medical expenses, an HDHP could save you money in the long run. Just be sure you can afford the deductible if you need to use your insurance.

Take Advantage of Tax Credits and Subsidies

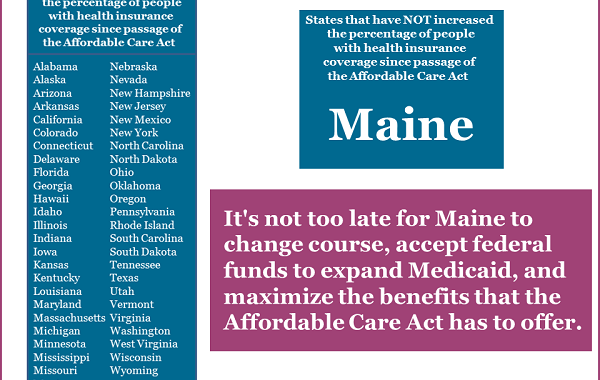

The Affordable Care Act (ACA) provides tax credits and subsidies to help low- and moderate-income individuals and families afford health insurance. If you qualify for these credits, they can significantly reduce your monthly premiums. Be sure to check with the insurance companies you’re considering to see if they offer plans that qualify for these credits.

Shop During Open Enrollment

The annual open enrollment period for health insurance runs from November 1st to January 15th. During this time, you can shop for plans and enroll in coverage without having to worry about qualifying for a special enrollment period. If you miss open enrollment, you may only be able to enroll in a plan if you experience a qualifying life event, such as losing your job or getting married.

Finding the most affordable health insurance plan in Arizona can be a challenge, but it’s not impossible. By following these strategies, you can increase your chances of finding a plan that fits your budget and provides the coverage you need.

Affordable Health Insurance Plans in Arizona

The rising cost of healthcare is creating a major financial burden for many Arizona residents. Finding an affordable health insurance plan that meets your individual needs and budget can seem like a daunting task. But fear not, Arizona offers a variety of health insurance options to fit every pocketbook.

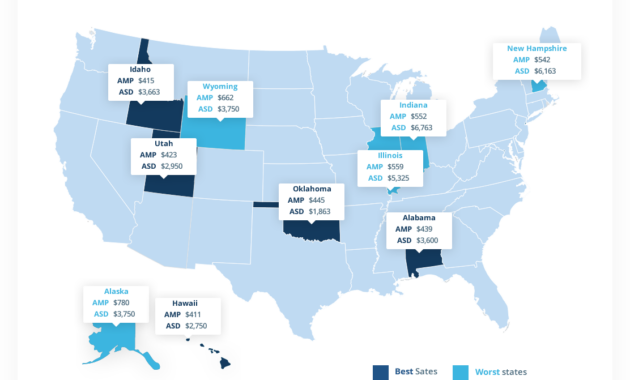

1 in 4 Arizonans are uninsured. The Affordable Health Care Act (ACA) has made it easier and more affordable for people to get health insurance. If you’re uninsured, you may be eligible for financial assistance to help you pay for health insurance. The average monthly premium for an individual health insurance plan in Arizona is $425. The average monthly premium for a family plan is $1,221.

Types of Health Insurance Plans

There are three main types of health insurance plans available in Arizona:

Health Maintenance Organizations (HMOs)

HMOs are the most popular type of health insurance plan in Arizona. HMOs offer a network of providers to choose from. You must stay within the network to receive covered services. HMOs typically have lower premiums than other types of plans, but they may also have more restrictions. For example, you may need to get a referral from your primary care physician to see a specialist.

Preferred Provider Organizations (PPOs)

PPOs offer more flexibility than HMOs. You can choose to see providers both inside and outside of the network. However, you will pay more for out-of-network services. PPOs typically have higher premiums than HMOs, but they also offer more choice and flexibility.

Exclusive Provider Organizations (EPOs)

EPOs are similar to HMOs, but they offer a more limited network of providers. EPOs typically have lower premiums than PPOs, but they also offer less choice and flexibility. You must stay within the network to receive covered services.EPOs are a good option for people who want a low-cost health insurance plan and who are willing to sacrifice some flexibility.

EPOs are similar to HMOs, but they offer a more limited network of providers. EPOs typically have lower premiums than PPOs, but they also offer less choice and flexibility. You must stay within the network to receive covered services.

Which Type of Plan Is Right for Me?

The best way to choose a health insurance plan is to compare the different options and find the one that best meets your needs and budget. Here are some things to consider when choosing a plan:

- Your budget

- Your health needs

- Your preferred providers

- Your tolerance for risk

If you have a tight budget, an HMO or EPO may be a good option for you. If you want more flexibility, a PPO may be a better choice. If you have a lot of health needs, you may want to choose a plan with a broad network of providers. If you are willing to take on more risk, you may be able to save money by choosing a plan with a higher deductible. Once you’ve considered all of these factors, you can start shopping for a health insurance plan.

There are a number of different ways to find and compare health insurance plans. You can use the Health Insurance Marketplace, talk to a health insurance agent, or contact your employer. Once you’ve found a few plans that you’re interested in, be sure to compare the premiums, deductibles, and copayments before making a decision.

Affordable Health Insurance Plans in Arizona

In the realm of healthcare, securing the right health insurance plan is paramount to safeguarding your well-being. If you’re on the hunt for affordable health insurance plans in Arizona, you’ve come to the right place. Let’s unravel the intricacies of this crucial decision and empower you to make an informed choice.

Factors to Consider When Choosing a Plan

Embarking on the journey to select a health insurance plan is akin to navigating a labyrinth of options. To emerge victorious, it’s essential to weigh these key considerations:

1. Your Budget:

When it comes to health insurance, understanding your financial landscape is non-negotiable. Determine how much you can comfortably allocate toward monthly premiums, deductibles, and other associated costs. It’s like balancing your checkbook – you need to ensure your expenses align with your income.

2. Your Health Needs:

Take stock of your current health status and anticipate any foreseeable medical requirements. If you’re in the pink of health, a plan with lower coverage might suffice. However, if you’re managing chronic conditions or anticipating major procedures, a more comprehensive plan is likely a wiser investment. It’s like choosing a sturdy umbrella – you want to be prepared for any storm life throws your way.

3. The Type of Coverage You Want:

The world of health insurance offers a smorgasbord of coverage options, each with its own set of benefits and limitations. HMOs (Health Maintenance Organizations) typically provide a more comprehensive network of healthcare providers, while PPOs (Preferred Provider Organizations) offer greater flexibility at a potentially higher cost. EPOs (Exclusive Provider Organizations) are similar to HMOs but offer an even narrower provider network, resulting in lower premiums. And finally, POS (Point-of-Service) plans strike a balance between HMOs and PPOs, allowing you to access out-of-network providers for an additional fee. Understanding these nuances is like being a culinary connoisseur – you need to know your ingredients to create the perfect dish.

4. Your Age and Lifestyle:

As you journey through life, your health insurance needs will evolve. Young adults may prioritize low premiums, while older individuals may require more comprehensive coverage. Similarly, if you have an active lifestyle, you may want to consider a plan that includes wellness benefits. It’s like adjusting your sails to catch the changing winds of life.

5. Your Family Situation:

If you’re part of a family, it’s crucial to factor in the health insurance needs of all members. Consider plans that offer family coverage and explore options for adding dependents. It’s like building a sturdy boat that can carry all your precious passengers.

Understanding Your Options

Now that you’re armed with these key considerations, let’s delve deeper into the available health insurance plans in Arizona.

1. AHCCCS (Arizona Health Care Cost Containment System):

AHCCCS is Arizona’s Medicaid program, providing health insurance to low-income individuals and families. If you qualify, AHCCCS can offer comprehensive coverage at little to no cost. It’s like a lifeline for those who need it most.

2. Marketplace Plans:

Through the Health Insurance Marketplace, you can compare and purchase health insurance plans from private insurers. These plans are regulated by the government and offer a range of coverage options and subsidies to help make them more affordable. It’s like shopping at a farmer’s market – you have a variety of choices and can find something that fits your budget.

3. Employer-Sponsored Plans:

If you’re fortunate enough to have employer-sponsored health insurance, you may be able to take advantage of group discounts and other benefits. However, it’s important to carefully review the coverage and costs to ensure it meets your individual needs. It’s like being part of a team – you get the advantage of shared resources.

4. Short-Term Health Insurance:

Short-term health insurance plans offer temporary coverage for those who are between jobs or waiting for other insurance to kick in. While they may be more affordable than traditional health insurance, they typically have lower coverage limits and may not cover pre-existing conditions. It’s like a stopgap measure to bridge the gap in your health insurance journey.

5. Medicare:

Medicare is a government health insurance program for people over 65 or with certain disabilities. Medicare offers a range of coverage options, including Part A (hospital insurance), Part B (medical insurance), and Part D (prescription drug coverage). It’s like a safety net for those who have reached a certain age or have faced life’s challenges.

Making the Right Choice

Choosing the right health insurance plan is a multifaceted decision that requires careful consideration. By weighing your budget, health needs, and coverage preferences, you can navigate the maze of options and emerge with a plan that provides peace of mind and protects your well-being. It’s like embarking on a treasure hunt – the reward is worth the effort you put in.

Remember, if you need additional assistance or have specific questions, don’t hesitate to reach out to a licensed health insurance agent. They can guide you through the process and help you find a plan that fits your unique needs. It’s like having a compass on your health insurance journey – they can help you stay on course and reach your destination.